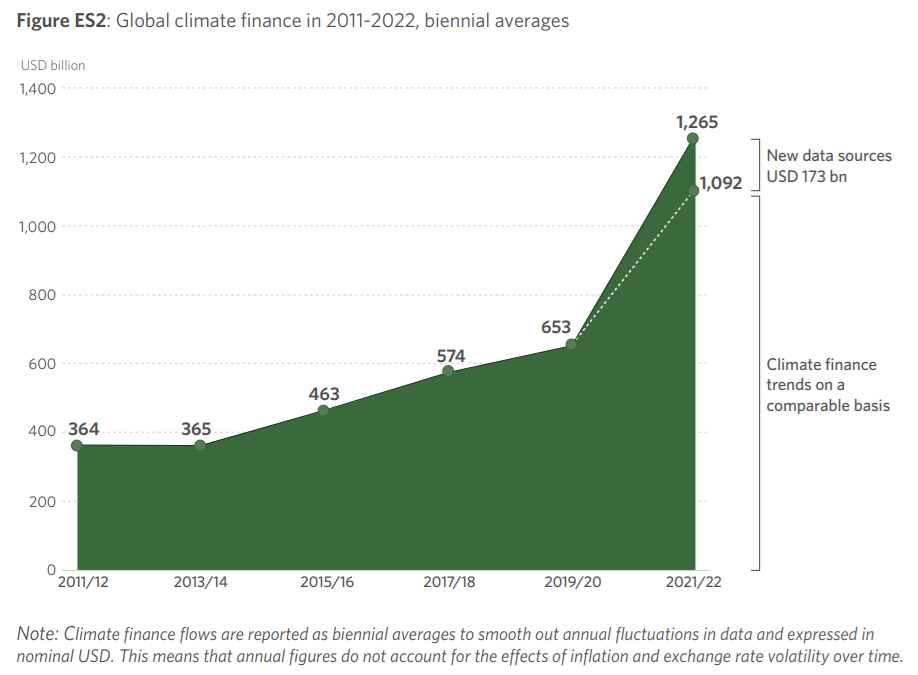

The urgency of climate action grows with each passing year. Yet, amid warnings and promises, one crucial question remains: how to convert ambition into action? Climate finance is the lifeblood of the collective pursuit of a sustainable future. Global climate finance touched $1.4 trillion in 2022. Although this figure appears impressive at first glance, a closer examination reveals its limitations. A significant portion of this funding is in the form of debt, placing an additional burden on poorer countries.

The primary aim of global climate finance is to alleviate the financial strain on less developed nations. The demand for non-conditional aid is substantial, reflecting the extensive damage that needs to be addressed. It is important to scrutinise the areas where global climate finance has fallen short and to explore potential solutions.

READ I Fossil fuels to freedom: India’s roadmap to shedding its crude oil import addiction

Mitigation efforts corner most of climate finance

In both 2021 and 2022, mitigation attracted the lion’s share of funds from both public and private sources. In 2022, private sources contributed $685 billion, with a staggering 98.39% ($674 billion) allocated to mitigation and a mere $2 billion for adaptation. Public funding was slightly more balanced, but still not sufficient. Of the $730 billion from public sources, $619 billion went to mitigation and $70 billion to adaptation. These numbers suggest a reluctance among investors to fund adaptation projects due to perceived lower returns.

Most of the funding for adaptation and mitigation in 2022 was secured through debt instruments, a trend also observed in 2021. The primary global finance instrument was project-level market-rate debt, accounting for 43% ($609 billion) of total climate finance. Balance sheet financing comprised 11% ($156 billion), and low-cost project debt represented 6% ($74 billion). Grants and project-level equity contributed just $80 billion and $58 billion, respectively.

A debt trap in the making?

While the funding seeks to assist vulnerable countries in combating climate change, the detrimental impact of debt on these nations cannot be overlooked. Even though the World Bank and other multilateral development banks offer low-cost concessional loans, their rates still exceed market levels.

Another issue is the uneven geographical distribution of climate finance, favoring developed economies. In East Asia and the Pacific, $660 billion was raised, largely through public investment. Western Europe saw $338 billion in finance flows, and the US and Canada accounted for $190 billion. In contrast, sub-Saharan Africa received only $30 billion, dominated by public flows, and the Middle East and North Africa a mere $20 billion in 2022.

However, 2023 brought cautious optimism with signs of progress. Notably, developing countries saw an uptick in climate finance, with sub-Saharan Africa receiving $45 billion and the Middle East and North Africa securing $27 billion – though still significantly lagging. Additionally, the inclusion of nature-based solutions in climate finance gained traction, with the AFOLU sector receiving $14 billion in 2023, marking a significant 100% increase. Though challenges remain, this shift acknowledges the crucial role of ecosystem restoration and conservation in both adaptation and mitigation strategies.

Climate finance was also disproportionately allocated across sectors. Adaptation funding totaled $72 billion in 2022, with a significant portion ($39 billion) going to water and wastewater projects. In mitigation, the focus was primarily on energy systems and transportation, receiving $559 billion and $407 billion, respectively. The investment in transportation was driven by the shift towards electric vehicles in line with net-zero commitments. Of the $559 billion for the energy sector, $490 billion was directed towards renewable energy.

Agriculture, Forestry, and Other Land Use (AFOLU), a sector crucial for adaptation, received only $7 billion in both 2021 and 2022. CUTS International advocates for the establishment of a ‘Fund of Funds’ to leverage various non-governmental financial sources for addressing both climate and biodiversity challenges, given their interconnection and common governance in many countries. Additionally, the creation of a Global Alliance for Leveraging Innovative Finance (GALIF) has been proposed to support this initiative.

Addressing the global climate finance gap is urgent, as the annual climate finance requirement through 2030 has risen from $8.1 trillion to $9 trillion. Failure to do so risks exacerbating the irreversible impacts of climate change and biodiversity loss.

Efforts are underway globally to develop technological solutions and address unsustainable production and consumption patterns, as highlighted in Goal 12 of the SDGs and the LiFE campaign launched by Indian Prime Minister Narendra Modi at the G20 summit in New Delhi in September 2023.

Despite ongoing efforts, bridging the climate finance gap continues to be a pressing concern. Recent estimates suggest the annual need reaching $10 trillion by 2030. To address this, innovative financing mechanisms like debt-for-nature swaps and green bonds are gaining momentum. Furthermore, calls for establishing a global carbon market with transparent pricing and equitable distribution of revenues are growing louder. By diversifying funding sources, fostering innovative financial instruments, and ensuring access for the most vulnerable, we can ensure that climate finance serves its intended purpose: building a resilient and sustainable future for all.

These initiatives are promising, but substantial financial investment is crucial. The launch of an agnostic Fund of Funds, gathering money from non-government sources, is a vital consideration. The allocation of these funds to deserving causes in the Global South should be managed by an independent international body.

Innovative solutions like debt-for-nature swaps and carbon market mechanisms offer fertile ground for growth. Yet, the journey ahead demands unwavering commitment. Bridging the gap between need and disbursement, ensuring equitable access for vulnerable nations, and nurturing nature-based solutions remain the biggest challenges.

(All the numeric data is sourced from Global Landscape of Climate Finance 2023 by the Climate Policy Initiative. The authors work for CUTS International, a global public policy research and advocacy organisation.)

Pradeep S Mehta is the Secretary General of CUTS International, a leading policy research and advocacy group. He is a featured columnist with several leading publications in the country.