India G20 presidency: The International Monetary Fund on Saturday convened a meeting in Bengaluru on restructuring debt for distressed economies. The meeting attended by China, India, Saudi Arabia, the G7 and the World Bank could not make much headway on the vexatious issue because of disagreements among members.

IMF Managing Director Kristalina Georgieva said there was a commitment to bridge differences to support economies facing debt crisis. Georgieva co-chaired the session with Finance Minister Nirmala Sitharaman. There was some progress on the issue, but the topic of debt restructuring could not be discussed in detail. The IMF and World Bank meetings in April will hold detailed discussions.

Georgieva backed efforts to beef up the debt financing architecture and improve the speed and effectiveness of debt resolution. The IMF had disbursed $272 billion loans to 94 countries since the pandemic broke out. The Fund had stepped up lending to help members facing debt crises. The lender is also in the forefront of helping the countries such as Malawi, Guinea, and Haiti which are facing a food crisis.

READ | Big Tech regulation: Blanket emulation of EU law may harm India’s startups

The delegates put pressure on China, the largest creditor, and other lender nations to take a large haircut in loans to developing nations facing debt crisis. China highlighted its position that multilateral development agencies also should take haircuts.

It will be a great achievement for India’s G20 presidency if it manages to resolve the debt crisis faced by several member nations. India’s neighbours Sri Lanka, Bangladesh and Pakistan are facing severe economic crises and have sought bailouts from IMF.

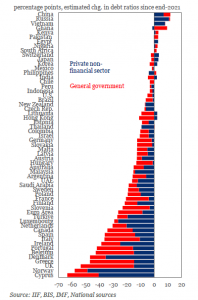

Estimated change in debt ratios since end-2022

India’s presidency of the G20 comes at a time when the world is mired in geopolitical and economic uncertainties. Most world economies are facing the double whammy of post-pandemic crisis and the economic disruptions caused by the Russian invasion of Ukraine.

New Delhi is drafting a proposal, urging G20 countries to help nations facing debt crises by asking lenders including the world’s largest sovereign creditor China to make concessions. India had earlier listed terror, climate change, and pandemic as the greatest challenges facing the world and had suggested that these are best fought together. In its agenda, New Delhi had also mentioned sustainable lifestyles, depoliticising the global food supply, fertilisers and medical products among its priorities for the tenure.

The debt crisis

The world’s poorest countries are burdened by debt, with some of them facing three years of soaring debt service costs, says the latest report by the World Bank. The external debt service payments on public and publicly guaranteed debt by the world’s poorest countries saw a jump of nearly one-third from 2021 to over $62 billion in 2022, it said. The result is under deployment of resources on vital areas such as health, education and social assistance. Dozens of countries are now reeling under unsustainable debts.

The report had also warned that payments for 2023 and 2024 will remain elevated, as central banks are bound to keep interest rates high. Further, a large number of bond maturities and deferred payments during the pandemic will also increase the pressure. With sticky inflation, central banks have been compelled to increase rates sharply, increasing global borrowing costs in the process. The dollar, in the meanwhile, has only strengthened in value off the back of several large rate rises by the US Federal Reserve.

Zambia and Sri Lanka are among the countries that have defaulted on sovereign debts since the start of the pandemic. Ghana and Egypt have also sought IMF help. India’s Chief Economic Adviser V Anantha Nageswaran said that in the face of debt concerns faced by countries, it is crucial to brainstorm on ways to forestall them. The country looks to pivot discussions at handling the situation before they arise and after they arise as well.

According to the World Bank, increases in the size of debt and debt payments highlight the need to create a more effective debt reduction process for low- and middle-income countries in debt distress. Under India’s G20 presidency, it is expected that some gainful discussions will be held in this direction.

Meanwhile, India is also eyeing rules on cryptocurrency regulation, reform in multilateral development banks, international taxation and securing adequate finance to combat climate change under its presidency.

There was widespread support for India’s demand for tougher regulation of cryptocurrencies. Policy makers should not take the option of banning cryptos off the table if regulation failed, said Janet Yellen, the United States Secretary of the Treasury.

India is also supporting a push by the IMF, the World Bank and the US for the so-called Common Framework. The initiative launched in 2020 to help poor countries delay debt repayments is now being proposed to be expanded to include middle-income countries.

The G20 is an informal group comprising 19 countries and the European Union with representatives of the International Monetary Fund and the World Bank. The grouping accounts for 64% of the world population and 85% of the global GDP and has become a key player in world affairs in recent years. G-20 is also being considered as an alternative to the United Nations Security Council (UNSC) which has been paralysed by the veto power of five permanent members.

The UN is also suffering from credibility issues after the COVID-19 pandemic and the Russian invasion of Ukraine. If the G-20 can manage to become a peacemaker in Europe, it will attain legitimacy as a group to promote international peace and security.