India’s gaming industry, long a silent contributor to global game development, is now entering a new phase—driven by a surge in original intellectual property rooted in local culture. Indian studios, which once focused on outsourcing, are now creating games that resonate with domestic audiences. The shift reflects both a maturing industry and a growing consumer appetite for content steeped in Indian narratives.

This transition is being led by titles like Indus Battle Royale from Pune-based SuperGaming—a game that blends Indian mythology with a modern shooter format. Launched in 2024, the title has clocked 8 million downloads, 15 million pre-registrations, and boasts 3 million monthly active users.

READ I Household income survey to bridge India’s data gap

Rapidly expanding market

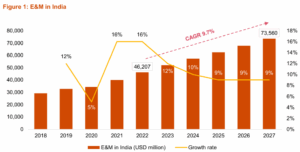

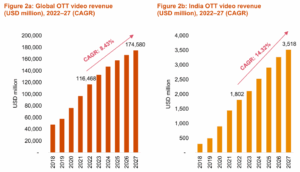

India’s gaming market is now the second-largest globally by downloads, with 23 million new users added in FY24 alone. According to PwC India, the domestic industry is projected to reach Rs 66,250 crore ($7.6 billion) by 2029, growing at a compound annual growth rate (CAGR) of 14.9%—almost double the global rate of 8%.

This growth is powered by mobile gaming, which commands over 80% of total revenues, aided by widespread smartphone adoption, cheap data, and a youthful demographic. Of the 591 million gamers in India, two-thirds come from tier-2 and tier-3 cities. In-app purchases have grown at a 40% CAGR over the past three years, indicating increasing willingness to pay for digital content.

Global ambitions, local foundations

Indian studios are no longer content with being passive participants in the global gaming ecosystem. Companies like Nazara Technologies and Felicity Games are building scale, backed by skilled talent and venture capital. The goal is no longer to merely consume global content but to produce and export culturally rich experiences.

Web-based gaming has emerged as the next frontier. These games, which don’t require downloads, are enabling wider access and new monetisation models. Platforms like Rooter connect gamers and content creators with brands, enabling sponsorships and in-game advertising. Enhanced micro-transaction behaviour is also fuelling sustainable revenue growth.

Capital, talent driving the ecosystem

The Indian gaming ecosystem has attracted $2.8 billion in funding over the last five years, with $1 billion raised in 2024 alone. Around 1,900 gaming companies and 130,000 professionals are active in the sector, which currently employs about 100,000 people. By 2029, the industry is expected to generate an additional 250,000 jobs.

The broader digital infrastructure is maturing in tandem. With 5G rollout, high-performance smartphones, and better cloud access, the ecosystem is ripe for exponential growth.

Regulatory hurdles and policy risks

However, this growth story is not without friction. In 2023, the imposition of a 28% Goods and Services Tax (GST) on online gaming dealt a severe blow to smaller studios and caused fantasy sports funding to plummet by 90%. Regulatory ambiguity and the conflation of gaming with gambling have created an environment of uncertainty.

Illegal offshore betting platforms, which reportedly process around $100 billion annually from Indian users, pose both economic and security threats. The UNODC’s Global Report on Corruption in Sport (2021) estimates the illegal betting market at $350 billion globally, while illegal gambling may be worth $1.7 trillion. Offshore operators alone siphon off $12 billion annually from Indian users, causing an estimated GST revenue loss of at least $2.5 billion.

Social concerns and gaming industry

Beyond tax and regulation, the gaming industry faces reputational risks. The World Health Organisation has recognised gaming disorder as a clinical condition in its ICD-11 framework. Studies indicate that 6–15% of gamers may show signs of addiction. Excessive gaming can lead to financial stress, including debt, especially among younger players.

The need for a framework that promotes responsible gaming is urgent. This includes parental controls, age restrictions, counselling services, and regulation of spending limits. Left unchecked, online gaming could deepen socio-economic vulnerabilities.

The gaming industry straddles a fine line—between being a key contributor to India’s $1-trillion digital economy ambition and becoming a cautionary tale of unregulated digital excess. What the sector needs is regulatory clarity, rational taxation, and strict action against offshore illegal operators.

Handled well, India’s gaming industry could not only become a global leader in culturally distinctive digital entertainment, but also a pillar of employment, investment, and soft power.