The monetary policy committee of the Reserve Bank of India slowed the pace of repo rate hikes, signalling that it is gauging the impact of the past rate action. While it is construed as a pause signal, the RBI communication doesn’t give out a clear signal as to whether the latest hike is the last one of the current cycle. The MPC voted 4-2 in favour of the hike, and retained its policy stance — focused on withdrawal of accommodation — as liquidity is still in surplus.

The RBI is expected to continue the mopping up of excess liquidity as banking system liquidity will increase due to higher government spending and expected forex inflows. However, higher liquidity will get offset to some extent due to scheduled LTRO and TLTRO redemptions this month and in April. The system liquidity has fallen from Rs 7-8 trillion in the beginning of the current financial year to nearly Rs 1.6 trillion.

READ I US economy stares at a debt limit standoff in the Congress

Repo rate up 250 bps since May

Cumulatively, the central bank has raised the repo rate by 250 basis points from May 2022 to control inflation that remained above its upper tolerance level of 6% for three consecutive quarters. However, inflation came down below the upper limit due to a sharp decline in vegetable prices.

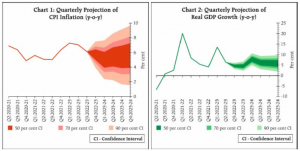

The RBI has cut its inflation projection for FY23 to 6.5% from the earlier projection of 6.7% with the assumption of lower crude oil price at $95/barrel. For FY24 inflation was projected at 5.3%. Real GDP growth for FY24 is expected to come down from FY23 levels due to a global slowdown that will weigh on net exports despite ongoing recovery on domestic front. The RBI has pegged FY24 real GDP growth at 6.4%.

Reserve Bank of India repo rate

The cut in the quantum of rate hikes to 25 basis points from 35 basis points in December provides the central bank an opportunity to evaluate the impact of its earlier rate hikes on inflation. It also offers some elbow room to raise repo rate by another 25 basis points if core inflation remained sticky. Slowing pace of rate hike by US Fed also provides room for lower rate hikes.

Further, RBI is expected to change its stance to neutral from current stance as system liquidity comes close to 0.5-1% of net demand and time liabilities. The central bank is still worried about the sticky core inflation. High input costs may keep core inflation at high levels, but RBI cannot risk the possibility of the Indian economy losing growth momentum.