On February 1, finance minister Nirmala Sitharaman will present the last full budget of the Narendra Modi government before the 2024 general election. India’s G20 presidency, Covid-19 recovery, and the need for impactful political messaging have made the upcoming Budget 2023 an interesting one. Officials at the North Block will have to do a delicate balancing act while giving a big investment push across sectors. While maintaining fiscal prudence, efforts must also be made to push social infrastructure wherein people can leverage the power of education, skilling, health, and digital transformation.

The interconnection between social sector expenditure and its long-term effect on the overall quality of life is well acknowledged across geographies. The finance ministry’s data suggest that the expenditure on social services as a percentage to GDP has remained steady between 5% and 8%. In the last five years, expenditure on social services has increased from 24.7% to 26.6% of total budgetary expenditure.

READ I Budget 2023: 10 suggestions to kickstart MSME sector

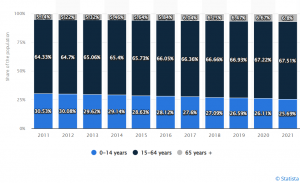

India eyes demographic dividend

India has the largest young population in the world. The future of the country will be determined by the quality and magnitude of educational opportunities for its young population. The current data suggest that the proportion of formally skilled workers is extremely low at 4.69% of the total workforce compared with 24% in China and 52% in the US.

India: The demographic dividend

Over the years, India’s expenditure on research and development (R&D) to GDP has virtually remained stagnant in the range of 0.56-0.70% which is among the lowest in the world and even less than the world average of 1.80%. Even the spending on education has remained stagnant over the last many years. The data on educational expenditure suggests that it is in the range of 2.8-3.5% of the GDP.

Although, several committees, including the committee on NEP, recommended 6% of GDP for education which does not suit the fiscal arithmetic of the budget. Over the years, the government spending on education as a percentage of the total expenditure has been in the range of 8.5-10.8%. The government must take initiatives like Skill India to accelerate skilling, upskilling and reskilling. The establishment of a National Digital University, as envisioned by NEP (2020), has very strong potential to enable our youth to skill, reskill and upskill.

READ I Budget 2023: Needed — a long-term roadmap for urban infrastructure

Skill development has been the subject of special attention over time. Allowing FDI and ECB (external commercial borrowings) in higher education, constituting the Higher Education Commission (HEC) for accreditation and regular funding of colleges and universities, allocating Rs 50,000 crore to National Research Foundation (NRF) to boost the quality and quantity of research, implementing New Education Policy (NEP), and collaborating with foreign countries are initiatives taken in this direction in recent years.

Push for digital infrastructure and internet penetration even in tier-2 and tier-3 cities will help the young talent grab tech advancement like ChatGPT. Open networks for digital commerce, and the commercial rollout of 5G have already set the tone for the same.

To expand the grand vision of PM e-Vidya, and One Nation, One Classroom, budgetary allocation for talent development and digital skill training in educational institutions must also be increased. During the pandemic, we have witnessed comprehensive uninterrupted learning using edtech.

The government must push hard and design conducive policies for edtech growth. Allowing edtech companies to offer online and hybrid skilling programmes in collaboration with international universities could be an impactful initiative. The government alone cannot impart skills effectively and efficiently among such a huge workforce.

Some start-ups such as AttainU, InterviewBit, Pesto Tech and AltCampus offer income sharing agreement (ISA) model in India. Parallelly, there is a need to develop an ecosystem where an investor can also explore the possibilities of rational investment in this sector. As per the latest available data from the ministry of external affairs, nearly 3 lakh students were studying abroad in 2022, and RBI estimates foreign exchange loss of around $28-30 billion a year from this.

Budget 2023 will boost social sector spending

Heavy public spending is required to remove the disparities in access to education and healthcare between the rich and the poor in both urban and rural areas. Merely spending money without adequately and judiciously monitoring does not serve the purpose. It is evident that social services, even though highly subsidised, may still be out of reach for the poor because the component of private costs (transportation, books, and medicine) may be prohibitively high.

For example, some of the best and most heavily subsidised higher educational institutions, such as IITs, IIMs, DU, JNU, IIS, and AIIMS are located in tier one and tier two cities where living costs are prohibitively expensive for middle and lower-middle-class families. A 2019 report by the ministry of education says, “Among public universities, only 3% students attend central universities.’’

The central universities and premier institutes receive 57.5% of government higher education funding. Therefore, an attempt to create social infrastructure via public spending on the social sector must ensure that it reaches the targeted population. Therefore, the vulnerable, the poor, and the deprived sections of the population should remain the responsibility of the government.

Budget 2023 may look at significant political messaging through new centrally sponsored social sector projects in the light of the elections in a few states and the general election. Consequently, it is expected to increase spending while maintaining fiscal consolidation, raising more money than usual through disinvestments and assets monetisation.

(Dr Shashank Vikram Pratap Singh is Assistant Professor, Shri Ram College of Commerce, University of Delhi.)