The hydrogen economy is expanding at a breakneck pace – the global green hydrogen market will grow more than 6000% from $2.14 billion in 2021 to $135.73 billion in 2031, says a new study by Transparency Market Research. This represents an astounding compound annual growth rate of 51.6%.

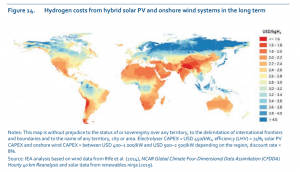

Emergence of green hydrogen as a viable alternative to carbon fuels is key to the global efforts to achieve net zero. Earlier, there were apprehensions about the ability to produce the fuel at a scale and cost required to make it an alternative to natural gas. The biggest problem here was the cost of generating renewable energy which accounts for three-fourths of the cost of producing green hydrogen.

The Russian invasion of Ukraine saw natural gas prices shooting up around the world at a time when technological advancements brought down the prices of renewable energy. This led to a situation unthinkable a year ago — green hydrogen is cheaper than liquefied natural gas in Europe. Global hydrocarbon majors who were betting on blue hydrogen produced using natural gas suddenly turned their attention to green hydrogen.

READ I Green hydrogen is cheaper than LNG in Europe

Green hydrogen as a viable fuel

Use of green hydrogen will cut the world’s carbon dioxide emissions a fourth. Hydrogen, being a potent fuel, can replace carbon fuels not only in industrial and heating uses, but also in heavy transport and maritime applications. It can be easily transported to long distances in large volumes, and can be stored at scale. Hydrogen fuel can be distributed in gas form or as pressurised liquid, or in more stable forms such as ammonia. It can be transmitted through the gas pipeline networks when mixed with natural gas.

Once produced in scale at right costs, green hydrogen can replace fossil fuels in some of the most polluting industries such as road transport (about 15% of global carbon dioxide emissions) as well as steel and cement industries that together contribute 7-8% of total emissions. Use of green fuel in these industries will go a long way in achieving net zero emissions ahead of schedule. The ability to transport and store hydrogen will help the world overcome the intermittent nature of wind and sunshine.

The world is pinning its hopes on hydrogen as it does not emit carbon dioxide when burned or used in a fuel cell to produce electricity. But, most of the global hydrogen production at present is done from methane. The hydrogen produced in the process is known as grey hydrogen. Production of grey hydrogen is responsible for 2% of the total carbon dioxide emissions. Green hydrogen is produced by splitting water using clean electricity, without emitting carbon dioxide or methane.

Changing energy economy

Sensing the change in the hydrogen dynamics, global oil and gas majors such as Shell and BP are investing heavily on green hydrogen. One reason behind the increase global interest in the green fuel is the recent spike in natural gas prices, triggered by the Ukraine conflict. The fall in the prices of electrolysers and the low cost of renewable energy also contributed to this. To top it all, all major nations have announced major tax breaks for clean hydrogen industry. All these factors will lead to a rapid increase in green energy investments.

Green hydrogen is the key to the decarbonisation of the world economy. The immediate focus should be on replacing the grey hydrogen used in industrial activity that contribute 2% of global carbon emissions. Hydrogen fuel need to be inducted into emission-sensitive industries such as steel, cement, road transport, shipping and aviation.

As green hydrogen becomes a viable alternative to fossil fuels, it will start attracting a large share of energy investments globally. Heavy investment in green hydrogen production and technology will make the fuel even cheaper in the coming years. A start has already been made by investors to move away from coal, petrochemicals and blue hydrogen. So, the recent changes could usher in a drastic change in the energy economy.

Sajna Nair is a former banker. Her areas of interest are environment, art and culture.