The Reserve Bank of India has been ramping up its stock of gold reserves amid rising global uncertainties and sticky inflation back home. The central bank’s bullion reserves touched 794.64 tonne in fiscal year 2022-23, marking an increase of about 5% compared with 760.42 tonne in the previous year. The increase in stock is part of the diversification process deployed by the RBI as gold is considered a safer, more secure, and liquid asset to safeguard returns in dire times. As of March 2023, India now ranks ninth in terms of the most official gold reserves, with the United States leading the list.

The RBI purchased 34.22 tonne of gold in the year 2022-23 which is almost half of the gold accumulated in the previous year. From June 30, 2019, RBI’s gold reserves went up by 228.41 tonne. Needless to say, the macroeconomic situation in the said period has not been good due to the pandemic and then the Russia-Ukraine war.

READ | Sustainable transport: Rethinking mobility for a greener future

Gold reserves as a Safe Haven

In India, possessing gold is always associated with safety, as it is a metal that is universally regarded as precious and can be sold easily in times of need. In fact, Indian households have the largest gold possession in the world.

According to analysts, the RBI is purchasing gold to diversify its overall reserves in the light of past negative interest rates, weakening of the dollar, and geopolitical uncertainty. Gold plays a key role in the portfolio diversification of central banks. Earlier, 60% of India’s forex reserves were held in dollars. The move towards de-dollarisation has also been making countries such as Turkey, Russia, and China increase their gold reserves.

All glitters: India’s gold reserves

Central banks across the world are looking for safety, liquidity, and high returns. Gold fits the bill as it is a safe asset with transparent international pricing, is liquid, and can be traded anytime. So, it is not just the RBI that is buying gold. Central banks across the world are shoring up their bullion stocks, as the World Gold Council’s India CEO said last week. The RBI is among the top five central banks ramping up their stocks.

The RBI’s affinity towards the yellow metal is least among its peers, at least in recent times. Of the total gold purchased by central banks in 2020 and 2021, the RBI bought 15.26% and 16.63%, respectively. In 2022, the central bank purchased a mere 2.9%, or 33 tonne, out of the 1,136 tonne of gold bought by central banks worldwide in the year.

Other central banks that have shored up their reserves recently include the Monetary Authority of Singapore, the People’s Bank of China, and the Central Bank of the Republic of Turkey. According to the report by the World Gold Council MAS was the largest single buyer of gold and added 69 tonne during January-March 2023. The report says the central bank buying remains robust and that there is little to indicate that this will change in the short term.

Turkey added the most gold to its reserves last year at 140.88 tonne, taking its total reserves to 572 tonne. China follows, having added 120 tonne, and Singapore, which added 68.67 tonne. India stands fifth among the countries that added glitter to their reserves last fiscal year but now is the seventh-highest buyer.

The other central banks have been more proactive in pursuing the yellow metal, as the world witnessed the largest gold buying spree since 1967 when central banks bought 1,404 tonne of gold.

Of the 794.64 tonne of reserves it currently holds, 56.32 tonne consist of gold deposits. According to its half-yearly report on Management of Foreign Exchange Reserves from October 2022 to March 2023, the Indian government has 437.22 tonne of gold held overseas in custody with the Bank of England and the Bank of International Settlements, and 301.1 tonne held domestically.

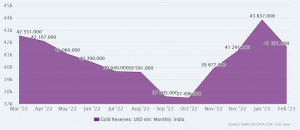

As of March 2023, India’s total forex reserves were $578.449 billion, while its gold reserves were $45.2 billion. The share of gold reserves in terms of value or dollars increased from 7% at the end of March 2022 to 7.81% by the end of March 2023.