The Reserve Bank of India has cautioned the state governments that are planning to revert to the old pension scheme, saying it will add to the fiscal burden of states in the coming years. The governments of Chhattisgarh, Rajasthan, and Jharkhand have launched efforts to dump the national pension scheme. The RBI has said that OPS will lead to accumulation of liabilities that can become a major risk in the future. The statutory OPS was replaced with participatory NPS in 2004.

A major problem with the old scheme, popularly known as PAYG, was that the current generation of workers are made to pay for the pension of earlier generations. This meant transfer of resources from the current generation of taxpayers to fund pension payments. If the current generation has fewer workers than the number of pensioners, it will simply put a major burden on the current crop of workers. According to the government pay scales, the minimum pension is Rs 9,000 a month and the maximum is Rs 1,25,000.

READ | Online gaming: Regulation must inspire confidence among stakeholders

Retired employees receive 50% of their last drawn salary as monthly pension under OPS, making it fiscally unsustainable. The state governments do not have the resources to fund it. The old pension scheme has no accumulated funds or stock of savings for pension obligations and hence is a clear fiscal burden. Pension pay-outs as a share of states’ tax revenue makes for an interesting reading. Economist Jose Sebastian says pension payment liability of the state governments consumes over 12% of the states’ revenues. For instance, the total revenues of Himachal Pradesh is Rs 9,100 crore while its pension outgo is Rs 7,266 crore. The burden is more than 22% of the revenues in the case of Kerala and over 6% in the case of Telangana.

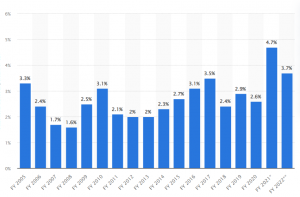

Fiscal deficit of states as % of GDP

Under the NPS, an individual undertakes retirement planning while in employment. With systematic savings and investments, NPS facilitates the accumulation of a pension corpus during their working life. This makes NPS a sustainable solution compared with the old pension scheme. With the NPS, the defined contribution comprised 10% of the basic salary and DA by the employee and a matching contribution by the government, however, the same was increased to 14% later.

The NPS allows subscribers which are government employees to decide where they want to park their money by contributing regularly into a pension account throughout their career. After retirement, they can withdraw part of the pension amount in lump sum and use the rest to buy an annuity for a regular income.

According to the RBI report titled ‘Report on State Finances’, the annual savings from the shift to OPS will be short-lived. By postponing the current expenses, states risk the accumulation of unfunded pension liabilities which is a risky proposition considering that the average age and life expectancy of citizens is rising. The Budget estimates for 2022-23 put a bleak outlook for the states which are set to incur a 16% rise in pension expenditure at Rs 463,436 crore in 2022-23 compared with Rs 399,813 crore in the previous year.

It is not an India only problem though. Pension scheme similar to OPS were in fashion in most countries before 1990s. However, they were discontinued given the problem of pension debt sustainability, an ageing population, an explicit burden on future generations, and the incentive for early retirement (as the pension is fixed at the last drawn salary), according to a report by SBI. The compounded annual growth rate (CAGR) in pension liabilities for the 12 years ended FY22 was 34% for all the state governments, the report added.

What is prompting states to shift to OPS and dump NPS?

After Rajasthan, Chhattisgarh, Jharkhand and Punjab, Himachal Pradesh has also announced its intention to opt for OPS, while Tamil Nadu, Kerala, and Andhra Pradesh are expected to follow suit.

The point of contention with the new scheme is that states find it convenient to pay old pensioners with the money collected from the serving employees. Shifting to OPS is also a major vote magnet for political parties as the restoration of the same entitles current aged pensioners to benefit even though they may not have contributed to the pension kitty, according to the SBI report.

However, what states need to bear in mind is that the reason why they had switched to NPS in the first place. At times as dire as now, the state governments’ plan to bring back the old statutory pension scheme will only be an additional fiscal burden which will leave states with little to invest in productive assets and income support to the poorest citizens. The need of the hour is to make sane judgment in view of the looming global recession that threatens to disrupt the financial management of Indian states.