Repo rate needed to shore up manufacturing sector: The imposition of US tariffs on Indian goods will hit several key sectors—textiles, electronics, gems and jewellery, auto components, and machinery. Pharmaceuticals and energy are relatively insulated, having been exempted. For American consumers, this translates to higher prices across a range of products.

For India, the immediate challenge is market diversification. While policymakers may revive earlier efforts to engage countries in the Global South, such recalibration will take time. Indian trade delegations have previously explored alternative destinations, but developing strong commercial linkages outside the US and Europe—long-standing trade partners—will be no easy task. Indian exporters, especially in sectors now facing tariffs, are likely to see margin compression and volume losses in the near term.

READ I Trump tariffs reveal the leader’s zero‑sum worldview

US macro stability, global spillovers

The US economy appears relatively stable on the surface—unemployment is low at around 4%, and headline inflation has moderated to 2.5%, near the Federal Reserve’s target of 2%. Yet this apparent calm masks persistent supply-side shocks, a legacy of pandemic disruptions and the prolonged Russia-Ukraine conflict.

Tariffs are already adding to price pressures in select categories. Although their full impact on consumer inflation remains uncertain, the US Federal Reserve remains cautious. It chose to hold rates steady at its July 31 meeting, citing the possibility of lingering inflationary impulses in specific sectors. The Fed signaled that while the tariff hike could be a one-off, the risks to inflation expectations cannot be dismissed.

India must chart its own course

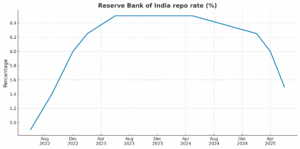

Whether the US cuts rates by September is beside the point for India. There is little merit in aligning our monetary stance with that of the US. India’s real interest rates remain elevated, constraining domestic investment and consumption. The RBI should retain the autonomy to respond to domestic conditions rather than mirror the Fed’s posture.

Globally, economic fragmentation is rising. Advanced economies like the Eurozone and UK are also grappling with sticky inflation—2.5% in the Eurozone and 3.1% in the UK—leaving little room for coordinated monetary easing. India will have to steer its course through these crosswinds largely alone.

Real economy gives mixed signals

India’s real economy presents a patchy picture. The monsoon has performed well, and agricultural output is expected to be robust—offering some reassurance on the food supply front.

Manufacturing, however, is showing signs of fatigue. The Index of Industrial Production (IIP) for April–May 2025 indicates a tepid growth of 2.8%, a marked slowdown from 4.6% in the same period last year. Sectors such as electrical equipment, machinery, and motor vehicles are doing relatively better. Rubber and plastic goods are also expanding. However, key core sectors—cement and steel aside—are underperforming. Crude oil, coal, natural gas, fertilizers, and electricity have all recorded weak numbers, indicating a lack of broad-based momentum.

Slowing credit flow

Bank credit growth has slowed notably. Year-on-year data show a 9.8% rise in 2025, compared to over 14% in 2024. The deceleration in credit flow to industry and services could weigh on capex and private investment.

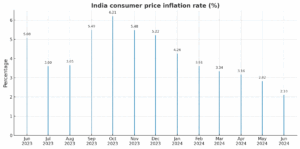

Inflation metrics, meanwhile, offer some comfort. The Wholesale Price Index (WPI) remains in negative territory. Consumer Price Index (CPI) inflation stood at just 2.1% in June 2025. Within food inflation, the rise is under 1%, driven by a significant decline in vegetable prices. Fruits and edible oils have risen modestly, but overall, price pressures remain subdued.

Yet this benign picture hides regional disparities. Inflation rates vary sharply across states—Andhra Pradesh recorded 0% inflation, Bihar 0.75%, Punjab 4.7%, and Kerala 6.7%. Such divergence complicates national policymaking and calls for greater fiscal and administrative agility at the state level.

Demand indicators and trade trends

High-frequency indicators continue to send mixed signals. Retail automobile sales grew 4.8% in June, marginally lower than 5.1% in May. Tractor sales, a proxy for rural sentiment, expanded 8.7% in June 2025—down sharply from 28.6% in June 2024.

Merchandise trade data also point to stress. Both exports and imports contracted year-on-year in June 2025, reflecting weak global demand and possibly the early impact of trade disruptions, including tariffs.

Time for a repo rate cut

With domestic inflation under control, credit growth slowing, and trade headwinds rising, India’s high real interest rate is increasingly hard to justify. The external environment remains uncertain, marked by protectionist impulses and limited scope for international coordination. Every major economy is now inward-looking, focusing on its own challenges.

India, though the fastest-growing large economy, must protect its growth trajectory. A modest repo rate cut—25 basis points, if not 50—would serve as a signal that the central bank is committed to supporting domestic industry and maintaining a pro-growth monetary stance.

In the current climate, policy passivity is not prudence—it is risk.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.