Nirmala Sitharaman’s Budget 2021 is an attempt to pursue fiscally conservative strategies during a period of real sector downturn and a market upswing. The budget continues to be hamstrung by the conservative doctrines of the government. It makes an effort to please rating agencies across the globe, rather than addressing the real sector concerns within. It is counting on the strong market rally fueled by capital inflows from advanced economies that are witnessing unprecedentedly low interest rates.

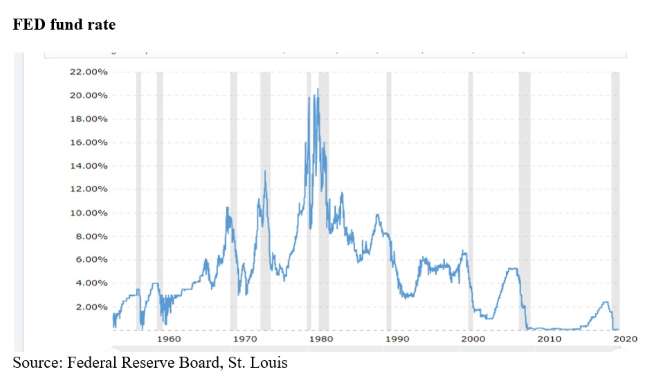

With the real sector continuing to be facing a downturn, the only glimmer of hope for taxation for the government was the stock market that has been rising despite the Covid-19 pandemic and the lockdown measures, thanks to the accommodative monetary policy pursued by the central banks in advanced economies. The federal fund rate, the rate at which US depository institutions trade federal funds overnight, is at the lowest level ever. (See figure)

READ I Budget 2021 scorecard: What is on offer for different sectors of the economy

Budget 2021: Skirting inequality issue

Had the government resorted to taxing the capital market to spend on public goods in Budget 2021, it would have been killing two birds at one stone. It would have paved the way for the recovery on the one hand, and addressed the widening inequalities that have worsened during the pandemic crisis. The Inequality Virus, an Oxfam report, has highlighted the unequal access to education during the Covid-19 pandemic crisis.

Belying the expectations, Budget 2021 has charted out a totally different plan. On the one hand, the real expenditure on employment has been kept stagnant and the signs of the mild increases in countercyclical expenditure are clearly showing visible signs of reversal. On the other hand, rather than resorting to the mobilization of tax resources from the capital market, the minister has plans towards disinvesting public sector firms (even those profitable cash cows of the government) counting heavily on the rising Sensex and favourable market environment. Therefore, the fiscal arithmetic of the government would work contingent on the bullishness in the market.

To be sure, even as the ease of financing has increased in the context of rising capital flows to the emerging market economies, it has also raised concerns about the growing vulnerabilities in the medium term. Concerns on this front have been raised by various corners including the recent Global Financial Stability Report Update 2021 of the International Monetary Fund.

READ I Budget 2021: A bagful of surprises from finance minister

Disinvestment plan leans on market buoyancy

Any reversal of the booming capital markets would affect the disinvestment arithmetic of the government, which expects a kitty of Rs 1,75,000 crore. Apart from this, Budget 2021 has also set ambitious plans of monetizing the assets of the public sector units like the NHAI, NHPC, Indian Railways, Airport Authority of India and HPCIL.

The user charge inconvenience which civil society faces at present in the highways will be repeated in various other corners. All of this could have been avoided with a marginal tax increase on the capital market, given the low tax/GDP ratio in our country.

Further, all calculations in Budget 2021 are done on the basis of the optimistic projection of a fiscal deficit of Rs 15 lakh crore or 6.8% of the GDP, is contingent on the economy growing at 11%. How realistic is this growth projection, only time will tell.

READ I Budget 2021: A promising start to reboot Indian economy

Budget 2021: High on political messaging

Budget 2021 seems to have degenerated into an explicit political message made in the context of the elections to four states. The FM has made politically volatile announcements on big-bang projects in election-bound Tamil Nadu, Kerala, West Bengal and Assam. The states have got far more than what they ever asked for. Whether these will materialise will be linked to the electoral outcomes in these states. Indeed, the budget lacks a modicum of honesty in this sense.

While the advanced economies have woken up to the reality that monetary easing alone would not ensure growth, Budget 2021 has made a hasty retreat from the fiscal steps taken in previous budgets. Let’s hope the finance minister would come out of these old habitual modes of thought based on fiscal conservatism. For that, she can find inspiration from the preface of the Economic Survey 2021-21 that quotes the shanti mantra from Brihadaranyaka Upanishad: Asato ma sadgamaya, tamaso ma jyotirgamaya.

(The author teaches economics at Sri Venkateswara College, University of Delhi. The views are personal.)

Krishnakumar S is a New Delhi-based economist. He teaches economics at Sri Venkateswara College, University of Delhi.