Alternative Investment Funds have emerged as a sophisticated investment choice for those seeking diverse and potentially high-return investment avenues. These privately pooled investment vehicles, tailored for high net-worth Individuals, family offices, institutional investors, and savvy market participants, have gained significant traction in recent years. Governed by the SEBI (Alternative Investment Fund) Regulation, 2012, AIFs represent a departure from traditional investment methods, offering unique opportunities and challenges in the financial market.

AIFs require a substantial financial commitment, typically with a minimum investment threshold of 1 crore. This criterion ensures that the participants are not just affluent but also possess a deep understanding of complex investment strategies. While these funds are distinct from conventional mutual fund regulations, they operate under the vigilant eye of SEBI, ensuring a structured and regulated investment environment.

AIFs are categorised into three distinct types, each with its own focus and investment strategy. Category 1 AIFs concentrate on startups, SMEs, and corporations that demonstrate high growth potential, often involving venture capital and angel investments. Category 2 AIFs, on the other hand, do not engage in leverage and primarily invest in unlisted companies, encompassing private equity funds, debt funds, and funds of funds. The third category, Category 3 AIFs, is known for its diverse and complex trading strategies, dealing with both listed and unlisted derivatives.

READ I India opens skies for satellite broadband revolution

AIFs: A regulatory nightmare

Investing in AIFs is not without its challenges and concerns, particularly in the context of regulatory compliance and the potential for misuse. The Reserve Bank of India, in its bid to curb malpractices, has issued advisories to financial institutions regarding investments in AIFs. One significant directive is the restriction placed on banks and non-banking financial companies (NBFCs) from investing in AIFs that have downstream investments in debtor companies to which these institutions have exposure. Such measures aim to prevent the evergreening of loans and the circumvention of regulations, ensuring a healthier financial ecosystem.

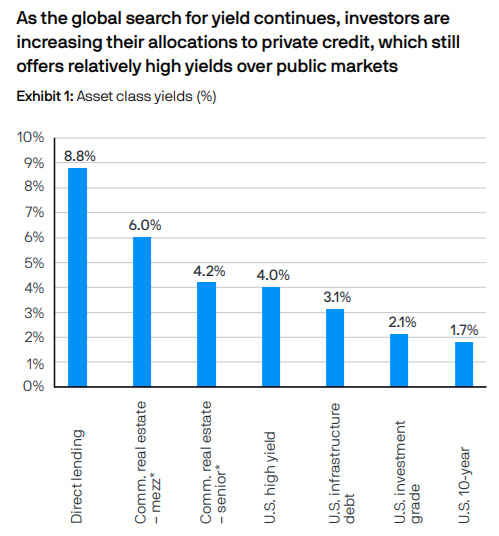

Despite the concerns, AIFs offer valuable advantages beyond just potential returns. They enable diversification by investing in assets like unlisted companies or complex derivatives, which are typically inaccessible to the average investor. This helps mitigate risk by spreading investments across different asset classes and reducing dependence on traditional markets. Additionally, AIFs often employ sophisticated risk management strategies, making them well-suited for investors seeking long-term wealth creation while managing risk exposure.

The effectiveness of AIFs in the investment arena is underscored by their performance over the past decade. These funds have demonstrated a commendable ability to generate alpha, outperforming traditional market indices like the S&P BSE Sensex TRI. This is not a trivial feat; a significant majority of AIFs have been successful in achieving positive alpha, indicating their potential for higher returns compared to conventional investment options.

The impressive performance of AIFs and growing interest in alternative investments indicate a promising future for these funds. Technological advancements and regulatory refinements are further expanding the AIFs landscape. For instance, the recent introduction of the AIF Debt Platform by SEBI is expected to facilitate debt crowdfunding and broaden access to AIFs for smaller investors. As global market trends and investor preferences continue to evolve, AIFs are likely to become increasingly adaptable and sophisticated, offering an avenue for savvy investors to navigate the changing financial landscape and achieve their wealth-building goals.

AIFs attract young investors

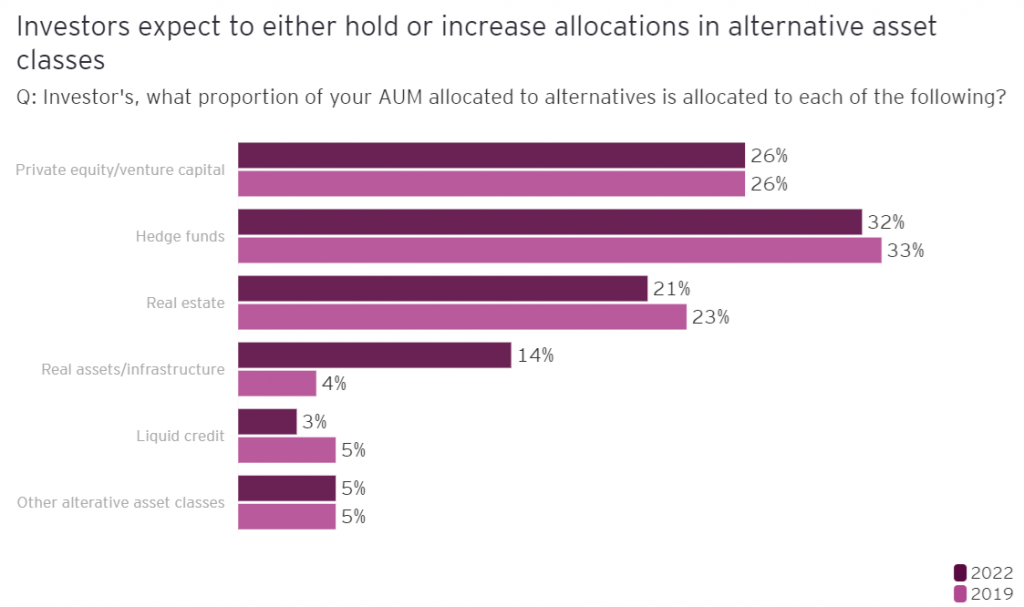

The interest in alternative investments has seen a surge, especially among younger investors who are increasingly wary of traditional investment vehicles. This trend has been influenced by several factors, including global economic uncertainties and specific events like the collapse of prominent financial institutions. As a result, there is a growing inclination towards diversifying investment portfolios with alternatives like cryptocurrency, collectibles, and gold. These alternatives offer not just potential financial returns but also an avenue to hedge against market volatility and inflation.

AIFs stand testament to the dynamic nature of the investment world. They offer a blend of high potential returns and sophisticated investment strategies, albeit accompanied by a need for prudent regulatory oversight and investor awareness. As the financial markets continues to evolve, AIFs are likely to play an increasingly significant role, offering discerning investors novel opportunities to grow their wealth in a rapidly changing world.

The Reserve Bank of India (RBI) has recently tightened norms regarding Non-Banking Financial Companies’ (NBFCs) exposure to Alternative Investment Funds (AIFs). These new regulations require NBFCs to adjust in their financial statements to accurately reflect their exposures to AIFs. This adjustment could be done either through capital funds or provisions. The change is significant as it demands greater transparency and risk management in the way NBFCs handle their investments in AIFs, which often include substantial commitments to various funds.

In response to these updated RBI norms, several NBFCs have begun to reassess and disclose their AIF exposures. This process includes identifying investments that may require substantial provisions or even liquidation to comply with the new guidelines. The RBI directive specifically restricts banks and NBFCs from investing in AIFs that are linked to debtor firms to which they have lent in the past year.

Failing to liquidate such assets within 30 days necessitates a 100% provision. This new regulation is expected to lead to the identification of stressed accounts as non-performing assets and could result in significant market-to-market losses for these financial institutions as they work to align with the RBI’s stricter investment guidelines.