Slow GDP Q2 growth: Robust GST collections have added another dimension to the debate on the health of the Indian economy. Goods and Services Tax mop-up in November rose 11% year-on-year to ₹1.46 lakh crore at a time when several domestic and global institutions had cut their growth forecast for India. Though there is a sequential decline in numbers, it was not totally unexpected when some of the largest economies are facing a recession.

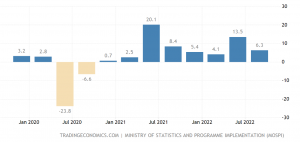

India has been a rare bright spot in a global landscape where the US, EU, and other OECD countries are sliding into a crisis. Indian economy expanded 6.3% in the second quarter of the year ended September and is expected to end the financial year with 6.8-7% growth. The country is likely to remain the fastest growing large economy despite lower-than-expected growth. The numbers cannot be considered dismal in the prevailing global economic situation.

Indian economy GDP growth rate

Chinese economy GDP growth rate

The GDP data is still indicative of a recovery buoyed by agriculture and the services sectors which posted growth rates higher than 4% for the third straight quarter. A slowdown is expected in the third quarter owing to a slowdown in the global economy that will affect exports growth. The government sees a rebound is expected in manufacturing. The companies which were hesitant to add inventories before the festive season, are likely to do so now after witnessing a steady demand growth.

Slow GDP Q2 growth is not all that bad

A slowdown in growth looks desirable at a time when the geopolitical situation is unfavourable. A large number of economists suggest that slow economic growth may not be a bad thing. The current estimates for India’s GDP growth hover around 6%, which will help the country bring the inflation rate within RBI’s comfort zone of 2-6%. A slower growth will also narrow fiscal and current account deficits. Higher interest rates may dampen demand, but India still be in a better position than its global peers.

READ | Digital Rupee explained: Retail CBDC offers savings for RBI, anonymity for customers

Slower growth and reduced demand will together help India along the glide path of inflation. India’s Widening growth differential with the rest of the world can cut both ways and could push India into an external deficit crisis. The country’s economy is already faring better than other global economies, but its momentum is being weighed down by external factors.

The ongoing war between Russia and Ukraine has been a major drag, along with high energy prices and a food crisis. The government’s efforts to stimulate growth by pushing demand could throw inflation, trade deficit and fiscal deficit out of control.

Q2 GDP growth in numbers

The economy had picked momentum after the pandemic crisis when the Russian invasion of Ukraine happened. The real GDP had jumped 13.5% in the April-June quarter this year and 8.4% in July-September 2021. The slowdown in manufacturing has derailed the growth momentum, queering the pitch for future growth. Higher interest rates and no pick-up in consumption did affect the growth in the second half of the current fiscal.

Amid these circumstances, two bright spots have emerged. The private final consumption expenditure, a measure of consumption of goods and services by individuals, grew 9.7% year-on-year during the July-September quarter. Gross fixed capital formation, a proxy for investment activity, grew 10.38% during the period. Agriculture sector recorded a GVA (gross value added) growth of 4.6% in July-September compared with 3.2% in the year-ago period. Trade, hotels and transport services also recorded a positive GVA growth of 14.7%, while construction and financial services grew 6.6% and 7.2%, respectively.

The global crisis has presented India with an opportunity to fix its financial situation. The Union government has been unable to control its fiscal deficit because of the continuing food security measures, increase allocations for fertilizer subsidy, and the drive to create employment in the government sector. The additional expenditure has offset the buoyancy in direct and indirect tax collections.

The high nominal growth may help India contain fiscal deficit within the targeted 6.4% of the GDP. The government must use the global crisis in its favour by reducing stimulus expenditure to boost demand and economic growth. It should rather focus on maintaining export competitiveness which will be crucial for the Indian economy post the crisis. The need of the hour is to tread carefully amid broader risks from global headwinds.