PSB NPA crisis: Weeks after an RBI circular allowing banks to enter into settlements with wilful defaulters came into force, Finance Minister Nirmala Sitharaman has nudged public sector banks to take action in such cases so that the process of recovering bad loans can be expedited. Sitharaman has asked PSBs to start taking steps in cases of fraud and wilful defaults so that the growth momentum of banks can be regained.

The government’s intention to recover bad loans and strengthen Indian banking is at odds with the RBI’s latest mandate, which dilutes laws for defaulters. This leniency is expected to lead to further exploitation by defaulters.

READ | Climate change: Sweltering heatwave envelops the planet

Wilful defaulters are borrowers who refuse to repay loans despite having the capacity to do so. While such borrowers were previously ineligible for restructuring or new loans, the June 8 circular now allows wilful defaulters or fraudulent companies to be eligible for new loans after 12 months of executing a compromise settlement.

The latest RBI move had come under criticism from bankers who said that the decision may be detrimental to the interests of banks and depositors as the wrongful actions of defaulters and fraudsters are being condoned.

The All India Bank Officers Confederation and the All India Bank Employees Association have strongly condemned the RBI directive and demanded its withdrawal. They believe that unless the directive is taken back, depositors will be affected, defaults will increase, and there will be no faith in the system.

India has seen notorious wilful defaulters leave the burden of their misdeeds on the shoulders of ordinary citizens, especially depositors. Indian banks have written off Rs 11.17 lakh crore of bad loans from their books in the last six years up to financial year 2021-22.

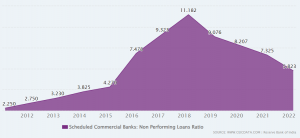

Non-performing assets of scheduled commercial banks (%)

In recent times, several borrowers have absconded with public funds, the most notable being Mehul Choksi, owner of Gitanjali Gems, who also remains the top wilful defaulter with an outstanding debt of Rs 7,848 crore as of March 31, 2022. In the last five years, banks have reported 983 frauds of over Rs 100 crore.

The government and the RBI need to find a balance between recovering bad loans and protecting depositors. It is unclear whether this move will help the banks in the long run. The government claims that compromise settlements will ensure maximum recovery from distressed assets. However, many believe that the need is to put stricter laws into place.

India’s NPA problem

Indian banks were drowning under bad loans until 2018 when Non-Performing Assets of scheduled commercial banks peaked. The numbers are telling; bad loans had reached about 12% of the gross loans that banks lent and nearly 80% of these NPAs were on the shoulders of public sector banks.

While NPAs have been on a downward trend for several years now, the issue has not been resolved to the root. To maintain a sense of semblance, banks sometimes write off bad loans and reduce the number of NPAs on their books. In the last ten years, NPAs have been reduced by Rs 13,22,309 crore through write-offs. The non-performing assets, including those in respect of which full provisioning has been made on completion of four years, are removed from the balance sheet of the bank concerned by way of write-off.

Instead of recovering the owed amount, banks write off the loans to present better financial health. However, this approach is causing significant harm to the banking industry and in turn the economy. Wilful defaults have a significant impact on the financial stability of banks. One of the reasons for the high interest rates in India is the high level of NPAs in the banking system.

Resolving this issue has been a priority for the government (at least on paper) and the finance minister urged PSBs to focus on having robust risk management practices. FM Sitharaman also emphasised that banks should follow a strong internal audit framework and adhere to caveats of internal policies. Earlier, RBI Governor Shaktikanta Das had also cautioned Indian banks against concealing stress and evading governance issues.

The government has also highlighted other pain points of public-sector banks including increased competition with private sector banks and pressure on the net interest margin of PSBs due to the high-interest rate regime. The government has suggested banks to focus on high-yield advances categories with due risk management and raise fee income.