Indian telecom industry: India’s third-largest telecom operator, Vodafone Idea, is looking to secure funds from new investors for a crucial capital infusion. This strategy will result in a dilution of the stakes held by current shareholders. The government of India is the largest shareholder with 33% stake, followed by Vodafone Plc of the UK and Kumar Mangalam Birla’s Aditya Birla Group. The company’s board of directors met on Tuesday to finalise the fundraising details.

The Indian telecom industry presents a fascinating case study. On the one hand, it boasts of the second-largest subscriber base globally, with immense potential for future growth. The rapid deployment of 5G infrastructure in 2023 and the planned pan-India coverage by Reliance Jio and Bharti Airtel by March 2024 are testaments to this progress. However, the industry faces significant challenges that threaten to impede its full potential.

READ | Food security debate at WTO – Balancing needs, mitigating risks

The fundraising initiative offers an opportunity for existing shareholders to preserve their stakes in the company. The Aditya Birla Group owns 18.1% shares, while the Vodafone Group has a 32.3% stake, while 16.5% of shares are publicly owned. The British firm had earlier declined further capital injections into its Indian counterpart, which faces ongoing challenges.

The telecom sector in India underwent significant disruption following the entry of Mukesh Ambani’s Reliance Jio, with Vodafone Idea especially struggling under a heavy debt burden. This debt is largely due to outstanding spectrum fees and Adjusted Gross Revenue (AGR) dues, limiting the company’s ability to invest in network improvements and expansion. As a result, Vodafone Idea finds itself at a competitive disadvantage in the 5G market, constrained by financial limitations that impede necessary investments in network infrastructure.

Challenges facing Vodafone Idea

The recent financial struggles of Vodafone Idea, particularly its heavy debt burden, highlight the fierce competition in the market. While aggressive pricing strategies benefit consumers, they can also strain the financial health of smaller players, potentially leading to a duopoly of Reliance Jio and Bharti Airtel. This scenario could stifle innovation and limit consumer choice in the long run.

The Indian telecom market is fiercely competitive, dominated by aggressive pricing strategies from players such as Jio and Airtel. This environment encourages consumer mobility towards networks offering superior services. Despite Bharti Airtel and Jio establishing a robust 5G presence, Vodafone-Idea is planning a substantial 5G rollout in June 2024.

Proceeds from the latest equity offering will be allocated towards repaying debts to banks and suppliers. With a debt repayment of Rs 5,400 crore due from December this year, including Rs 1,600 crore in optionally convertible debentures, Vodafone Idea is under pressure to expedite the deployment of 4G and 5G networks and pursue network expansion. The company’s debt stands at Rs 2.1 trillion, with an annual repayment instalment of Rs 43,000 crore starting from FY26.

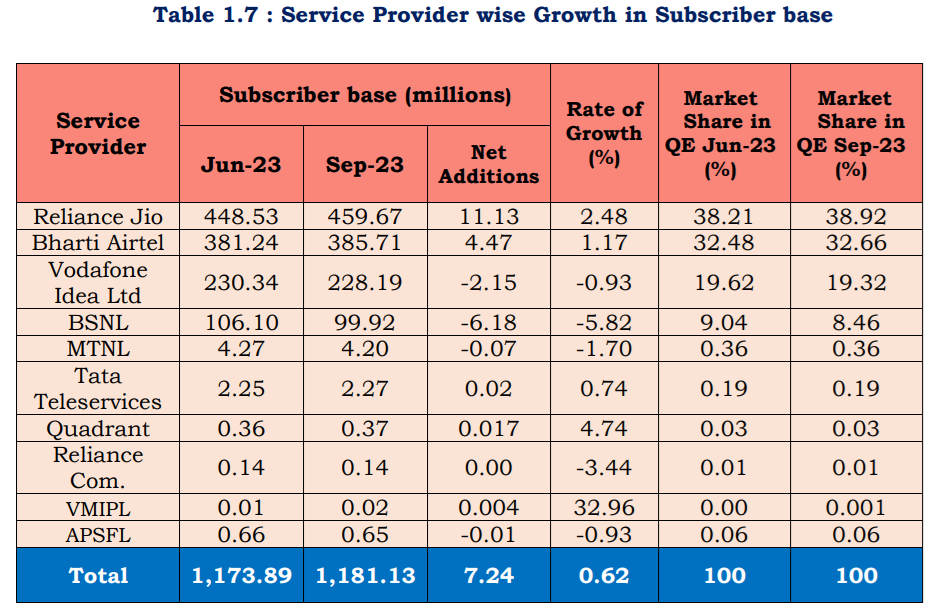

The entry of Reliance Jio has heightened competition in the telecom sector, leading to a market dominated by a few key players. As per the Telecom Regulatory Authority of India (TRAI), Reliance Jio and Bharti Airtel gained subscribers in December 2023, while Vodafone Idea, MTNL, and BSNL saw declines. The total number of wireless subscribers in India reached 1,158.49 million in December 2023.

AGR dues remain a contentious issue for operators like Bharti Airtel and Vodafone-Idea, which sought Supreme Court intervention in October 2023 to address their grievances over the dues calculation. The industry fears a duopoly unless the government steps in to support struggling entities.

The telecom sector celebrated a milestone with the rapid deployment of 5G infrastructure in 2023, setting the stage for pan-India coverage by Reliance Jio and Bharti Airtel by March 2024. Additionally, India has made significant progress in satellite-based communications and aims to contribute to the 6G standardisation process.

Despite its global standing as the second-largest telecom market, the Indian telecom sector faces challenges that hinder its growth potential. The government is urged to revise its approach to address issues such as corruption, crony capitalism, and spectrum concentration, which stifle competition and innovation. The industry calls for government initiatives to revitalise the sector, ensuring its profitability and sustainability for all stakeholders.