The growth narrative of India presents an intriguing tale at the end of the second quarter of the financial year. This period coincides with the commencement of the festival season, fostering expectations of economic improvement. India, with the potential for an approximate 8% growth rate, is now projected to hover around the range of 5.5-6.5% in the fiscal year 2024. This development raises concerns since it signifies that India is yet to realise its full growth potential. The recent monsoon season exhibited a notable rain deficit across the nation, potentially affecting both the kharif and rabi agricultural seasons.

The industrial sector has recorded moderate performance up to July 2023, with room for improvement. Manufacturing has seen a growth rate of 4.6%, electricity at 8%, and mining at an impressive 16.7%. While these figures represent an improvement from July 2022, there remains untapped potential, especially in the manufacturing sector. Primary goods and infrastructure sectors have fared well in July 2023 compared with the same period the previous year. However, the performance in the capital and intermediate goods segment leaves room for improvement.

READ I Taxing online gaming: India must craft nuanced policies for digital age

Core sector growth robust

The situation in the consumer durables segment is challenging, as it exhibited negative growth in July, whereas consumer non-durables have performed better at 7.4%. The performance of the eight core industries varies, with coal production, crude oil, and natural gas showing strength, while refinery and fertilizer sectors need bolstering. Industries associated with infrastructure, such as steel, cement, and electricity, have recorded robust performances.

The government’s fiscal position remains robust, despite mixed manufacturing sector performance and uncertainties in the agricultural sector. GST collections witnessed an 11% jump in August 2023, reaching Rs 1.6 lakh crore compared with Rs 1.4 lakh crore in August 2022. GST revenue from domestic transactions has grown by 14% over the previous year. Gross direct tax collection as of September 16, 2023, increased by 18%, with net direct tax collection at 23.5%. These figures indicate healthy growth in the fiscal sector.

In the banking sector, aggregate deposits have expanded by 14%, totaling Rs 193 lakh crore, while credit is growing at a year-on-year rate of 19.8%, reaching Rs 150 lakh crore.

On the external front, concerns arise as growth in advanced countries decelerates, leading to a decline in demand from India. In July, overall exports reached an estimated $59.4 billion. The trade deficit in July was $8.4 billion, down from $15.2 billion in July 2022. Noteworthy export increases include iron ore at 962%, electronic goods at 13%, and ceramic products and glassware at 20.8%. Agricultural exports also improved, with fruits and vegetables up by 19%, oil meals by 34%, and rice by 5% year-on-year.

India can realise growth potential despite global headwinds

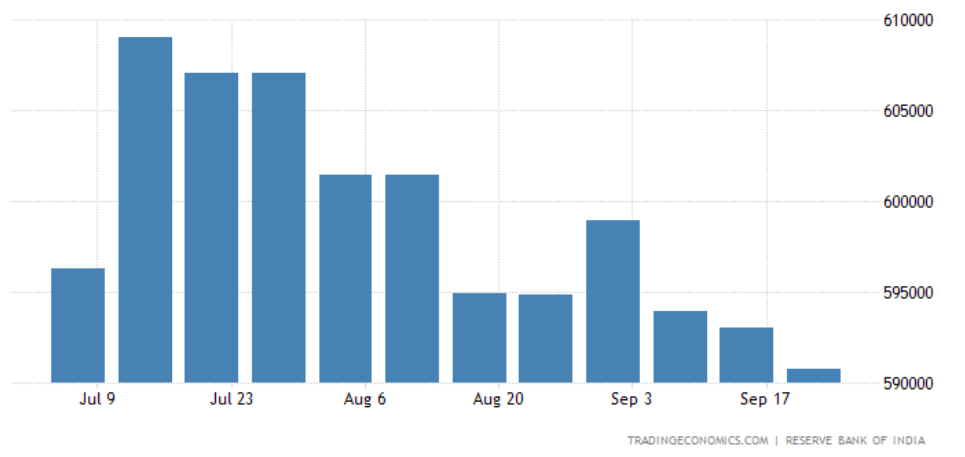

Given the rising global economic uncertainty, it is essential to bolster India’s Foreign Exchange Reserves currently standing at $593 billion. These reserves are vital for instilling confidence in the economy and providing a cushion against speculative endeavors. While building forex reserves may take some time and have implications for liquidity, the RBI must carefully monitor the exchange rate, which has recently fluctuated around Rs 83 per dollar. Heightened global uncertainty, coupled with rising oil prices approaching $100 per barrel, adds to market volatility.

India foreign exchange reserves

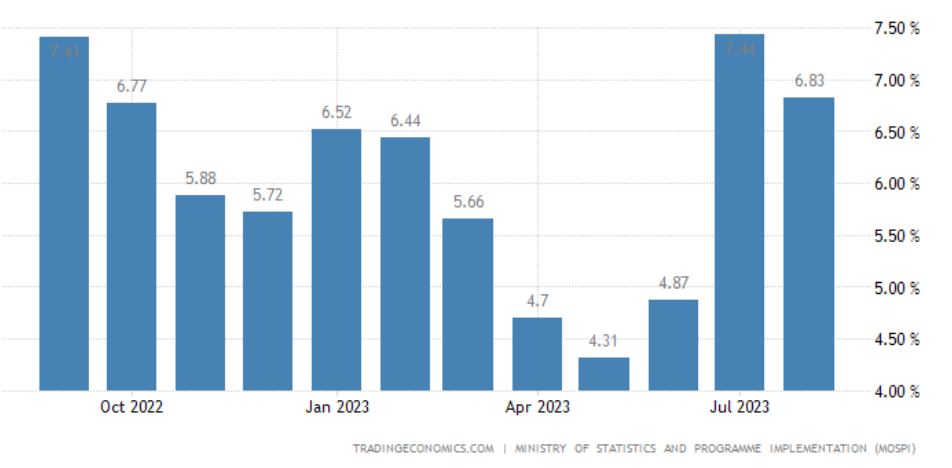

Inflation data released in mid-September reveals that inflation based on the Consumer Price Index (CPI) for all commodities stands at 6.8% , with food CPI at 9.9%. Meanwhile, the Wholesale Price Index (WPI) shows negative growth for all commodities at -0.5% and 5.6% for food WPI. Notably, food prices under CPI are elevated, primarily attributed to supply-side factors like fluctuating vegetable and pulse prices, rather than demand-side issues.

India consumer price inflation

The interest rate scenario in advanced economies is somewhat perplexing. The ECB raised its policy rate by 25 basis points, while the Federal Reserve and Bank of England maintain extended pauses. The US Fed’s interest rate hike has been postponed to 2024 due to receding recession fears.

In 2023, while inflation is stabilising in advanced economies, the looming possibility of an end to the extended pause continues to cast uncertainty over emerging market economies. Interestingly, even if inflation surges due to supply-side disruptions, recent policy trends suggest the likelihood of interest rate hikes. However, if inflation in advanced economies remains benign and converges toward the long-term average of less than 2%, there may be room for rate cuts.

Supply-side disruptions are also expected to subside now that the specter of war has receded. Consequently, prices may continue their downward trajectory in advanced economies. In such a scenario, the likelihood of a US Fed interest rate hike is minimal. India’s interest rates are closely tied to US policy rates due to factors such as trade relations, exchange rate considerations, and capital movement.

India finds itself in a challenging phase. While its growth rate ranks among the world’s highest, it remains below its long-term potential. India’s demographic dividend, driven by its youthful population, has a limited window of around 20 years. To maximise the benefits of this demographic dividend and avert a demographic disaster, it is imperative to promptly reverse the current higher-than-normal interest rates. Lowering interest rates is vital to reignite the investment cycle in the country. Household savings need to be channelised through both banking and non-banking finance companies.

Interest rates play a crucial role in long-term investments, making rate reduction beneficial for the economy and potentially pushing growth rates beyond the 8% mark. Given that India is entering an election cycle, with the interim budget due in February 2024 and the full-fledged budget scheduled for February 2025, maintaining low interest rates during the election phase could be advantageous. The RBI should consider initiating the interest rate reversal process soon after the October 6, 2023 policy meeting.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.