Gold prices and inflation metrics: Gold has seen a meteoric rise in 2025, climbing over 30% since January amid heightened global economic uncertainty. From central banks to individual investors, the flight to the yellow metal has intensified, making it one of the year’s top-performing asset classes. The Reserve Bank of India and the People’s Bank of China have both been actively bolstering their gold reserves, reflecting a broader trend of strategic hedging against geopolitical and financial instability.

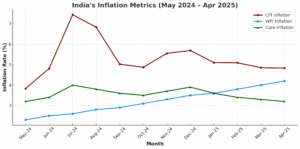

India’s inflation trends, however, reveal a striking divergence. While headline retail inflation — measured by the Consumer Price Index (CPI) — dropped to a 75-month low of 2.8% in May 2025, core inflation has been rising steadily, reaching 4.2% the same month. This 111-basis-point increase from May 2024 has been driven largely by gold prices, which have injected volatility into what is typically a more stable indicator.

To clarify, headline inflation reflects price movements in a broad basket of goods and services, including food and fuel — categories prone to sharp swings due to weather or global commodity prices. Core inflation strips these out to focus on more persistent price movements in housing, transport, healthcare, and consumer goods — and is thus preferred by central banks for policy calibration.

READ | Indian farmers are leading a rural income revolution

Gold’s outsized role in core CPI

According to CRISIL, most components of core CPI are seeing disinflation or stable prices. But categories such as gold, silver, mobile tariffs, transport, and toiletries are bucking the trend. Among them, gold is the clear outlier. Gold inflation averaged 24.7% in FY25, up from 15.1% in FY24 — a dramatic jump. Despite gold holding a modest weight of 2.3% in India’s core inflation basket, it accounted for a staggering 17% of the rise in core CPI over the past 12 months.

This distortion is not trivial. By June 19, 2025, global gold prices had surged 43.01% year-on-year to $3,376.12 per troy ounce — the result of a wave of safe-haven buying driven by deepening global financial instability and geopolitical tensions.

Global forces, not domestic demand

Unlike food or housing, gold inflation in India is less a reflection of domestic demand than of global sentiment. During turbulent times — war, recession, or currency devaluation — gold draws investors as a reliable store of value. ETFs, sovereign wealth funds, and central banks ramp up gold purchases, amplifying price momentum. This international dynamic often overshadows local consumption trends, even in gold-loving India.

While Indian households continue to buy gold for weddings, festivals, and wealth preservation, it is global capital flows that increasingly dictate price levels. Given this disconnect, gold’s inclusion in India’s core CPI may not offer a true picture of domestic inflationary pressures.

A Case for Exclusion from Core CPI

CRISIL has argued that gold could be treated like food and fuel — volatile categories that are excluded from the core index — to prevent it from distorting inflation signals. This would align core inflation more closely with underlying economic activity and help policymakers make better-informed decisions.

In fact, if gold inflation had followed historical norms, core CPI in May 2025 would have been closer to 3.4%, not 4.2%. That 80 basis point difference is significant for a central bank that uses core inflation to guide interest rate policy.

Major global central banks — including the Federal Reserve, Bank of England, European Central Bank, and Bank of Japan — also include gold in their core indices, but assign it negligible weight. In contrast, India’s relatively high weight amplifies its effect. Reducing or removing this weighting could lend greater clarity to core CPI readings in times of global volatility.

Implications for monetary policy

The RBI tracks core CPI closely to assess demand-side pressures and guide monetary policy. The rise in core inflation has triggered speculation that further rate cuts may be postponed. An RBI bulletin in May noted that core inflation hit an 18-month high in April, raising concerns about premature monetary easing.

However, RBI Governor Sanjay Malhotra has signalled that the central bank remains open to further easing if inflation stays below projected thresholds. After the recent rate cut and a shift to a neutral stance, the RBI continues to walk a tightrope — balancing the need to support growth with the imperative of anchoring inflation expectations.

As the gold rally shows little sign of abating, its role in shaping India’s inflation metrics will remain contentious. Excluding gold from the core CPI could offer a clearer view of demand-side inflation and reduce the noise created by global market turbulence. For a central bank striving for clarity in complex times, this debate is far from academic — it may well shape the course of India’s monetary policy in the months ahead.