By Naliniprava Tripathy

The coronavirus pandemic is spreading in India at a fast rate, growing 20% over the last week to around 1.7 million confirmed cases. The country is adding 50,000 new cases per day. This means the lockdown restrictions will stay, dampening consumer sentiments and impeding the economic recovery. The fiscal stimuli announced earlier have been ineffective due to expenditure cuts and higher taxes on petroleum fuels. This has, in fact, been one of the reasons for inflation rising to 6.1% in June, compared with the consensus estimate of 5.3% and the RBI’s target range of 2-6%.

Given the economic situation, the RBI’s key objective would be higher growth. Most estimates and forecasts put growth at sub-zero levels. The consensus estimate is -2.8% for the current year (2020-21) and therefore, rate cuts are warranted. Economists expect a slow U-shaped recovery rather than a V-shaped one that was predicted earlier. The demand side, which has shown a weak recovery since early May due to the phased reopening of the economy, appears to have stagnated since Mid-June at depressed levels.

READ I Covid-19: Surviving the economic tsunami of global recession

India agriculture boost is the only silver lining amid the pandemic crisis. Surplus monsoon rains and migration of workers from urban centres to their villages are giving a supply-led boost to agriculture activity. The cumulative rainfall surplus from June 1 to July 25 was 4.8% higher than the average, leading to higher agriculture sowing of 18.5% over the previous year.

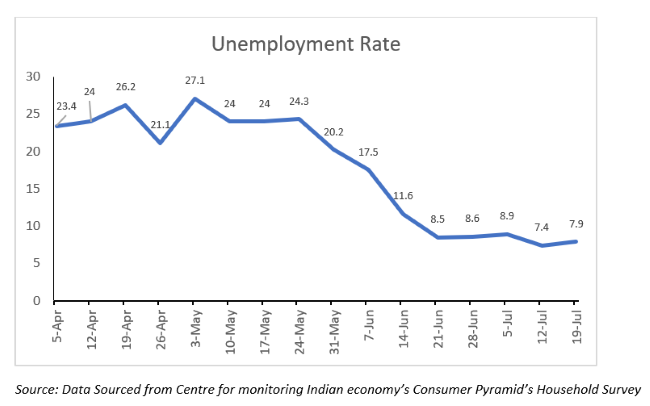

A drop in India’s unemployment rate masks an underlying stress in the labour market. Massive migration of urban workers to rural areas marks a significant shift of labour from industrial and services sector into less productive rural activities. This is already leading to increased underemployment. As demand for seasonal agricultural tasks wanes and the government’s rural expenditure runs into fiscal constraints, additional stress could re-emerge in the labour market.

READ I Why India should avoid milk powder imports

READ I Covid-19 explainer: All you need to know about how coronavirus is transmitted

It is expected that food prices, housing rentals, and retail prices will drop due to the demand slump. The recent pickup in food inflation is likely to be temporary and seasonal in nature. It reflects an increase in wastage of perishable vegetables and fruits during the rainy season that will end in September. Post the monsoon, food prices are expected to drop because of a huge surplus of grains and other crops. The fundamental reasons for the surplus are an increase in sowing, record government food grain stocks, higher levels of seasonal rains and excess labour availability.

The Reserve Bank of India’s monetary policy committee (MPC), chaired by RBI Governor Shaktikanta Das, is meeting from August 4 to August 6. Given the current economic scenario, a rate cut of 25 basis points is warranted with guidance for further cuts in the year. A sharper rate cut was feasible at this point, but for the high inflation in the first quarter of 2020. It is expected that the policy rates would drop further to 3% levels in June, to help the economy achieve higher GDP growth in 2021-22.

(Dr Naliniprava Tripathy is Professor of Finance at IIM Shillong.)

Naliniprava Tripathy is an Indian economist based in Shillong. She teaches finance at IIM Shillong.