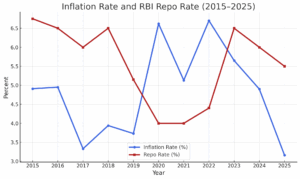

When the Monetary Policy Committee voted five-to-one to spring a 50-basis-point cut in the repo rate and an equally dramatic 100 basis point cut in the cash reserve ratio, many observers gasped. The consensus had been for a polite 25 bps trim. Yet the decision was not reckless adventurism; it was the logical response to a conjuncture in which inflation has slid comfortably below the 4% target and growth is losing altitude. Governor Sanjay Malhotra captured the moment with a flourish—“we have won the war against inflation.”

With retail prices anchored at 3.16% and the RBI’s own FY26 projection now 3.7%, the real policy rate threatened to drift into contractionary territory. A central bank that preaches counter-cyclicality could not sit on its hands. The bigger-than-expected move also compresses what might otherwise have been a tedious, confidence-sapping sequence of baby steps. Speed matters when private investment is stalling and global trade winds are turning chilly.

READ I Cut interest rate or stall: Viksit Bharat hinges on RBI

Reading the new inflation–growth equation

Sceptics have seized on the MPC’s sudden pivot from an “accommodative” bias to a “neutral” posture, deriding it as a bout of monetary split-personality. In truth, the move simply acknowledges that the heavy lifting on rates has largely been front-loaded. By keeping the stance neutral, the committee signals it will not pander to every clamour for lower rates but will calibrate future action to data—especially food prices and global oil. The message is clear: a single swallow does not make a monetary spring.

Crucially, the growth–inflation balance has tilted. The RBI still pegs FY26 growth at 6.5%, but that optimism disguises sagging exports and faltering rural demand. If the monsoon behaves, benign food prices will keep headline CPI in check; but if it doesn’t, the room for lower rates will disappear in a flash. Hence the governor’s caveat that future easing will be data-dependent. Simultaneously, the MPC has injected Rs 2.5 lakh crore of durable liquidity through the CRR cut to ensure banks are not starved of lendable funds when the harvest-time credit cycle kicks in.

Liquidity is not a substitute for reform

Liquidity, though, is only fertiliser; it cannot by itself germinate investment. Large corporates already sit on flush balance-sheets and yet hesitate. Why? Because capex decisions hinge on visibility of demand, regulatory clarity and the speed of dispute resolution—areas where policy has been erratic. Unless government departments clear pending infrastructure invoices, states pay contractors on time, and utilities honour power-purchase commitments, cheaper credit will merely fund arbitrage, not factories.

The RBI has done its bit; the ball is now in North Block’s court. A credible medium-term fiscal consolidation road-map would anchor inflation expectations far more durably than another 25 bps rate cut. Raising the tax-to-GDP ratio by pruning exemptions, enforcing GST compliance and divesting non-strategic public assets is fiscally prudent and growth-friendly.

Repo rate cut—transmission test begins

The last easing cycle taught us that headline rate cuts do not magically travel from Mint Street to the borrower’s doorstep. Banks must re-price deposits, mutual funds must adjust money-market schemes, and bond dealers must digest signals from RBI’s forward FX book. Indeed, economists expect part of the liquidity injection to be offset as the central bank rolls off its $53 billion forward book, pulling rupees out of circulation.

Transmission will therefore be patchy. Short-tenor corporate bonds have already rallied, but longer-dated sovereign yields are sticky near 6.20% as investors debate the size of the government’s borrowing calendar and the spectre of another crude-oil spike. If yields refuse to budge, housing finance and capital-goods outlays will remain hostage to high real rates.

To grease the wheels, RBI must stand ready with Operation Twist or limited open-market purchases should liquidity tighten unexpectedly. Equally, it should not hesitate to drain surplus cash if forex inflows surge—sterilised at minimal fiscal cost by tapping its re-inflated dividend kitty.

Fiscal prudence cannot take a holiday

Rate cuts create space, but fiscal policy fills it. Fortunately, the Centre pocketed a record Rs 2.69 lakh crore RBI dividend in May—almost twice the budgeted figure—and promptly cleared fertiliser and food-subsidy arrears. That is welcome. Yet the temptation to splurge on populist transfers ahead of state elections must be resisted. Spending priorities should tilt toward shovel-ready public-investment projects with high domestic value-addition—rural roads, urban water grids, low-cost housing—rather than blanket revenue giveaways.

States, too, must tighten their belts. The aggregate state fiscal deficit is nudging 3.2 per cent of GSDP, fuelled by election-year doles. A coordinated glide path, possibly overseen by the proposed Fiscal Council, could prevent sub-national exuberance from nullifying national restraint.

Safeguarding macro-stability in a volatile world

Global conditions offer both reprieve and risk. The Federal Reserve is widely expected to sit tight until September; the European Central Bank has already cut once. If the Fed resumes hiking—perhaps reacting to a re-acceleration in US wage growth—the rupee could face renewed pressure. That would import inflation just as the kharif crop hits mandis. The MPC’s new-found neutrality keeps a safety buffer of 50–75 bps for such contingencies, which is wise.

Moreover, front-loading cuts now allows the RBI to pause later without shocking markets. As the old Keynesian adage goes, “the time to repair the roof is when the sun is shining.” In this case, the RBI has repaired the roof and stocked sandbags—but the neighbourhood must fix its drainage lest the next storm flood the house again.

Building a bridge from relief to recovery

In sum, the “jumbo” rate cut was not a sugar-rush gimmick; it was an essential bridge from disinflation to sustainable recovery. Yet bridges collapse if only one pillar is reinforced. The monetary pillar now looks sturdy; the fiscal pillar must match it in strength and alignment. That means sticking to promised deficit targets, accelerating capital spending, and resisting the urge to convert a dividend windfall into a binge.

Equally, structural reforms—land pooling, faster environmental clearances, credible contract enforcement—remain the only engines capable of lifting potential growth beyond 7%. Cheap money can prime an engine; it cannot substitute for pistons.

Sound economics is a dialogue between prudence and audacity. The RBI has spoken with audacity; New Delhi must now answer with prudence. If both voices harmonise, India could emerge from 2025 not merely with lower headline inflation, but with higher, more durable growth—and perhaps the first glimmer of that elusive demographic dividend.