The Reserve Bank of India is putting into place a mechanism for international trade settlements in the rupees, even as the Indian currency is hitting fresh lows daily against the dollar. The decision, which has taken immediate effect, is aimed at promoting growth of global trade with a special focus on exports.

With internationalising the rupee, India is expected to arrest the depletion in its foreign exchange reserves which shrank by a whopping $46 billion since January to stand at $588.314 billion on July 1, 2022. The dip in reserves comes in the backdrop of the Reserve Bank of India’s intervention in the forex market to curb fall of the rupee against the dollar. India is expected to save $30-36 billion thanks to rupee trade settlements.

The move is also expected to support the increasing interest of the global trading community in the rupee, the central bank said. The arrangements for invoicing, payment, and settlement of exports/imports in rupees are already in place. However, the move comes with an extra set of challenges as popularising rupee as a global currency against the dollar will prove to be a herculean task for the government.

READ ALSO: Demographic dividend: Can India benefit from its young population

Why is the rupee going global a big deal?

Before the RBI’s latest announcement, the exchange control regulations for international trade (except for those done with Nepal and Bhutan) required it to be settled in fully convertible currencies such as the dollar, the pound, euro and yen. With the latest notification, trade can be billed and settled in rupee terms.

With the globalisation of the rupee, the position of the Indian currency is likely to be strengthened in the world market. The move also augurs well for India’s trade deficit which is likely to fall after the beginning of trade settlement in rupee. As rupee comes to be widely accepted by other nations, it will also help in situations when certain countries are under sanction. Take for example the current scenario with Russia which is under trade sanctions due to its ongoing war with Ukraine. Trade has come to a virtual standstill between India and Russia ever since sanctions were placed on Moscow.

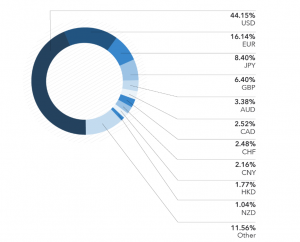

Share of major currencies in global trade

While the RBI announcement does not specify trade with Russia as the chief reason for the move, experts believe that the West cutting off Russia from the SWIFT payments system is likely one of the motivating factors behind this decision. India and Russia mostly deal in pharmacy, programming and food (especially fruits/vegetables). In fact, Russian intermediaries have backed rupee as a currency of trade as it also looks to do away with euro-dollar duopoly.

The rupee can be transformed into an international currency by making it a stable currency to enable international trade or by keeping it as an asset. To simplify, we can say that the rupee needs to become a currency in which assets are held. Other countries may start adopting the rupee as their trade currency. The internationalisation of rupee is also likely to impact the duopoly of dollar and euro and may also cool off exchange rate pressure.

READ I NPAs at 6-year low; but can banks withstand a global crisis?

The impact on imports and exports

A currency is considered an international one if it is widely accepted across the globe as a medium of exchange for trade. Currently, the dollar is the most widely accepted currency for international trade, followed by the euro. However, there was a time in Indian history when certain countries accepted rupee for payments.

In the 1960s, the rupee was accepted in gulf countries such as Qatar, the UAE, Kuwait, and Oman. The country also had payment agreements with eastern Europe in place, helping it to use rupee as a unit of account under these payment agreements. However, the same was terminated in the mid-1960s.

So, how does the RBI move help? For one, Indian importers currently go through a laborious process by undertaking imports through a mechanism under which payment in rupees must be credited into a special vostro account of the correspondent bank of the partner country. This is done against the invoices for the supply of goods or services from the overseas seller or supplier. With the new arrangements in place, the importers can instead use rupee to settle dues.

Indian exporters undertaking exports of goods and services via past arrangements had to pay the export proceeds in rupees from the balance in a designated Special Vostro account of the correspondent bank of the partner country.

Roadblocks ahead

The ambitious move is certain to run into a set of roadblocks. According to experts, making the rupee a global trade currency is easier said than done. This is because the dollar and euro currently have a market domination and external trade denominated in rupee terms will prove to be quite difficult.

Further, the country needs to expand its exports and become a manufacturer as that would significantly help the rupee become a currency of trade. Amid the ensuing war between Russia and Ukraine, Russia was able to negotiate with the foreign governments to make the trade in Russian currency ruble instead of more popular currencies as it had an upper hand as it supplies 40% of European Union’s natural gas requirements.

RBI’s decision to make rupee global comes on the heels of a SBI proposal that the RBI should make a conscious effort to internationalise the rupee. In its latest Ecowrap report, SBI had said that the ongoing Russia-Ukraine war and the disruptions to payments caused by it poses an opportunity to insist on export settlement in rupees, beginning with some of the smaller export partners.

China too once had the ambitions to replace dollar as the global currency with its own currency yuan. Despite China’s huge manufacturing base, trade surplus with major countries, and brimming forex reserves, the dragon nation had failed to make any impact to bring down dollar-euro duo as Beijing has an iron-clad grip on the economy and it needs to drastically loosen its control to make yuan a serious contender in the global currency race

Prachi Gupta is an Assistant Editor with Policy Circle. She is a post graduate in English Literature from Lady Shri Ram College For Women, Delhi University. Prachi started her career as a correspondent with financialexpress.com. She specialises in policy impact studies.