The crisis in the Chinese economy has sent shockwaves across the world with analysts suggesting that the growth engine may be slowing too fast. And the government is not taking bold steps to stop the economic slide. The People’s Bank of China cut its key policy rates by 10m basis points to 2.75%, a move analysts see as too little, too late.

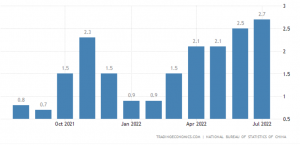

The rate cuts have failed to impress economists across the world. Chinese central bank has more room to cut rates as core inflation is still under control at around 0.8% in July. Considering the enormity of the current crisis, Beijing will also need huge stimulus packages to revive economic growth.

Chinese economy: The gathering storms

The cut in the central bank’s one-year seven-day lending rates follows a series of disappointing macroeconomic numbers that were below market expectations. Consumer spending rose by a meagre 2.7% in July when the market was expecting around 5% growth. The growth in industrial production for the month was a disappointing 3.8%. China’s booming housing sector seems to be in trouble with fixed investment growing by just 5.7% in the January-July period compared with 10.3% in the same period, last year.

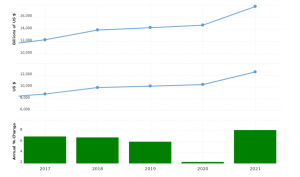

China GDP, per capita income, growth rate

Chinese economy managed to narrowly avoid a contraction in the April-June quarter with a 0.4% expansion as China’s zero Covid policy led to the lockdown of its commercial capital Shanghai. China is expected to miss the 5.5% economic growth target set by the government for the first time in seven years.

The employment scenario is dismal. The unemployment rate showed a slight improvement in July to 5.4% from 5.5% in the previous month, but youth unemployment remained high touching a new high of 19.9%.

READ I Confusion prevails over the state of Indian economy

Timid response from government

The Chinese leadership seems unruffled. They have no plan to revoke the stringent zero covid policy or come up with a huge stimulus package to pull the economy out of the crisis. China’s largest economic hub Shanghai is under a stringent lockdown as many other parts of the country. This has darkened the prospects of an economic revival and the global forecasters are likely to cut growth projection to below 4%. Economists see the 10 basis point cut as too little to lure the reluctant households and businesses to borrow.

China inflation rate

The normal response of Chinese policymakers during slowdowns is pumping up public infrastructure investment, create a borrowing boom, and effect sharp interest rate cuts. But for the 10 basis points rate cut, Chinese authorities haven’t taken any major step, to the surprise of China watchers. There is also no attempt to prod local governments to borrow and fund infrastructure projects. The efforts so far are not enough to mitigate the crisis at hand.

While the Chinese real estate market is in total disarray, production and sales of cars remain unaffected, offering a silver lining in the gloomy economic scenario. The foreign companies are cutting down investment plans, and if the crisis prolongs some of the world’s largest consumer durables and automobile manufacturers will start getting affected, dimming the growth prospects of some of the largest and most developed economies in the world.

Slowing China threatens global growth

The crisis in China poses the single largest threat to the growth prospects of the world economy. China is a growth engine for the global economy as a large exporter and importer. Slowing consumer spending in the Asian powerhouse threatens world’s most powerful economies like the US and Germany for which China is one of the largest markets.

China’s economic woes will spread fast because of its importance for the global value chains. The news of the Chinese slowdown has already sent the commodity markets into a tailspin. The debt-ridden emerging-market economies won’t be able to absorb the impact of a full-blown Chinese economic crisis.

The US economy which is in the cusp of a recession would be the worst victim of a possible Chinese meltdown. A crisis in the world’s largest manufacturing hub will fuel inflation in the US, negating the aggressive rate effected to cool inflationary pressures, leading to a further fall in global energy and food prices.

Will China slip into stagnation?

The future of Chinese economy is not as bleak as some commentators suggest. The Chinese economy, with its huge market and well-laid physical and social infrastructure, is unlikely to collapse, or even slip into a stagnation. The disappointing growth in the April-June quarter is a direct consequence of Covid lockdowns that affected industrial output. Once the restrictions are lifted, Chinese economy will slowly gather steam.

Even after rapid growth for around three decades, Chinese income levels are much lower than those of the developed world. China can grow at a faster pace compared with the developed world for several years without depending on exports.

The Chinese authorities are confident of overcoming the current crisis without much pain. The government blames the Covid pandemic and the Russia-Ukraine conflict for the current situation and says the entire world is facing similar situations. With a huge market and technological leadership in several key industrial sectors, China is unlikely to face a Japan-style economic stagnation. Japan was growing faster that the rest of the developed world when bubbles in real estate and share markets burst, pushing the economy into a state of perpetual stagnation.

Like in Japan’s case, China has also made huge investments in infrastructure and real estate, which has created bubbles that threaten the economy. China’s real estate sector has run into trouble with homebuyers stopping payment on their mortgages for unfinished apartments. China needs calibrated policies to avert a collapse of its real estate sector.

Anil Nair is Founder and Editor, Policy Circle.