The Group of Seven nations are looking to put a cap on the price of Russian crude oil from December 5 as they seek to curb the country’s ability to finance its war on Ukraine. The G7 — the United States, Japan, Germany, Britain, France, Italy and Canada –- is yet to finalise the price of Russian crude. While G7 is looking at a price range of $40-$60 per barrel for crude, some members of the coalition may push for a higher price, fearing disruption of Russian supplies.

As the G7 looks to tighten the screws on Russia, Moscow is likely to reach out to its neighbour China and long-time ally India. It is already offering discounted crude oil to woo the Asian giants. The Russian government recently made an offer to India whereby it will offer crude at rock-bottom prices if India stayed away from the western coalition. The government is now considering the offer and discussing it with its trading partners.

In May, Russia was giving India a $16 per barrel discount on the average import basket price of $110 a barrel. It was later reduced to $14 a barrel in June when the Indian crude basket averaged $116 a barrel. In August, Russian crude oil was cheaper by $6 a barrel.

READ I Indian economy crosses another milestone, but worries linger

Indian dependence on imported crude

India is one of the biggest crude oil importers and the Russian offer will help it fight runaway inflation and a depreciating rupee. But it will have to withstand diplomatic pressure from the US and allies if it accepts the Russian offer. India has drawn heavy criticism from the West for continuing to import oil from Russia when G7 is trying to choke Moscow’s cash flow.

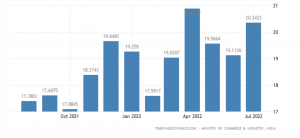

India crude oil imports (mn tonne)

India is dependent on imports to meet its energy needs. The ongoing geopolitical tension has sent crude oil prices through the roof at a time when the Indian currency was on a free fall. The rupee crossed the Rs 80 mark against the dollar for the first time in history. The depreciating rupee and the soaring oil prices have seen a surge in inflation and the import bill has shot through the roof. High crude oil prices, rising import bill and the falling rupee may force India accept the Russian offer.

India remains vulnerable to spikes in crude oil prices with 85% of its daily requirement of 5 million barrels is met through imports. The country will find itself in a deep crisis if the prices average $100 per barrel against the Union Budget estimate of $75. According to the Reserve Bank of India (RBI) estimates, a 10% spike in oil prices can depress real GDP growth by 20 basis points over the baseline.

READ I India’s Arctic policy regime and its geopolitical significance

The rise of Russian crude oil

Iraq is India’s biggest oil supplier of crude and has been undercutting Russia since late June by supplying a range of crudes at a discount of $9 a barrel compared with the Russian crude. Due to an extremely price-sensitive market, buyers shifted heavily to Iraq, Russia slid to the third position in the list of largest oil exporters to India. Still, Russia met nearly 20% of all the country’s oil needs. Saudi Arabia and Iraq are now the top two suppliers.

While Russia was not a major partner for exports for crude oil and the country only imported less than 1% of its crude oil import volume from Moscow before the Ukraine invasion, the import volume soar to 8% in April, 14% May and 18% in June, according to industry estimates and official Commerce Department data. However, with a fall in total import of crude oil, imports from Russia have also declined. According to analysts, India is likely to continue importing from Russia until it continues to compete with other major producers in offering discounts.

Meanwhile, the Union Petroleum Ministry is on its way to finalising a report by which it aims for a comprehensive strategy to reduce dependence on imported crude, gas and coal by 2024-25. Some of these measures include improving energy efficiency and productivity as well as improving refinery processes and promoting greater use of bio and alternate fuels.

India is currently also taking active steps to move towards the renewable energy sector. The country has pledged to achieve net-zero emissions by 2070 at the COP26 in Glasgow. Also, the government has committed to meet 50% of its energy requirements from renewable sources by 2030. Since 2014, India has also attracted more than $42 billion in investments in the sector.