The Indian economy presents a complex picture of growth and disparities that demands a nuanced policy recalibration. The corporate earnings for the third quarter of the current financial year (October-December 2023) reflect resilience and potential, underscored by the upwardly revised GDP growth figures.

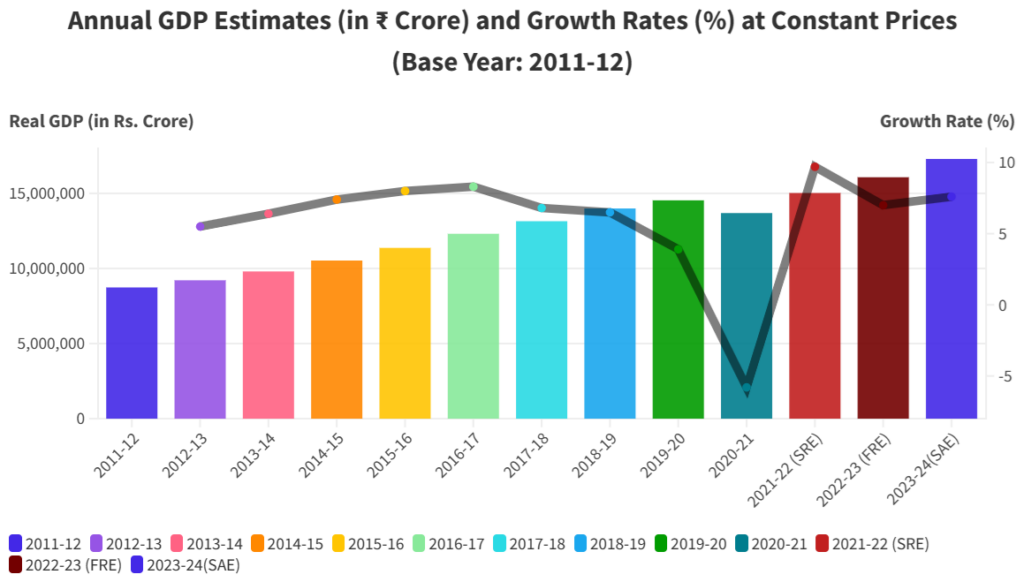

The Indian economy outperformed expectations by recording 8.4% growth rate in the third quarter of FY24, the highest in six quarters. This is attributed to unprecedented tax collections and effective subsidy management. This performance has led to a significant upward revision of the GDP growth estimate for FY24 to 7.6% by the National Statistical Office (NSO), surpassing previous projections.

With a revised fiscal deficit target of 5.8% of GDP for FY24 now more attainable, the government’s economic strategy appears to be paying dividends. This growth momentum underscores the resilience and potential of the Indian economy, making a strong case for global rating agencies to reconsider their growth projections for India.

The economic recovery, however, masks uneven growth across sectors. The manufacturing sector, buoyed by policy initiatives aimed at enhancing productivity and competitiveness, has shown commendable growth. But the contraction of the agricultural sector points to underlying vulnerabilities affecting rural incomes and food security, exposing the vulnerabilities of India’s growth narrative.

Corporate earnings further delineate this narrative, with sectors like BFSI, automobiles, and oil & gas demonstrating robust growth, indicative of strong demand and operational efficiencies. In contrast, technology and consumer staples exhibit subdued performance, reflecting the differential impact of economic conditions and policy environment across sectors. This dichotomy underscores the resilience of India’s financial system and the strategic importance of sectoral policies in driving growth.

READ I PE-VC investments fall despite robust growth numbers

Digital transformation and financial inclusion

With India’s digital infrastructure gaining ground, the surge in Unified Payments Interface (UPI) transactions exemplifies a pivotal shift towards financial inclusion and digital literacy. This transformation, underpinned by the government’s push for digital India, has not only democratised access to financial services but also catalysed a new era of consumer behaviour.

The proliferation of digital payment platforms has significantly reduced transaction costs and enhanced the ease of doing business, thereby fostering an environment conducive to the growth of small and medium enterprises and startups. This digital leap, while facilitating economic inclusivity, also underscores the need for bolstering cybersecurity measures and enhancing digital literacy across the nation’s diverse demographic landscape.

Indian economy: Contradictions and challenges

Despite the optimistic growth narrative, the Indian economy grapples with significant challenges. The distress in the agricultural sector and muted growth in certain sectors underscore the urgent need for targeted policy interventions. These challenges are symptomatic of a broader issue: the persistence of a dual economy where growth indicators such as mutual fund investments and demat accounts coexist with signs of distress, particularly in rural incomes and wage growth.

The phenomenon of speculative trading, exemplified by the surge in demat accounts and stock options trading, raises concerns about the long-term sustainability of wealth creation strategies. This trend, coupled with the negative growth rate of retail rural wages, points to the critical need for economic policies that not only spur growth but also ensure its equitable distribution.

Policy imperatives and recalibration

The way ahead for Indian economy requires a strategic recalibration of policies that will address both immediate distress and long-term sustainability. Enhancing agricultural productivity through technology, supporting the tech sector with policy incentives, and stimulating consumer demand in underperforming sectors through fiscal measures are imperative. Additionally, the service sector’s potential as a significant economic driver necessitates investments in digital infrastructure and skill development.

Another finding emerges from the economic data is the notable rise in speculative trading, particularly highlighted by the explosive growth in stock options trading. This trend not only reflects the increasing financialisaton of the Indian economy but also raises concerns about the potential risks associated with speculative bubbles.

The allure of quick gains from the stock market, as evidenced by the short holding periods of options contracts, underscores a departure from traditional investment in favour of riskier financial manoeuvres. Addressing this phenomenon requires a dual approach: enhancing investor education to foster a culture of long-term investment and implementing regulatory measures to mitigate systemic risks. This strategy will ensure that the capital markets contribute to sustainable economic growth rather than becoming a volatility catalyst.

As India looks to become the third largest economy by 2030, aligning its growth with the achievement of the Sustainable Development Goals (SDGs) becomes crucial. This alignment ensures that the benefits of economic growth are not only widespread but also contribute to a sustainable and inclusive future.

India’s growth trajectory is increasingly being scrutinised through the lens of sustainability and environmental stewardship. The reports underscore the necessity of integrating environmental considerations into the economic policy framework. This involves not only adopting green technologies and promoting renewable energy sources but also ensuring that infrastructural development and industrial expansion are aligned with ecological conservation principles.

The transition to a green economy presents an opportunity for India to lead by example in combating climate change while fostering economic resilience. Incorporating sustainability into the core of economic planning will not only address global environmental challenges but also unlock new avenues for economic diversification and job creation.

The resilience of the Indian economy, mirrored in robust growth figures and corporate earnings, is a testament to its potential to overcome intrinsic challenges. However, this resilience is not without its contradictions, as evidenced by the dual nature of the economy and the disparities across sectors.

The strategic recalibration of policies aimed at addressing the multifaceted challenges of today while laying the groundwork for a prosperous, inclusive, and sustainable future is the need of the hour. As India navigates its economic trajectory, the imperative is not just to foster growth but to ensure that it is equitable, sustainable, and aligned with the broader goals of societal well-being and environmental stewardship.