As they struggle to find their feet in the crisis triggered by the Covid-19 pandemic and the Russia-Ukraine war, Indian startups may find the window for crowdfunding closing before them. A ruling by the ministry of corporate affairs has dealt a body blow on small companies looking to raise funds using fintech platforms that connect businesses with investors.

The Registrar of Companies in Delhi and Haryana has started imposing penalties on companies for raising capital through technology platforms in violation of a Companies Act provision. The RoC imposed a penalty of Rs 2 lakh on a Delhi-based company and Rs 1 lakh each on two of its directors.

READ | India’s green hydrogen drive must address technology needs, water scarcity

The existing law limits private placement to 200 investors. With the fintech platforms, companies were able to breaching this limit. The new ruling will affect the startup ecosystem as it loses a quicker and cheaper way to raise money. The timing couldn’t have been more unfortunate as startups are facing a backlash from the recent collapse of the US lender Silicon Valley Bank.

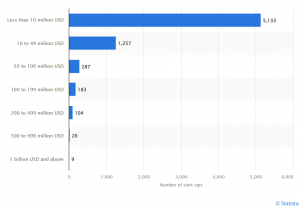

Startups funding deals in India (2014 to 2022)

According to a PwC report, Indian startups attracted around $24 billion in 2022, a drop of 33% in comparison to 2021 when $37.2 billion was raised. There was already a funding slowdown which began at the start of last year when Russian forces invaded Ukraine. With the war continuing even after a year, the ripples continue to be felt by the startups. The prolonged funding winter has driven Indian startups to look at ways to survive by cutting costs and extending their runways, resulting in mass layoffs. That the world economic outlook isn’t rosy and recession is almost a certainty is not helping.

Startups work on the growth, commercialisation, and the creation of brand-new products, services, or mechanisms that are driven by intellectual property or new technology. Startups function as centres of innovations, generate jobs and hence play a pivotal role in the economy. The time demands that the government handholds the startup industry. It can roll out tougher norms later when the economic situation picks up. The need is to come up with startup-friendly policies and channelise help from successful founders.

The Indian startups ecosystem was brimming before the Covid-19 pandemic and funding poured in from both domestic and foreign investors. However, like in the case of other countries, India’s startups were also hit hard by the pandemic, and a funding winter in the first half of 2020. A funding winter is a situation when the market is correcting its cash flows, and companies find it difficult to raise funding and achieve high valuations.

There have been reports of a funding freeze in certain sectors with investors becoming more cautious about the startups they choose to invest in. A dismal performance of the IPOs of some Indian companies bears testimony to this. The other reasons for the funding freeze are the sanctions imposed by the US on Russia, global inflation, and the value of rupee falling to historic lows against the dollar.

Some startups have reported difficulty in raising funds due to the economic downturn and uncertainties. The trend is likely to continue for at least another year and will likely test the resilience of the ecosystem.

Startups needs to be prudent

The current year is one of correction for Indian startups as most of them were overfunded, resulting in cash burn. However, those startups which were prudent and smart with their business plans have managed to survive the funding winter. Going ahead, startups must minimise their expenses by not spending much on consumer acquisition and instead focussing on product market fit. Usually, startups lose most money on marketing and hiring and this is where they must tread carefully.

Meanwhile, some Indian startups have millions of dollars stuck with the troubled Silicon Valley Bank and it is still not clear if they will be able to withdraw their money from the bank. The fallout of the bank’s collapse is likely to be far-reaching especially for the Indian startup ecosystem. Startups may be unable to pay employees in the coming days and venture capital firms may be unable to raise funds.

The tech industry is the biggest customer of the fallen bank with a large number of Indian startups, especially in the SaaS (software as a service) sector that services US clients having accounts with the bank. Silicon Valley Bank has been an important lender to Indian startups. Among its clientele is the parent company of Paytm – One97 Communications, Bluestone and Carwale.