By Nikky Shah and Darshini Shah

A SEBI working group set up to enhance the quality of disclosure and to protect the interest of minority stakeholders has proposed some significant amendments to strengthen the listing obligations and disclosure requirements, 2015 (LODR) regulations. The recommendations include changes in the definition of related parties and related party transactions, revising the threshold limits for transactions to qualify as material transaction, approval mechanism, and reporting requirements.

The group chaired by Ramesh Srinivasan reviewed policy relating to SEBI regulations on related party transactions recommended that any person/entity belonging to promotor or promoter group of the listed entity be considered as related parties of such listed entity, irrespective of their shareholding. As per the current LODR regulations, any person or entity belonging to a promoter group and holding 20% or more of shares in the listed company shall be deemed to be related party. The group has also recommended any person/entity, holding (directly or indirectly) 20% or more shareholding of a listed entity within the definition of related party.

READ I Decoding framework of social stock exchange model in India

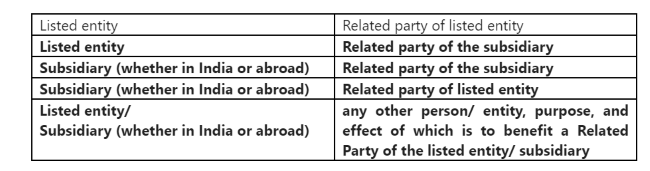

The group has recommended the inclusion of the following parties in related party transactions involving the transfer of resources, services, or obligations between:

Currently, all related party transactions (irrespective of whether they are in the ordinary course of business or are on an arm’s length basis) require prior approval of the audit committee. In this regard, the group proposed a change in the approval mechanism i.e. a related party transaction to which the subsidiary of a listed entity is a party, but the listed entity is not a party, shall require prior approval of the audit committee of the listed entity only if the value of such transaction (individually or aggregate) exceeds 10% of the annual total revenues / total assets / net worth of the subsidiary on a standalone basis in the immediately preceding financial year, whichever is lower.

READ I Income tax assessments: Personal hearing may be needed in many cases

The Group has not provided any parameters to identify transactions that might enter to benefit the related party. In the absence of any established parameters, the companies will encounter practical difficulties in identifying whether a particular transaction benefits a related party or not. This will further increase the high compliance burden of the audit committee of the listed entity and makes the task of the audit committee onerous.

Another concern in connection with these recommendations to enlarge the scope of related party transactions is that this may lead to a scenario where the audit committee of the listed entity will examine and approve the related party transactions entered by its overseas subsidiary. Apart from the fact that listed companies will encounter practical challenges in identifying the related party of an overseas subsidiary, it has the following legal, constitutional and tax implications.

- Income-tax department can take a view that examination and approval of significant RPTs of overseas subsidiary by the audit committee of the listed parent entity in India may constitute place of effective management (POEM) of the foreign subsidiary in India under the Income-tax Act, 1961 and consequently, the income of such overseas subsidiary may liable to tax in India.

- Review of related party transactions of overseas subsidiaries by the listed parent entity in India may be perceived as ‘piercing of the corporate veil’ and may affect the independence of the board of directors of such overseas entities to undertake transactions between related parties.

- The proposed recommendation regarding review of related party transactions of overseas subsidiaries by the audit committee of the listed parent entities in India makes those transactions extra-territorial in operation and may raise concern regarding its constitutional validity.

READ I Covid-induced reverse migration can be a boon for home states

Further, the group has proposed prior approval from shareholders for all material related party transactions and material modifications thereon. Material threshold has also been proposed to be revised – a related party transaction shall be considered material if the transaction exceeds Rs 1,000 crore or 5% of the annual total revenues, total assets or net worth of the listed entity on a consolidated basis, whichever is lower.

The group has proposed to change disclosure / reporting requirements to shareholders and to stock exchanges. One of the proposed changes enables shareholders to have insights on related party transactions by allowing inspection of reports of the audit committee.

READ I Tax compliance: Rewards may work better than punishments

The group’s recommendations may serve to curtail the peril of abusive related party transactions through prevalent use of complex structures for siphoning of funds, money laundering and round tripping. However, this will significantly increase the compliance burden of the listed entity and workload of the audit committee, particularly for a large corporate with several subsidiaries.

Some recommendations of the group need to be closely examined, particularly to avoid any unintentional tax and other consequences on the overseas subsidiaries of the listed parent entities in India and to reduce the voluminous disclosure compliance.

(Nikky Shah and Darshini Shah are part of a boutique tax consultancy firm, Rajeshree Sabnavis & Associates. Views expressed are personal.)