The Monetary Policy Committee meeting of the Reserve Bank of India which ended on April 10 offered a comprehensive assessment of the current and evolving macroeconomic landscape. Against the backdrop of global economic shifts and domestic indicators, the RBI has made a series of decisions that underscore its commitment to achieving both inflation targets and sustaining economic growth.

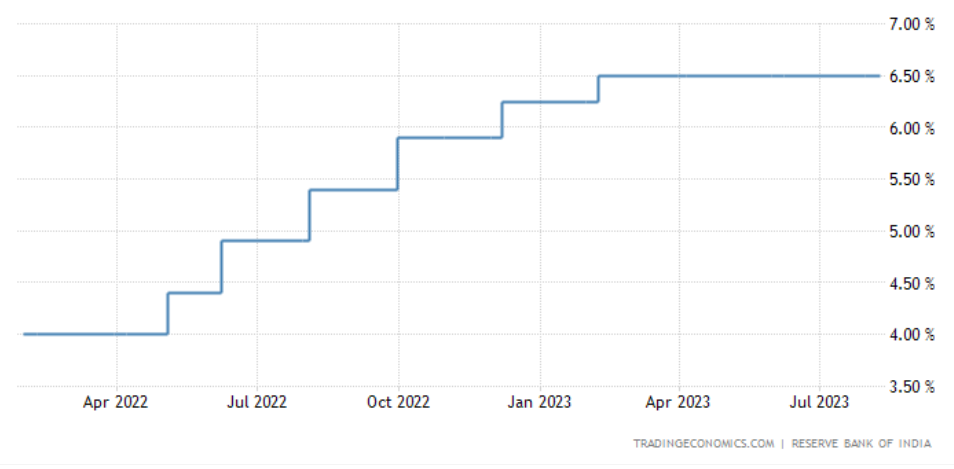

The MPC resolved to keep the policy repo rate unchanged at 6.5%. Concurrently, the standing deposit facility rate remains steady at 6.25%, while the marginal standing facility rate and the Bank Rate stand at 6.75%. This steadfast approach towards policy rates aligns with the RBI’s endeavor to stabilise economic conditions while monitoring inflation trends. The analysis of the global economy highlights a deceleration in growth trajectories across regions, accompanied by inflation that remains above target levels. This is juxtaposed against tight financial conditions and simmering geopolitical tensions.

READ I Tourism-driven growth to propel global economy in 2023

RBI takes confidence from growth numbers

On the domestic front, the Indian economy demonstrates resilience, with key indicators such as monsoon rainfall, kharif crop sowing, industrial production, and purchasing managers’ indices signaling positive momentum. Urban demand remains robust, buoyed by factors like air passenger traffic, while rural demand, though tempered in some sectors, continues to show signs of recovery.

Notably, CPI inflation rose from 4.3% in May to 4.8% in June, primarily driven by dynamics within the food group. A notable surge in vegetable prices, particularly tomatoes, has introduced an element of upside pressure on short-term inflation, though this is expected to normalize as market arrivals stabilize. Fuel inflation, on the other hand, experienced a decline, driven by kerosene price reductions, while core inflation remained steady.

RBI holds policy repo rate

Liquidity conditions, as evidenced by the daily absorption of liquidity under the LAF and money supply (M3) expansion, reflect underlying stability. Bank credit growth maintained positive momentum, although it moderated slightly. The report emphasizes that these conditions provide a favorable environment for economic activities.

Looking ahead, the RBI anticipates a potential spike in vegetable prices due to supply disruptions, while highlighting the importance of vigilance in managing inflationary pressures. The forecast for consumer price index (CPI) inflation in the coming year is projected at 5.4 percent, with expectations of a gradual alignment with the medium-term target of 4 percent within a range of +/- 2 percent. In terms of real GDP growth, the outlook remains positive, with the economy projected to expand by 6.5 percent in 2023-24.

All members of the MPC voted unanimously to maintain the policy repo rate unchanged, affirming the collective stance toward sustaining the policy framework. While there is consensus on withdrawal of accommodation to ensure progressive alignment of inflation with the target, one member expressed reservations in this regard.

The RBI’s August 2023 Monetary Policy Statement underscores a cautious yet optimistic approach toward managing inflation and sustaining economic growth. The central bank’s decisions reflect a judicious blend of addressing near-term challenges while maintaining a long-term perspective on economic stability and resilience.

Highlights of RBI governor’s statement

Indian economy’s strength and stability: Despite global economic shocks, the Indian economy has exhibited enhanced strength and stability. India’s economy continues to grow at a reasonable pace and has become the fifth-largest economy in the world, contributing around 15% to global growth. Significant progress has been made in controlling inflation, and the banking sector is robust with high levels of capital, reduced non-performing assets, and increased profitability.

Corporate balance sheets show lower leverage, improved debt servicing capacity, and strong profitability. The current account deficit is lower, and capital flows have strengthened the external sector, resulting in increased forex reserves that act as a buffer against external shocks.

India’s role in global economy: India is uniquely positioned to benefit from global shifts due to geopolitical realignments and technological innovations. With its large domestic demand, untapped resources, and demographic advantages, India has the potential to become a new growth engine for the world.

Monetary policy committee decisions: The MPC met and decided to keep the policy repo rate unchanged at 6.50%. The stance is focused on withdrawing accommodation while aligning inflation with the target and supporting growth.

Inflation and policy decisions: Headline inflation has increased due to vegetable price shocks, and possible El Niño weather conditions and global food prices are being monitored. The cumulative rate hike of 250 basis points by the MPC is affecting the economy, but domestic economic activity remains strong. The MPC remains watchful and decided to keep the policy repo rate unchanged while maintaining the commitment to aligning inflation to the 4% target.

Growth and inflation assessment: The global economy faces challenges like inflation, high debt levels, financial volatility, and geopolitical tensions. However, India’s economic activity is positive, with robust industrial and services activity, investment, and consumption. The outlook for real GDP growth for 2023-24 is projected at 6.5%, with Q1 at 8.0%, Q2 at 6.5%, Q3 at 6.0%, and Q4 at 5.7%. Inflation projections for 2023-24 are revised to 5.4%, with Q2 at 6.2%, Q3 at 5.7%, and Q4 at 5.2%.

Liquidity and financial markets: Surplus liquidity has increased due to various factors, and measures are being taken to manage excess liquidity, including an incremental cash reserve ratio (I-CRR) of 10% on the increase in net demand and time liabilities. Market response to liquidity management tools is being monitored.

Financial stability and external sector: The Indian financial sector is stable, with sustained credit growth, low non-performing assets, and sufficient capital buffers. India’s current account deficit is manageable, and foreign investment flows are positive. Forex reserves have crossed $600 billion.

The RBI announces various measures, including a revised regulatory framework for financial benchmarks, changes in regulations for Infrastructure Debt Fund – NBFCs (IDF-NBFCs), enhanced transparency in interest rate reset of floating interest loans, harmonization of supervisory data submission guidelines, and initiatives to enhance digital payments.

Frictionless credit platform: A Public Tech Platform for Frictionless Credit is being developed to accelerate digital lending processes, starting with Kisan Credit Card (KCC) loans and dairy loans, to enhance financial inclusion.

Commitment to stability and growth: The RBI remains committed to maintaining stability, safeguarding the financial system, and promoting growth. Inflation remains a concern, and the RBI is focused on aligning inflation to the target while closely monitoring emerging trends.

The statement by the RBI Governor highlights the strong foundation of India’s economy, the cautious approach to inflation, efforts to manage liquidity, and initiatives to enhance digital payments and financial inclusion.

(This article has been written with artificial intelligence inputs.)