India’s GDP growth has consistently surpassed expectations, affirming the country’s trajectory of fast economic expansion. The sustained GDP growth, resilient in the face of global economic fluctuations, is backed by strong macroeconomic fundamentals. Among these, the fiscal health of the economy stands out as a critical element, which has surprised economists across the spectrum, including the sceptics.

Last year, the fiscal deficit reached Rs 17.33 lakh crore, amounting to 6.4% of the GDP, which was lower than expected. Projections for the coming year align with India’s goals for fiscal consolidation. The IMF’s commendation of India for meeting its fiscal deficit targets in an election year highlights this achievement. However, India still maintains one of the highest fiscal deficits among emerging market economies.

READ I Climate change: India braces for economic, human costs

GDP growth and fiscal health

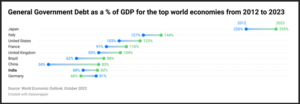

Several factors suggest that the fiscal deficit may be supporting the impressive GDP growth rates. For instance, India’s debt-to-GDP ratio is among the lowest compared with other leading global economies. Over the last decade, while the debt-to-GDP ratio surged by 83% for emerging markets and developing economies, India experienced a modest 20% increase. The RBI projects a decrease to 73.4% by 2030-31. Moreover, external debt accounts for a small fraction of India’s public debt and the sahre is decreasing, primarily contracted through multilateral agencies, which mitigates associated risks. Domestically, a stable savings rate of about 30.2% supports borrowing for deficit financing.

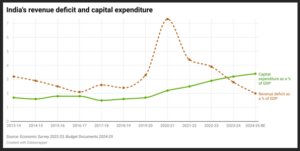

The fiscal deficit facilitates capital formation. From ₹3.8 lakh crore in 2015-16, effective capital expenditure rose to ₹12.71 lakh crore in 2023-24, despite the pandemic, and is expected to reach 3.4% of the GDP (₹11.11 lakh crore) in 2024-25. The high capital investment stimulates further GDP growth.

Technological innovation is significantly influencing capital expenditure. The government’s focus on smart cities, renewable energy projects, and digital infrastructure highlights a strategic shift towards long-term, sustainable investment. These projects not only drive current GDP growth but also set the stage for future efficiencies and cost savings. By investing in technology driven sectors, India is not only addressing current fiscal needs but also preparing for a more dynamic economic future.

Investment-driven growth, currently at 7.6%, enhances debt sustainability, with the GDP growth rate exceeding interest payments, thus managing debt servicing obligations effectively. On the other hand, high growth does not obscure the challenges of debt servicing, which consumed 6.7% of GDP in 2023, exceeding total public spending on health and education. While there are no immediate risks of debt rollover, unforeseen shocks could have significant negative impacts.

India’s demographic dividend also plays a crucial role in shaping its fiscal future. A young and growing workforce provides a unique advantage in terms of lower dependency ratios and potential for higher productivity. However, this demographic advantage also necessitates significant investments in education and job creation to harness the full potential of this young population. Effective utilisation of this demographic asset is critical for sustaining growth and achieving fiscal consolidation.

Furthermore, Gross Fixed Capital Formation as a percentage of GDP has stagnated, particularly concerning in the private sector, which saw a decline from 25% in 2009-10 to 19% in 2020-21. Although there is a slight forecasted increase, the decline in private sector investment poses a risk to future growth. Another concern is the high debt burden of states, with a few like Punjab and Kerala disproportionately contributing to this burden. While some states show declining debt ratios, others like Kerala face escalating debt, potentially increasing the overall public debt.

Securing fiscal sustainability

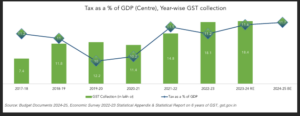

Low revenue and tax buoyancy also challenge fiscal strengthening. Despite a tax-to-GDP ratio of 17.7% in 2022-23, there is room for improvement, especially compared with other economies. Although there was a slight increase in tax revenue in the last financial year, growth in tax rates lags behind economic expansion.

India’s fiscal position, while not precarious, requires further efforts to reach sustainability. Prioritising government revenue enhancement is crucial. Simplifying and rationalizing the tax regime has increased direct tax revenues in recent years. Moreover, revising outdated tax provisions, improving GST efficiency through digitisation, and rationalising GST rates could further boost revenue. Additionally, enhancing property tax collection and exploring non-tax revenue sources such as strategic disinvestments are vital.

The burgeoning digital economy plays a pivotal role in enhancing fiscal health. Digitalisation of financial services has not only expanded the tax base but also improved tax collection efficiency. The widespread adoption of digital payment platforms across urban and rural areas alike has reduced the incidence of tax evasion and increased transparency in transactions. This shift is instrumental in aligning India’s fiscal strategies with global standards and fostering a more inclusive economic environment.

Government expenditure reforms, particularly in the power sector, could reduce subsidies and cut costs. Addressing fiscal imprudence in states and reducing debt servicing costs are essential for fiscal sustainability. With these adjustments, India’s economic expansion is poised to reach a successful culmination.

(Sakshi Abrol is a visiting fellow at Pahle India Foundation, Delhi.)