MSMEs can trigger manufacturing boom: The Indian economy has been growing at a healthy rate ever since the economic reforms were initiated in early 1990s. It has been following an unconventional path in terms of the contribution of various sectors to the gross domestic product. In 1960, the services accounted for 39.1% of the GDP, and its share rose marginally to 42.5% in 1990. The reforms resulted in higher growth rate for the service sector, which accounted for 54.3% in GDP in 2019. However, its share in total employment remained at a modest level of 25%. Agriculture and manufacturing that contributes 15.96% and 13.72% respectively to the GDP employ a disproportionately high number of people.

In the development process of an agrarian economy, the share of agriculture in GDP decreases gradually as economic activities and employment shift towards the industrial sector, in particular, manufacturing. Once the industrial development stabilises, the service sector gradually overtakes the industry, and people start earning their livelihood predominantly from the service sector. For example, in the two largest economies namely the US and China, the service sector employs around 79% and 46% people, respectively. The marked dominance of the service sector and retardation of the manufacturing sector as seen in India during the last 30 years has raised questions about the country’s development strategy. More so, because India needs to create 5 million new jobs each year outside agriculture to employ its young population.

READ I Why ease of doing business rankings are important

By the early years of the millennium, the policymakers started realising that an unconventional development trajectory that rides on service sector growth would not help solve the unemployment problem. Even after more than a decade of the structural reforms of 1991, the agriculture was the source of employment for a majority of Indians. In 2005, 56.5% of the total labour force was employed in agriculture, compared with 62% in 1991 (Source: globaleconomy.com). However, services with a share of 60% in the GDP in 2005, employed only 31% of the labour force. Consequently, a review of the policy priorities resulted in the launching of policies/schemes in quick succession to bring manufacturing to the forefront of economic growth. This is not to suggest that the pivotal role of manufacturing in our economy was not recognised earlier.

In late 1990s, the economic liberalisation process removed all manufacturing activities except defence items, explosives, and hazardous chemicals from the requirement of an industrial licence under the I(D&R) Act. Also, the gradual opening up of the FDI regime gave high priority to manufacturing activities, and FDI in all companies engaged in manufacturing activities except in defence sector were brought under the automatic route up to 100%.

READ I e-commerce policy must focus on investment, infrastructure

Initiatives for boosting manufacturing, MSMEs

In 2006, the first specific plan for promoting the manufacturing sector was launched as the National Manufacturing Competitiveness Programme formulated by the National Manufacturing Competitiveness Council (NMCC), an autonomous body under DIPP which put forward 10 schemes for the promotion of the manufacturing sector in the PPP model. It was followed by the National Manufacturing Policy (NMP) notified in 2011 which was the first major initiative with a target of enhancing the share of manufacturing in GDP to 25% and creating 100 million jobs by 2022. Framed in the backdrop of an uncertain global economic environment, NMP was based on the principle of industrial growth in partnership with the states, and, by then, the most comprehensive one for the sector. It addressed the regulatory environment, infrastructure deficiency, need for skill development, technology, availability of finance, exit mechanism, and other factors related to the growth of the sector.

The policy has a clear focus on SMEs which, in terms of value, accounted for about 45% of the manufacturing output and40 % of the total exports of the country. The policy sought to fill the gap in the productivity level between the Indian SME units and those in countries like Thailand, Malaysia and South Korea that saw manufacturing success. The policymakers believed that strengthening the SME sector can help in maximising opportunities for both employment generation and exports. Another important policy initiative was the National Investment and Manufacturing Zones (NIMZs), conceived as large integrated industrial townships having 30% of the total land area dedicated to manufacturing units. Acknowledging that nine years is a reasonable period to assess the movement and magnitude of outcomes of medium or long-term policy initiatives, a review of the progress made under NMP is due now.

READ I India’s retail sector: Overcoming policy and structural challenges

As the policy instruments were intended to boost growth in three key variables of the manufacturing sector — investment, production value, and employment growth — an assessment of these areas will help measure the success of the policy. So far, three NIMZs have been approved while 13 NIMZs have been granted in-principle approval. All the three approved NIMZs are in Andhra Pradesh and Telangana. The central ministries are engaged in the process of creation/ up-gradation of external infrastructure linkages for these NIMZs. As of now, NMP implementation is running behind schedule to achieve targets set for 2022. One of the reasons is the requirement of 5000 hectares of contiguous land for setting up NIMZ. Land acquisition is a major challenge in India. And unlike SEZs, it does not allow flexibility of different area limits for specific sectors. Then, creation or upgradation of external infrastructure like road or rail connectivity requires huge amounts of coordination work, and is time taking.

On the positive side, the process of consultations on labour reforms which were initiated with the ministry of labour and employment. This was done as part of NMP implementation to address concerns regarding labour productivity, availability of skilled workforce, resolving labour disputes, and managing archaic labour laws. The process has culminated in consolidating 29 central labour laws into four labour codes, namely, the Code on Wages, the Code on Social Security, the Occupational Safety, Health and Working Conditions Code, and the Industrial Relations Code. While the codes have some novel provisions, it is to be seen how the rules being drafted under the acts and their implementation on the ground meet the precarious balance between the welfare of the employees and the flexibility in hiring by the employers for specific manufacturing activity.

READ I Drawing a line: Protection of personal data in a digitised world

Make in India to boost manufacturing, exports

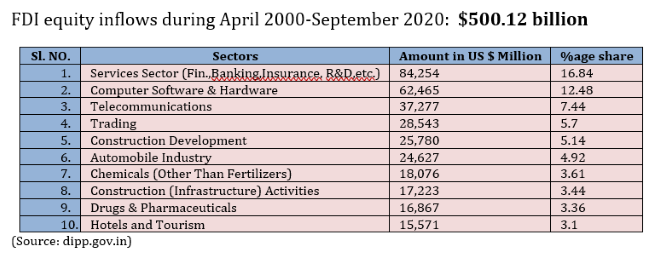

It would not be inapt to say that NMP was relegated to the backstage with the launching of the Make in India (MII) campaign in 2014. MII with the primary goal of making India a global manufacturing hub by encouraging both multinational as well as domestic companies to manufacture in India set a target to increase the contribution of the manufacturing sector to 25% of the GDP by the year 2025 (from 16% in 2014). However, unlike the NMP, the MII action plan was not sector-neutral. MII initiatives sought the participation of industry leaders also in devising an action plan for 25 identified sectors. Several reforms undertaken at the central and state level for improving ease of doing business have helped in a jump in India’s ranking from 142 to 63 in six years — a major achievement under MII. Another striking gain was a substantial jump in annual FDI inflows from $45.1 billion in 2014-15 to $74.3 billion in 2019-20. An increase in capital inflows is undeniably helpful for economic growth. It would be interesting to see the top 10 sectors attracting FDI inflows (see table).

FDI Equity Inflows in major sectors

A large segment of the total FDI inflows into India during the last 20 years was invested in financial services, software, telecom, trading, and construction sectors, suggesting the preference of the foreign investors. On the manufacturing side, automobiles, chemicals, and drugs/pharma sectors were the leading recipients of FDI. The investment made in the pharmaceutical sector is mainly by way of mergers and acquisitions (M&As) arising from MNC interest in India’s pharma sector. This is a concern as it might affect India’s ability to produce low-cost generic drugs. Such trends need to be arrested and the investment promotion strategy may be directed at encouraging the foreign investors to set up greenfield manufacturing units.

READ I Farmers protest: Is contract farming a bad thing for Indian farmer?

Extending fiscal benefits to greenfield investments in the manufacturing sector could be an option to maximize gains from investment for the local economy. One product segment which needs mention here is mobile handsets that have seen a spurt in local manufacturing with the addition of 60+ assembly units from only two units in 2014. The success in expansion in manufacturing base can be attributed to incentives being offered, and to the increase in import duty on assembled sets. The import of mobile sets has also seen a sharp fall with import value crashing from $7948 million (82% from China) in 2014-15 to $1037 million in 2019-20. However, the role of higher demand for mobile phones, and rise in popularity of e-banking and e-Commerce also played a role in attracting cell phone manufacturers to set up assembly units.

As of now, the targets under Make in India plans for 2025 call for extra efforts and innovative methods as the share of the manufacturing sector in GDP is still below 17%. While the ease of doing business rank has improved, the target to increase the share of the manufacturing sector in domestic output is an unfinished task.

READ I Climate change: Green infrastructure key to keeping temperatures low in cities

Production-linked incentive scheme

In a fresh initiative to encourage local manufacturing and to reduce import bill, the government in announced a scheme March 2020 to give companies financial incentives on incremental investment and sales from locally manufactured products. It was also an attempt to address issues arising from post-COVID-19 disruptions in the global supply chain, and anti-China sentiments due to LAC skirmishes. Initially rolled out for mobile and specified electronic components, pharmaceutical ingredients, and medical devices, the scheme was extended to 10 more key sectors. It aims to encourage foreign as well as local companies to set up or expand existing manufacturing units.

The additional sectors covered under the scheme are advance chemistry cell (ACC) battery, electronic/ technology products, automobiles and auto components, pharmaceutical drugs, telecom and networking products, textile products (MMF segment and technical textiles), food products, high-efficiency solar PV modules, white goods (ACs & LED), and speciality steel. The list of industrial sectors under the scheme has been prepared keeping in mind the need to reduce dependence on imports, particularly from China.

The scheme offers an incentive of 4-6% on incremental sales (over the base year) of goods manufactured in India. The reduced production costs resulting from incentives under the scheme are expected to make the final product more competitive in the market. The big question is whether it would create a ripple effect, and will benefit the entire value chain to realise the ultimate objective of boosting local manufacturing. This is vital since sustaining long-term manufacturing growth without a healthy MSME sector would be difficult.

Out of the 13 sectors targeted under the PLI scheme, consumer-driven sectors like mobile handsets, automobiles, and air conditioners are expected to be the immediate gainers of the scheme. However, the response of other products falling under intermediate or industrial use category like bulk drugs, MMF segment, technical textiles or even medical devices could be a big challenge. It is understood that guidelines for the PLI scheme for additional selected sectors are under preparation, and interactions with specific industry bodies for framing the parameters of the scheme may facilitate the productive implementation of the scheme.

READ I Stakeholder Capitalism: A code for future-proofing governance

Increasing manufacturing output, productivity

Many Indian manufacturing companies have demonstrated their excellence and capability in adopting world-class manufacturing practices to produce quality products. India’s homegrown manufacturers have won 38 Deming Prizes, the highest global recognition for TQM implementation awarded by Japan. In the pharmaceutical sector, India has the most US FDA-approved pharma plants outside the US. There is a need to adopt methods to achieve operational excellence like lean manufacturing, TQM, automation, waste reduction, and energy efficiency. The first thing the Indian manufacturing sector lacks is innovation culture with the result that new products are not coming even from large companies, making them less attractive in the market.

A low level of manufacturing productivity is another area that needs improvement. Without a good presence in the export market, it is not possible to reach a global scale in production, and to make their products cost-competitive. All three requisites — innovation, productivity, and scale — require investment in R&D, skill development, capital expenditure and technology. Availability of low-cost finance to MSME units for such expenditure and appropriate financial benefits could help meet the objectives. The infrastructure deficit too pushes up the logistics cost, which is the highest globally. Development of infrastructure and connectivity need to be given priority around industrial clusters as it offers the opportunity for better value chain management.

Efforts to improve EoDB ranking is a fruitful exercise, however, it is important to address issues arising out of incidents giving wrong publicity to India’s business environment. The recent incident of workers unrest on December 12, 2020, allegedly due to the non-redressal of payment and overtime issues at the plant of Wistron Infocomm Manufacturing India Pvt Ltd, which manufactures iPhones for Apple, must be investigated and sorted out on an urgent basis. Another recent decision by Boeing not to establish a manufacturing unit in Bengaluru, and instead, to convert its entire land in Bengaluru into an R&D facility does not speak well of our manufacturing ecosystem. Although the US company has attributed lack of demand for the change in plan, some believe it to be a comment on India’s conduciveness for manufacturing investment.

READ I Covid-19 vaccine: Compulsory licensing key to equal access

The PLI scheme is unique as it offers financial incentives that are linked to incremental investment and production. It is reported that mobile manufacturers have desired for extension in the period to meet the investment and production targets for the first year as there is a shortage of electronic components and raw materials due to Covid-induced supply disruptions. This is another reminder that without a sound production base from the basic stage, any promotional scheme is prone to hiccups.

India’s quest to realise the aim of becoming a global manufacturing hub continues with the government promising to come out shortly with a new industrial policy which will be aimed at promoting emerging sectors, reducing regulatory hurdles, and making India a manufacturing hub.

(Krishna Kumar Sinha is an industrial policy and FDI expert based in New Delhi. His last assignment was as an industrial adviser in the department of industrial policy and promotion, DIPP, currently known as DPIIT, under the ministry of commerce and industry of the government of India.)

Krishna Kumar Sinha is an industrial policy and FDI expert based in New Delhi. His last assignment was as an industrial adviser in the department of industrial policy and promotion, DIPP, currently known as DPIIT, under the ministry of commerce and industry of the government of India.