The largest economies in the world are sending out conflicting macroeconomic signals, making it difficult for fiscal and monetary authorities to frame right policies. This trend was observed ahead of monetary policy review by US Federal Reserve when indicators such as economic growth, unemployment and inflation required conflicting policy prescriptions. And India is no exception. It has become extremely difficult to comprehend the state of the Indian economy after a series of high frequency indicators offering confusing readings.

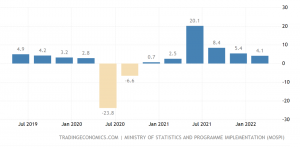

The Indian economy may have posted double digit GDP growth in the first three months of the current financial year. Most forecasts put growth in the range of 12.5-15% on the back of robust consumer spending, a revival of the services sector, and of course by the low base.

India economic growth rate (%)

Most forecasts put growth in the range of 12.5-15% on the back of robust consumer spending, a revival of the services sector, and of course by the low base. The Reserve Bank of India expects the economy to expand 16.2% in Q1 and 7.2% for the entire financial year. The government data for the quarter will be released on August 31.

READ I Explained: America’s Inflation Reduction Act 2022 is more about environment

The inflation vs growth dilemma

The expectations of robust growth come with a set of worries. Private investment, which is yet to recover, is likely to be hit by RBI’s monetary tightening efforts. High interest rates will definitely hurt the manufacturing sector dominated by MSMEs that are already facing severe funds crunch. The RBI, however, is expected to go ahead with tightening because unabated inflation is hurting the most vulnerable sections of the society as well as the largest corporates that face a squeeze on profit margins.

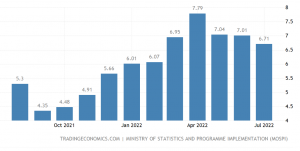

India inflation rate (%)

The annual inflation rate based on the consumer price index fell to 6.71% in July from 7.01% in June, registering a decline for the third month running. Food inflation fell by one percentage point to 6.75% in July from 7.75% last month as prices of vegetables, oils and fats, meat and fish eased considerably. Inflation in cereals continued to be a pain point by crossing 6% mark after almost a year. Fuel and light inflation rose to 11.76% in July from 10.39% in June.

The Reserve Bank of India had, earlier this month, raised the policy repo rate by 50 basis points to 5.40%. It has hiked the key policy rate by 140 basis points within three months. It the inflation stays above 6% till September end, RBI will have to give an explanation to the government.

READ I RBI digital lending norms silent on lending scamsters

Global forecasts bullish on Indian economy

India’s industrial output expanded 12.3% in June, compared with 19.6% in May and 13.8% in June last year. However, the growth is higher than most forecasts and is backed by robust performances by manufacturing and capital goods sectors that augurs well for the fragile industrial recovery. The manufacturing sector which accounts for 75% of the Index of Industrial Production expanded 12.5%. Electricity (16.4%), capital goods (26.1%), and consumer durables (23.8%) also recorded stellar growth in June.

Earlier this week, analysts at Morgan Stanley had projected the Indian economy to grow 7% in 2022-23, making it the fastest-growing Asian economy in the period. They said lower corporate taxes, the production-linked incentive (PLI) scheme and supply chain diversification benefits will boost domestic demand. Indian policymakers have initiated a series of reform measures that will lead to a spike in private investment, the note said.

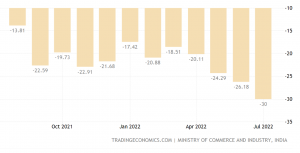

India trade deficit ($ bn)

The note expects further decline in crude oil prices after a 23-37% fall since March. This will bring stability to the economy and the RBI may not need to continue its aggressive rate hiking spree, it said, adding that India is still vulnerable to global supply shocks like another spike in oil prices. India’s ballooning trade deficit offers another worrying piece of statistics. The trade deficit almost tripled to $30 billion in July, despite a weak rupee. The country’s exports rose 2.14% to $36.27 billion in July, while imports rose 43.61% to $66.27 billion because of a 70% increase in crude oil imports.

Apart from cooling commodity prices, Indian economy will also benefit from the reopening of the economy after two years marred by lockdown measures. The economic recovery will ensure the most robust growth in almost 10 years for Asia’s third largest economy, the note said. Most global forecasters seem more optimistic than the Indian government and the central bank that are weighed down by conflicting policy objectives.

Anil Nair is Founder and Editor, Policy Circle.