Faced with the toughest inflation challenge in four decades, the US Federal Reserve on Wednesday raised its short-term benchmark interest rate. The central bank raised the benchmark Federal Funds Rate by 0.25% in the first hike in more than three years. The Fed said inflation remained high and the Ukraine war may create additional upward pressure on prices. The Federal Open Market Committee has also signalled the possibility of six more rate hikes this year to bring the inflation back to pre-pandemic levels. The Fed is hoping to ease inflation to 2.3% in 2024 from the 40-year high recorded in February.

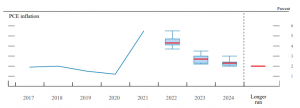

Inflation measured by the consumer price index stood at 7.9% in February, while the number as per Fed’s preferred PCE index was 6.1%. The spurt in inflation was sudden. In March 2021, Fed had projected inflation to rise to 2.4%. In another six months, prices shot up to record levels, similar to what happened after the oil shock. Workers are seeking higher salaries to meet expenses, raising the spectre of structural inflation.

READ I Timely action on inflation needed to avert hard landing, says Maurice Obstfeld

US public debt soared by $5 trillion due to the stimulus measures taken by the government to jump start the economy which was stalled by the Covid-19 pandemic. The money supply increased by 30%, generating demand and pushing inflation to record highs. Going by the signals from Fed, it will take several years before it manages to drag inflation back to pre-pandemic levels when it ruled below 2%. The Fed says inflation measured by the PCE price index would average 4.3% before ending the year at above 3%. These numbers are shocking considering that the Fed had forecast 1.9% inflation in the beginning of 2021.

Has the Federal Reserve done enough?

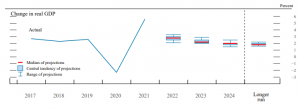

With the Fed moving in to tighten monetary policy by raising policy hikes, will the prices of fuel, groceries, and cars come down? The series of rate hikes will slow GDP growth and demand, but these consequences are justified in a fight against runaway inflation. But will six more quarter percentage point hikes suffice? The Fed projections hint at the need for more aggressive action. The six equal increases in the next six Fed meetings will take the federal funds rate to 1.75-2% by the year-end. It may be hiked further next year to 2.8-3% if inflation persists.

READ I Easing of public debt burden will cause economic disruption

US policy makers have already factored in slow GDP growth in their projections. Fed has pared its growth estimate for the current year to 2.8%, considerably below its December forecast of 4%. The reasons for the lower projection are monetary action and the impact of the Ukraine war which may trigger an increase in the prices of crude and other commodities.

The Fed action will also have a bearing on the global debt and equity markets. Stock indices including the Sensex and Nifty have responded positively to the decision. The investors had already factored in the rate hike and drew confidence from the Fed chief’s statement that the American economy is strong enough to handle tight monetary policy.

Like central banks all over the world, the Reserve Bank of India will also be influenced by the US Fed decision to raise rates. RBI’s monetary policy committee is scheduled to meet between April 6 and 8. The action will be less spectacular as retail inflation is still hovering around the upper limit of RBI’s target range. The CPI inflation in February was 6.07%, just above the 6% tolerance limit set by the RBI.

The RBI will have to do some monetary tightening eventually by tightening lending rates and changing its accommodative stance. Inflation has been rising for five months. The central bank may see the bout of inflation as transitory and not as a breach of its tolerance level. As the economy is facing challenges posed to growth, the RBI may retain its present stance despite the higher prices of crude and other commodities.