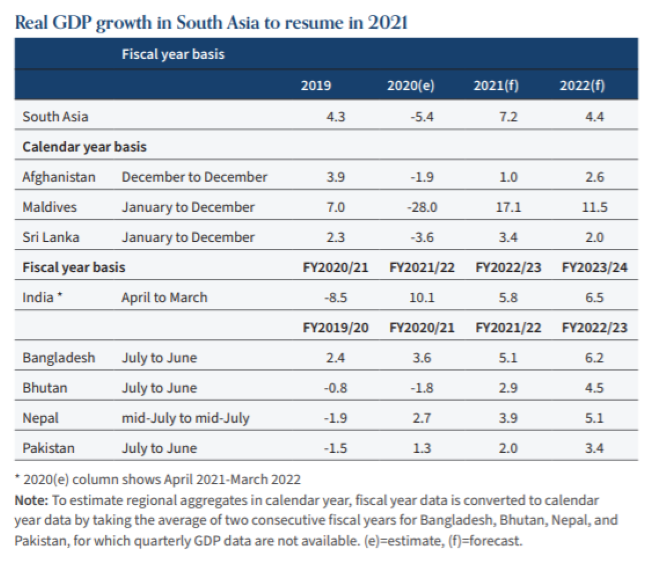

Indian economy will expand between 7.5% and 12.5% in financial year 2021-22, depending on the success of the Covid-19 vaccination drive and the global economic recovery, according to a World Bank report.

The COVID-19 pandemic will have a long-term impact on India’s fiscal position. The increased spending to tackle the new coronavirus pandemic and the resultant economic crisis will see the government deficit remaining above 10% of the country’s gross domestic product till FY22, says South Asia Economic Focus, a report prepared by the Bank’s office of the Chief Economist for the South Asia Region (SARCE) and the Macroeconomics, Trade and Investment (MTI) Global Practice.

READ I Blow to naysayers: Covid-19 vaccines just got a CDC booster shot

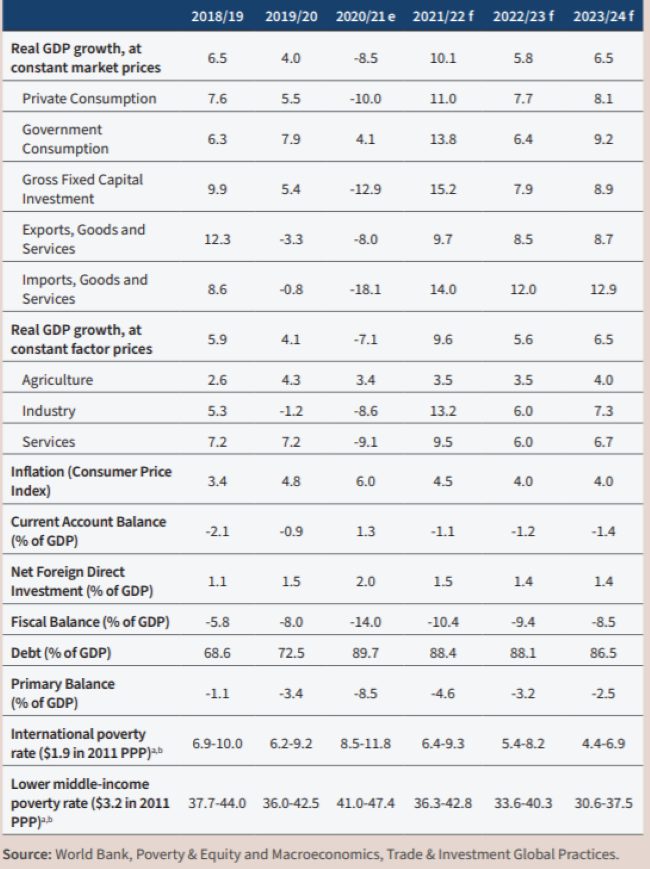

Macro poverty outlook indicators

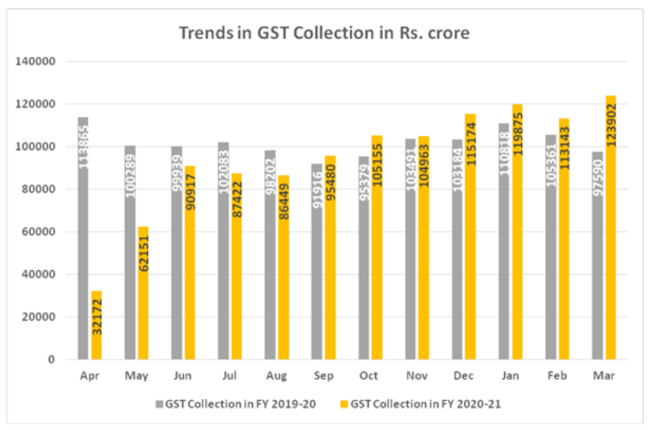

Indian economy: GST collections hints at recovery

The positive outlook for the Indian economy got a boost from the highest indirect tax mop-up since the introduction of GDP in July 2017. The GST collections in March 2021 set an all-time record of Rs 1,23,902 crore, keeping in with the trend in the last five months. This is 27% more than the GST revenues in March 2020.

India’s public debt will touch 90% of the GDP in FY 21, before beginning a slow descent. The current account deficit will to return to around 1% in FY22 and FY23, as the easy monetary policy will result in higher capital inflows.

South Asia will grow 7.2% in 2021 and 4.4% in 2022, boosted by the low-base effect (5.4% GDP decline in 2020). Fiscal stimulus packages announced last year will see government consumption rising 16.7% in 2021. The vaccination drive will improve economic activity and boost incomes. The per-capita income will touch pre-COVID levels before 2022, with the region losing two years to the pandemic.

READ I Kerala economy: Time for soul searching on government size, welfare schemes

Indian economy on recovery path

Indian economy was already in the grip of a slowdown when the Covid-19 pandemic struck. The GDP growth slipped from 8.3% in FY17 to 4% in FY20. The lockdown measures taken to curb the spread of the virus disrupted the supply and demand conditions in the economy. The Union government and the Reserve Bank of India employed fiscal and monetary measures to cushion the economic impact of the pandemic. Despite the steps taken to protect the vulnerable sections of the society and firms, the pandemic took the sting off India’s poverty reduction programme, slowing it considerably.

The nationwide lockdown and restrictions on mobility impacted sectors such as aviation, tourism, hospitality, trade, and construction. Agriculture remained unaffected however, shielding the economy from a sharp decline. The economic outlook will depend on materialisation of financial sector risks that could impact a recovery in private investment, and the success of measures taken to curb further spread of the disease.