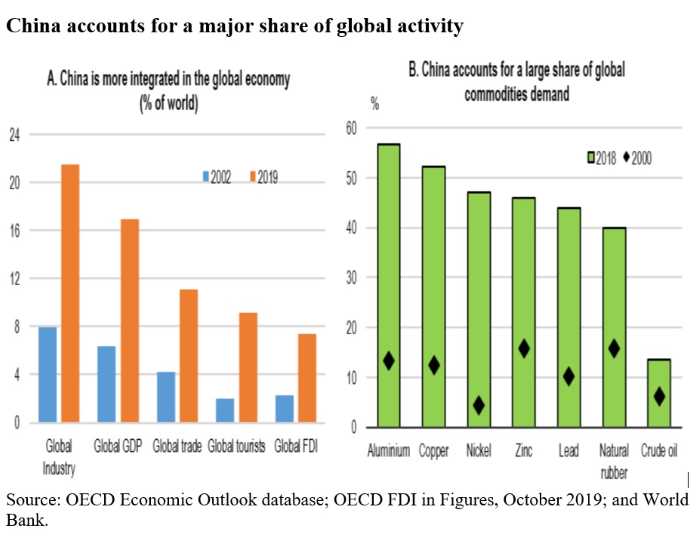

The Covid-19 outbreak resulted in unprecedented suffering and economic destruction. The health crisis has virtually stalled trade and commerce worldwide. The virus, first detected in Wuhan, eventually spread to most parts of the world to assume pandemic proportions. China plays a significant role in global production, trade, tourism, commodity markets and global supply chains as a producer of intermediate goods such as computers, electronics, pharmaceuticals, and transport equipment. Hence, the crisis spilled over to other countries. The pandemic led to the destruction of global supply chains, weaker demand for goods and services, fall in international tourism, increased risk in financial markets, drop in commodity prices, and a dip in business and consumer confidence.

The pandemic resulted in Chinese economy contracting in the first quarter of 2020 — the first time since the reforms were launched. These developments will lead to zero growth in Asian economies for the first time in 60 years. (IMF World Economic Outlook). The pandemic damaged most sectors of the Indian economy with demand, supply, and liquidity shocks wreaking havoc. Three significant contributors to GDP — private consumption, investment, and external trade — are affected. Two factors play a key role in economic growth — capital and labour. Labour is abundant in the country, while capital has always been scarce. Currently, India is dependent on the banking system for financing trade, manufacturing, and services. The lockdown has affected the banking system in terms of business, though banks continue to run essential services.

READ: India’s storied middle class may be sliding into poverty

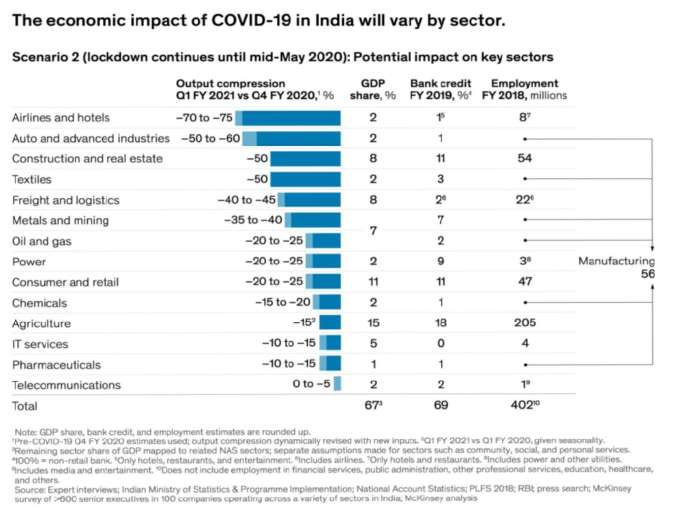

IMF has forecast 1.9% growth for Indian economy in 2020, while predicting a sharp pickup next year. The actual growth rate will depend on how early the economic activities resume. Efforts to stabilise the economy may cost India up to $130 billion or more than 5% of the GDP (Mc Kinsey & Company Reports, April 2020). The impact of Coronavirus on various sectors of the Indian Economy is shown in figure 1. The novel coronavirus has disrupted all three sectors of the economy — the primary (principally farming), secondary (predominantly manufacturing), and the tertiary (services). Except for health sector, all other sectors are affected. Agricultural inputs, manufacturing sector, oil and gas, automobiles, real estate and construction, transportation and travel, both retail and wholesale trade, tourism, telecom, information technology, hotels and restaurants, financial services, and stock markets are all hit hard by the crisis. However, the degree of disruption varies across sectors. Remote working may work in teaching, legal, taxation services, and finance. Services such as transportation, tourism, trade, retail, repairs and maintenance, manufacturing, and agriculture need physical activity. Shutdown will affect output, efficiency, and productivity and, in turn, will obstruct economic growth from both supply side and demand side.

The most affected sectors currently are aviation, while the least impacted are IT-enabled services and pharmaceuticals. Consumption sectors such as clothing and furnishings are likely to drop by more than 30%, while food and utilities may see a 10% drop. Output in travel, transport, logistics, textiles, power, hotel and entertainment also have suffered badly. The pandemic caused significant cash flow problems for corporates. The fall in oil prices is favourable for the Indian economy since 80% of its oil requirement are met through imports. The government has levied an additional excise duty of Rs 3 per litre on petrol and diesel, which will bring in additional revenues of Rs 39,000 billion.

READ: India’s Faustian bargain: Alcohol revenues trump health, welfare

Sector-wise analysis

Food and agriculture: Food and agriculture accounts for 16.5% of the gross value added and 43% of jobs in India. Food and agriculture are the lifeblood of Indian economy. Essential items such as cereals, pulses, fruits, vegetables, and dairy will not be affected. Still, edible oil price is expected to fall in the short term due to a global downturn in demand. It is also likely that import items such as agrochemicals and fertilisers may be facing some volatility in the long run. The prices of food items that are exported to the US, China, and Europe, such as tea, meat, spices, and seafood crashed due to lack of demand and domestic supply chain problems. Nevertheless, a majority of food processing units are not affected. Since the bulk demand from restaurants and hotels are falling, it unfavourably affects the prices of some agricultural commodities.

Prices of perishable vegetables have fallen 15-20% due to falling demand and uncertainty over exports. However, vegetables such as onions and potatoes have seen a price rise.

There is no shortage of grains and pulses in the country, with huge stocks piled up at the godowns of Food Corporation of India (FCI) and 3.2 million tonne pulses with NAFED. Further, the e-NAM platform actively engaged in debottlenecking agri-logistics, creating an interface for large transport aggregators. All India Agri Transport Call Centre has been launched to coordinate between states for inter-state movement of vegetables and fruits, and inputs like seeds, pesticides, and fertilisers. It will be better to implement the National Agricultural Labour Force Register for identification and movement of the labour force for enhancing agricultural and processing operations. PM-KISAN scheme is required to cover agriculture labour to enable the vulnerable sections to leverage the benefit. In addition, recent guidelines of color-coded zones enable to revive economic activity and allow for an entire ecosystem of primary and agro-based industries.

READ: Decongest cities, promote industries in villages to revive growth

Apparel and textiles sector: The apparel and textile sector contributes 2% of India’s GDP. It provides more than 45 million direct jobs and a sizable number of contract jobs. The lockdown led to the temporary closure of factories. However, the price remains stable, but demand has been impacted. Hence, these sectors are under great financial stress. A comprehensive financial package, along with cuts in interest rates and taxes may be considered to boost consumer spending. There is also a need to review the loans given to this sector to make this sector competitive and lucrative.

Auto sector: Auto and auto components contribute 7.1% and 2.3% to the GDP, respectively. It provided more than 40 million direct jobs in 2018-19. Automobile sector production is affected by the shutdown. Indian automobile industry imports 25% of its parts from China. Disruption in the supply of raw materials affected imports. Further, liquidity shortfall impacted domestic sales and exports. This sector was already reeling under a demand slump and the lockdown has compounded the problems. It is essential to develop a repayment support scheme for automobiles and related firms, especially for dealers and auto component manufacturers. In addition, it is a prerequisite for implementing the scrappage scheme for commercial vehicles to incentivise the purchase of new vehicles. Another step to revive the sector may be relaxation of the GST rates on automobiles for a short period. The government can also eliminate the cess on auto sales. Further, it will be better to waive off the registration fees on new vehicles.

READ: Treat migrants with empathy, allow them to go home

Aviation and tourism sector: The aviation and tourism sectors contribute 2.4% and 9.2% to the GDP, respectively. They provide more than 42.7 million direct jobs. Since international and domestic travel is closed, demand for turbine fuel declined substantially. According to the Indian Association of Tour Operators, hotel, aviation, and travel sectors may incur losses of Rs 8,500 crore. It is essential to ease the financial stress in the sector. Further inclusion of aviation turbine fuel in the GST regime can allow airlines to claim input tax credit on taxes paid on fuel. The airline and hospitality sectors must be treated as priority sectors for lending purposes, and the NPA norms may be eased for the sectors.

Building and construction sector: The real estate sector is one of the largest job creators in the country. This sector is likely to contribute 13% of the GDP by 2025. The residential segment was witnessing a demand slump due to the NBFC crises, economic slowdown, and undesirable practices by some developers, leading to inventory pileup in major cities. Though the government introduced a $3,570 million bailout package for real estate projects suffering from liquidity crunch, the problems are far from over. The cement, steel, and other buildings materials are also affected. Hence, NPA classification can be extended beyond 90 days.

READ: An imperfect future: Imagining the post-Covid world order

Chemical and petrochemicals: India is the sixth largest chemical and petrochemicals producer in the world, and it contributes 3.5% to the global chemical output. The majority of chemical producing units are SMEs. These units cannot meet sudden working capital requirements. The market uncertainty will affect the sectors badly. Hence, they should be provided working capital loans on favourable terms. Looking at the present situation, there is an opportunity for India to negotiate with other countries of the world for long-term investment in these sectors.

Consumer, retail, and internet business: These sectors account 10% of the GDP and provide 8% all jobs. The biggest challenges faced by the sector is supply chain disruption. However, food and grocery retail is less affected. The e-commerce companies will eventually witness depression in growth. Easing of manufacturing rules for essential commodities and suitable insurance coverage can be considered. Digital payments can be prioritized for smooth, risk-free transactions. Consumer durables, electronics, engineering goods, IT, specialty textiles and garments, AI, and robotics are areas where India can grab a major market share in the current global atmosphere.

MSMEs: Micro, small and medium enterprises contribute around 30-35% to the GDP and employs more than 11.4 crore people. MSME sectors are the worst affected from the shutdown. Production facilities and retail have been hit the big time, especially service sectors are significantly affected. MSMEs engaged in essential services are operational, but those involved in tourism, hotel, and logistics are witnessing a decline in business. In addition, those in consumer goods, garments, footwear, and automobiles are majorly affected. The relaxation in repayments announced by the RBI will provide some relief to these sectors. In these circumstances, it is better to assess the actual impact on these sectors to take long-term policy action. Now global investors are realizing that their overdependence on China is risky. They may consider shifting part of their business to India. It is high time MSMEs leveraged the opportunity since India is rich with a large market and quality human resources.

READ: FDI from China: India must balance strategic and economic interests

Pharmaceuticals: India is the fourth largest medical device market in Asia. Pharmaceutical manufacturing is considered to be one of the essential services during the lockdown period. India is importing 70% of raw material from China. To make available sufficient quantities of essential medicines, specific medical devices, sanitisers, surgical masks, and ventilators, India has banned the export of all these items. It is essential to frame rules for explicit permission for the manufacturing and transport of raw materials and we need to strengthen local investment to prevent counterfeit medicines. India should reduce dependence on China for raw materials and must find alternate sources of pharmaceutical products over the long term. India can also consider leveraging FDI in pharmaceuticals, biotech, medical supplies, equipment, and related health infrastructure.

The current economic crisis is a chance for India to enact comprehensive reforms to attract more foreign investment into the country. The Union government must go the extra mile to return to high growth trajectory. Indian entrepreneurs should be encouraged to meet domestic and global demand to build a global production hub.

(Dr Naliniprava Tripathy is a professor of finance at IIM Shillong.)

Naliniprava Tripathy is an Indian economist based in Shillong. She teaches finance at IIM Shillong.