EVs in India: The country is making giant strides in electric vehicles adoption as it looks to combat climate change and cut reliance on fossil fuels. Recent data from the Vahan Dashboard indicates that four Indian states have surpassed a 10% penetration rate for electric two-wheelers (e2Ws). Goa leads Indian states with 17.20% adoption rate in the two-wheeler segment, followed by Kerala (13.66%) and Karnataka (12.19%). However, when considering overall sales volumes, Maharashtra stands out, despite a lower e2W penetration rate of 10.74%. EV penetration simply means the sale of electric vehicles as a percentage of the total light vehicles (including commercial and passenger vehicles).

By the end of May, the country’s total e2W penetration reached 5.63%, compared with 4.05% in 2022. This indicates a gradual increase in sales despite various challenges faced by the EV market. The data reveals that 392,681 e2Ws were sold in the first five months of 2023, out of the 6.98 million two-wheelers sold in India during the period. India has set a target of 80% penetration rate for e2Ws by 2030.

READ | Government bets big on BSNL with $10.79 bn revival package

With the growing demand for electric vehicles, companies have been launching new models across various segments. In 2019, no state had an e2W adoption rate exceeding 1%. However, this situation is undergoing fast change with more people making the switch to electric vehicles. Several factors contribute to this trend, including government incentives for EV production and purchasing through schemes like FAME, lower electricity tariffs, increased availability of charging infrastructure, scrappage incentives, and investments in battery recycling.

It has been observed that government policies and stricter emissions standards have played a major role in accelerating the adoption of electric vehicles. According to the International Energy Agency (IEA) estimates, more than 14 million electric cars will be sold by the end of this year, marking a 35% increase from 2022.

Analysing the data by state reveals varying rates of e2W adoption. Some states demonstrate higher adoption rates, while others have considerably lower penetration rates, particularly in the Northeast, where the combined penetration is 0.51%. Although Goa has the highest penetration rate in terms of the percentage of EVs sold compared to regular vehicles, Maharashtra leads in the number of e2Ws sold as of May 31, with a total of 76,304. Karnataka follows closely with 60,620 vehicles.

There is a direct correlation between robust EV policies and the number of EV sales. States that offer the most tax benefits tend to achieve more favourable results. Notably, the top ten states with the highest e2W adoption rates have implemented commendable EV policies, such as exemptions from road tax and registration fees. Karnataka became the first Indian state to introduce such policies in 2017.

Apart from Goa, Kerala, Karnataka, and Maharashtra, Gujarat (8.70%), Rajasthan (7.15%), Andhra Pradesh (6.44%), Chhattisgarh (6.32%), Tamil Nadu (6.31%), and Odisha (6.17%) have also surpassed the national average in e2W adoption.

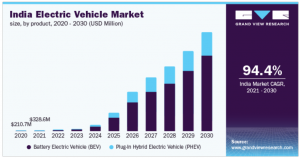

Electric Vehicles market

Challenges to EV Adoption in India

The biggest hurdle to EV adoption in India is the manufacturing process. Even the most technologically advanced electric vehicle manufacturers in India are dependent on imports for critical components such as lithium cells and semiconductors. These components are primarily imported from China. The limited availability of these key minerals hampers the manufacturing process.

Additionally, the government recently made the decision to discontinue the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles scheme, which is set to expire in March 2024. Furthermore, the government has reduced subsidies on electric two-wheelers under the flagship FAME II scheme from 40% to 15%. These subsidy cuts have made electric two-wheelers more expensive, and since Indian consumers are price-sensitive, it is likely to dampen sales of EVs.

Are EVs a Solution to Carbon Emission Challenges?

Despite the hype around the ability of EVs to reduce carbon emissions, many proponents of EVs overlook the environmental cost of manufacturing electric vehicles. The production of electric vehicles also contributes to climate change and leaves a significant carbon footprint. Analysts argue that mining, refining, and processing the metals required for electric car batteries are far more carbon-intensive processes than manufacturing a petrol vehicle. This claim is supported by a 2021 study conducted by Swedish carmaker Volvo, which stated that the processes released 70% more carbon emissions compared to manufacturing an internal combustion engine (ICE) car.

A government panel has recommended a ban on diesel cars to promote EV adoption in India. But this report also has failed to address the issue of the high environmental costs associated with EVs. Vehicle registration is valid for only 15 years in the country, and in Delhi and the National Capital Region (NCR), it is limited to 10 years. The thinking within the government is that the new scrappage policy will help in recycling of cars, the most environment friendly approach is to utilize vehicles for as long as possible to offset the environmental costs that have already been incurred.

Perhaps there is no straightforward solution to a problem as vast as climate change, and EVs are certainly not the ultimate solution.

India’s EV penetration rate was just 1.1% per cent in 2022 against the Asian average of 17.3%. China has the highest EV penetration rate in Asia with 27.1%, followed by South Korea at 10.3%, according to data published by S&P Global Ratings. India is dependent on imports for its requirement of cells. The government expects a major change with cells coming under the production-linked incentive (PLI ) scheme. India has recently discovered 5.9 million tonnes of lithium in Jammu and Kashmir.