India’s mobile manufacturing Industry: India’s trade with China has been expanding at a dramatic pace despite uncertainties in bilateral relations between the Asian giants. Imports from China are booming despite the NDA government’s make in India push and the PLI scheme. India imported $26.39 billion worth of electrical, electronic equipment from China during 2021, according to the United Nations COMTRADE database. Chinese exports to India increased by 45.51% in FY22 as compared with imports in the previous year. So, what is India doing about the widening trade deficit with China?

The biggest imports from China include mineral fuels, mineral oils, chemicals, fertilisers, plastic, iron and steel, electrical machinery and equipment, and medical equipment. The country is also a large market for Chinese smartphone makers with nearly three fourth of phones sold in India belonging to Chinese brands. New Delhi has started a clampdown of the same which has, in turn, raised trade tension between two of Asia’s biggest economies.

READ ALSO: Telecom Industry: Adani foray may trigger another round of consolidation

Indian mobile manufacturing and Chinese imports

India has stepped up the crackdown on Chinese smartphone makers that rule the country’s market. The Indian smartphone market is dominated by Xiaomi with a 23% share in the January-March quarter this year. Together with other Chinese brands such as Realme, Vivo, Oppo, and OnePlus, Xiaomi dominate the Indian market.

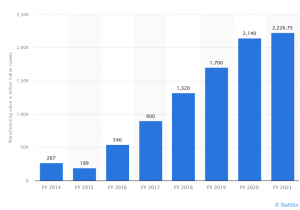

Value of mobile manufacturing in India

The recent crackdown on Chinese firms comes in the wake of New Delhi seeking to build its domestic high-tech manufacturing sector to reduce dependence on imports. This has been a fallout of rising tension between India and China over their disputed border. India, however, continues to insist that the legal cases against Chinese companies are not politically motivated. Concerns regarding snooping by Chinese companies also abound considering the distrust between the two nuclear-armed nations even while the government has only slapped tax evasion charges on Oppo and Vivo, owned by Dongguan-based BBK Electronics.

READ ALSO: Falling labour share highlights high income inequality in India

The Chinese embassy in India said that frequent investigations by the government into Chinese enterprises were disrupting their business operations. The resentment in the smartphone market is also caused by the fact that along with South Korea’s Samsung, Chinese-owned device makers snatched market share from once-prominent Indian phone brands. This has undercut homegrown companies with newer technology at cheaper prices.

For a country which is one of the biggest smartphone markets, it is a matter of concern that no Indian brand is catering to the Indian audience. India once had plenty of homegrown brands including Micromax, Lava, Karbonn, Intex, LYF, and Spice which have now faded out of existence.

Reliance Jio has transformed mobile telephony with dirt cheap data since 2016. It also launched its own smartphone last year with backing from Google and Meta. The device is yet to take off but it is expected that it will gain significant market share in the next two to three years with the probability of many more players join the mobile manufacturing industry.

Prime Minister Narendra Modi’s push for make in India has not borne significant fruit at least as far as making smartphones is concerned. However, most China-owned phone companies manufacture devices in India and have invested heavily in factories.

India is now among the largest mobile manufacturing hubs. According to latest estimates, the country now produces roughly one in 10 smartphones made around the globe as India learnt the importance of making electronic devices domestically. The country also made drastic changes to adapt to evolving needs of the industry and allowed 100% FDI in the mobile manufacturing sector.

Prime Minister Modi’s Digital India initiative and PLI scheme were a further push to mobile manufacturing. Under the production-linked incentive scheme, domestic manufacturing is encouraged to help reduce the country’s huge import bill. The scheme also offers incentives to manufacturers on incremental sales of locally manufactured products.

India-China relations: A double-edged sword

India-China relationship in trade, however, is a twin-edged sword and India must wield this cautiously. The trade relations between these two countries are complex as China also makes big bang investments in Indian start-ups. In fact, in 2021, these investments hit a three-year high after a slowdown due to the lockdown. Chinese funding is quite crucial to the Indian start-up ecosystem with Alibaba and Tencent being the biggest backers.

The India-China bilateral trade, however, has grown in China’s favour as the former imported $27.7 billion worth of goods from China in the first three months of 2022 but exported paltry $4.9 billion to China which translates to a record trade deficit. Electronics, chemicals and car parts make up the bulk of Chinese imports.

The telecommunication sector is one sore point for India which continues to import heavily from China as Huawei makes telecommunications equipment. Huawei has in turn come under the radar of the government and is now facing tax probes even while it claims full compliance with Indian laws. However, economists argue that no wise country should mix the lethal combination of commerce and politics and they should remain separate.