Digital rupee: The RBI is gearing up to launch the retail version of the central bank digital currency, or digital rupee, in December. Thr CBDC-R will be sort of an official cryptocurrency for retail users and will be issued as digital tokens in the same denominations as paper currency. The e-rupee can be used to make and receive payments, essentially making it an electronic version of cash. It is meant for retail transactions and is expected to be lapped up by the private sector, non-financial consumers and businesses.

The digital rupee will be backed by RBI unlike the cryptocurrency which remains unregulated and hence unsafe for payment and settlement. The RBI had earlier said that CBDC will be a legal tender issued by a central bank in a digital form, and will be exchangeable one-to-one with the fiat currency. This makes it hugely different from cryptocurrency. The central bank has repeatedly dismissed cryptocurrency calling it a serious challenge to the stability of the financial system of the country. In fact, to disincentivise Indians from using cryptocurrency, the government had slapped a hefty 30% tax on trading of the virtual asset.

READ | Unified health interface key to efficient, accessible health services

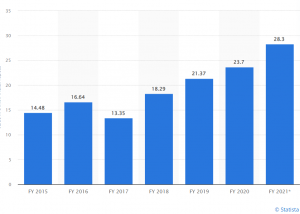

Value of currency in circulation (Rs lakh crore)

Digital rupee: A boon to economy

Apart from providing an alternative to cryptocurrency, the CBDC will reduce operational costs involved in physical cash management, foster financial inclusion, bring resilience, efficiency and innovation in the payments system. It will also add efficiency to the settlement system, boost innovation in cross-border payments, and provide the public with services that other virtual currencies provide without associated risks.

India’s volume of bank notes in 2021-22 rose 4.95% to 13,053 crore from 12,436 crore and 11, 597 crore in the previous years, says the RBI annual report 2022. This meas a rising cash management cost for the government. The RBI says that the total expense incurred on security printing in FY22 was Rs 4,984.8 crore compared with Rs 4,012.1 crore in the previous year.

As of now, 98 countries are exploring CBDCs, according to the Atlantic Council tracker. Of these, 11 countries have already experimenting with their CBDC. These include the Bahamas, Eastern Caribbean islands and Jamaica. China, Russia, South Korea and Thailand that have launched pilots of digital currencies. Countries like Japan, Singapore, and Sweden are currently examining the various facets of the digital legal tender. A few days ago, the US Federal Reserve released a report outlining the costs and benefits of issuing a central bank backed digital dollar. Among the early entrants, Nigeria failed to convince its people, leading to the failure of its digital currency.

Challenges to central bank digital currencies

The government will face certain obstacles in popularising its CBDC, the e-rupee. Firstly, with a successful payment system like UPI around, the general population doesn’t have a particular requirement for digital currency. Furthermore, according to RBI’s own survey, cash remains the preferred mode of payment for receiving money for regular expenses which poses a problem for adoption of e-currency. Cash is still used predominantly for small value transactions amounting up to Rs 500.

There are several possible risks associated with the introduction of CDBCs. In the case that retail CBDC, accounts are interest bearing. There are obvious implications for the banking system. It is also possible that during periods of extreme uncertainty, depositors may choose to migrate away from commercial banks, causing financial upheaval and economic chaos.

There is also the question of whether CBDCs will offer the same degree of anonymity as cash does. According to news reports, RBI has asked banks not to report low-value transactions to maintain anonymity. Such transactions won’t be recorded and will not leave a trace in the banking system. The RBI has not proposed a limit for traceless low-value transactions. Currently, cash transactions and bank deposits below Rs 50,000 are reported. The customers are required to disclose their PAN number while making transactions above that amount. RBI is likely to retain this limit for digital rupee transactions too.

There are also upsides of using digital currencies. As far as addressing the problems associated with existing physical currencies and cross-border transactions, the government will be able to curb it to some extent. Cross-border money transfer and conversion of money into foreign currency is a tedious and expensive enterprise. With the launch of the digital rupee, the instant cross-border money transfer is set to make bank cash management and operations seamless. To what extent these benefits actually materialise remains to be seen.

Also, cash placement and tracking is a major challenge in India. The CBDC can be a success as far as addressing anonymity in a non-intimidatory way. The government will also save operational, printing, distributing and storing costs which is likely to help the transition towards a cashless economy.

Initially four banks — State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank — have been charged to issue digital currencies in Mumbai, New Delhi, Bengaluru and Bhubaneswar under the first phase of the pilot project. After this, the services will be subsequently extended to the cities of Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna, and Shimla. Four more banks will join the pilot programme. These banks are Bank of Baroda, Union Bank of India, HDFC Bank, and Kotak Mahindra Bank.