The Monetary Policy Committee of Reserve Bank of India will hold a special meeting on Thursday to discuss the central bank’s note to the government explaining the reasons for inflation staying above its 2-6% target band for three consecutive quarters. As per Section 45ZN of the Reserve Bank of India Act 1934, the apex bank has to set out a report to the Union government for not achieving the inflation target, remedial action proposed, and an estimated time frame within which inflation will be brought within the target range.

The Reserve Bank of India Act, 1934 was amended by the Finance Act 2016 to “provide for a statutory and institutionalized framework for a Monetary Policy Committee for maintaining price stability, while keeping in mind the objective of growth”. The MPC is assigned the job of setting up the benchmark policy rate to control inflation. The inflation target was set at 4% with upper tolerance limit of 6% and lower limit of 2%. The flexible inflation targeting regime in India attempts to ensure price stability and is mindful of the growth objective.

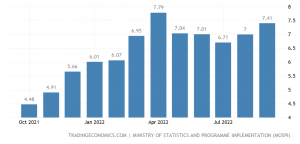

The first meeting of the MPC was held in October 2016. The consumer inflation stayed above the upper limit of 6% for three consecutive quarters between January and September 2022 – for the first time since the MPC mechanism came into existence. Earlier during the Covid-19 outbreak between April and November 2020 inflation was higher than 6% for eight straight months due to supply side bottlenecks caused by the pandemic.

READ I India stares at fiscal strain despite robust tax collections

Global, local factors behind inflation

Inflation has become a global phenomenon with most countries battling stubbornly high prices. Consequently, many countries have negative real interest rates. Inflation has moved up globally, firstly due to Covid-19 induced supply side bottlenecks and secondly due to the Russia-Ukraine war that led to an energy crisis in Europe that saw inflation soaring to 10.7%. The UK is also witnessing an unprecedented spurt in inflation to 11.6%. In the US, consumer price inflation is hovering above 6.2% despite drastic monetary tightening by the Federal Reserve.

India annual consumer inflation rate

Tight demand-supply balance kept the crude prices elevated ever since the Russia-Ukraine war broke out in February this year. The brent crude touched $133.18 per barrel on 08 March 2022. Global food prices rose by 30% in March and April. Although global food prices have decreased since then, it is still about 12% higher compared with the year-ago period. Similarly, base metal prices grew above 30% year on year in February and March 2022.

Higher global inflation had a spillover effect on domestic inflation. The wholesale price inflation rose above 15% between April to June 2022 due to broad increase in prices across primary, fuel and manufacturing components. Sharp rise in manufactured products led to pass-through of input cost pressures to retail inflation.

READ I TRAI: Lack of autonomy, punitive powers reduce telecom regulator to a bystander

Domestically, food inflation — a major component of the consumer price inflation — remained higher all these months. Barring January and February, the food inflation remained above 6% this year till September. Food prices went through various shocks in recent months. Among the food items, cereal prices have remained higher due to a heat wave in the northern part of India that impacted the production of wheat. The government had to put a ban on export of wheat to control prices earlier. The uneven monsoon rains hit paddy sowing forcing the government to ban export of broken rice and to impose a 20% export duty on certain non-basmati rice varieties.

Fluctuation in wheat prices

Vegetable prices have remained above 10% in the seven months till September. Flood in some of the regions, uneven spatial distribution of monsoon rains and lower base of last year had contributed to higher vegetable inflation. Inflation in oil & fats category spiked with edible oil prices increasing due to Russia-Ukraine war that led to supply disruption as India imports substantial amounts of crude sunflower oil from Russia and Ukraine.

Additionally, the temporary palm oil export ban by Indonesia had its impact on edible oil inflation. India consumes about 24 million tonnes of edible oil annually of which 13.5 million tonnes is imported. The government provided concessional custom duty on import of edible oil to control domestic prices. In September, the inflation in oil & fats moderated to 0.37%. Earlier, the government cut excise duty on petrol and diesel to control inflation as crude oil prices remained elevated globally. With the economy opening up post pandemic, the demand for services have increased that could lead to higher prices. The core inflation (excluding food and fuel) remained sticky and hovered around 6%.

To control soaring inflation, the MPC has raised the benchmark repo rate by 190 basis points to take it to 5.90% till September. The MPC started to raise the repo rate in May with an off-cycle meeting wherein it delivered a 40 basis points hike. In April, the RBI introduced the standing deposit facility as the floor of the liquidity adjustment facility corridor. It also shed the accommodative stance in June and continued with its stance of “remain focused on withdrawal of accommodation”.

Depreciation of the rupee has also led to inflationary pressures with elevated crude and commodity prices. RBI has been actively intervening in the forex exchange market to curb volatility of rupee amid aggressive rate hikes by the US Fed.

As the future course of action in its battle against inflation, the MPC is expected to continue with its rate hikes and take the terminal repo rate to around 6.50-6.75% levels. Inflation is expected to be about 6.7% for 2022-23 with some moderation in second half of 2022-23. Further the inflation is expected to come down to about 5.1% in 2023-24 on relatively lower global commodity prices. Moreover, easing momentum and favourable base in food prices along with normal monsoons will help overall domestic inflation to come down.

(Sudarshan Bhattacharjee is Principal Economist at Yubi.)