By Anagha Deodhar

The Monetary Policy Committee of the Reserve Bank of India unanimously voted to keep the repo rate unchanged at 4% and to keep the stance of monetary policy accommodative at the first bimonthly monetary policy for the financial year 2021-22. While the MPC decisions on rate and stance were on expected lines, the policy was far from a routine RBI affair.

Here is an analysis of the important announcements made in the April 2021 policy and their implications.

Monetary policy takes QE route with G-SAP

In what can be termed as the most significant decision of this policy, the RBI announced secondary market G-Sec Acquisition Programme or G-SAP 1.0. Under this programme, the central bank committed to buy specified amount of government securities to ensure the ‘orderly evolution of the yield curve’. During the policy brief, RBI Governor Shaktikanta Das announced that the bank will buy government securities worth Rs 1 tn in Q1FY22. Also, the name G-SAP 1.0 suggests that there will be more versions of the programme in the subsequent quarters. Market estimates suggest that the central bank will purchase securities worth Rs 3 tn during FY22 under the programme, an amount comparable to net OMO purchases during FY21.

This is a significant development especially in the backdrop of the recent tug-of-war between the RBI and the bond market over yields. In the recent past, the RBI adopted what can be called as a soft yield curve control approach by intervening when the benchmark yield crossed a certain level. However, this ad hoc and reactive approach was not enough for the bond market, which wished for a definite OMO calendar to have clarity on the extent of purchases by the central bank. By committing an amount under G-SAP, the RBI delivered on this demand. However, it added that the programme will not replace OMOs and will run alongside its regular liquidity operations such as OMOs and operation twist.

READ I Monetary policy: RBI stays focused on growth with accommodative policy

Although the RBI said its other liquidity operations will continue alongside G-SAP, I believe the need to use them is likely to be much lower now. The G-SAP announcement is likely to keep financial conditions benign. Only in an event of sharp spike in yields beyond the RBI’s comfort level (which seems unlikely) will the central bank need to use other measures.

The bond market reacted positively to this announcement and yields fell sharply after the announcement. After the policy announcement, consensus estimates of 10-yr G-Sec yield over the next month came down by 15-20bps.

Before and during the global financial crisis, only issuers of reserve currencies deployed quantitative easing to keep financial conditions benign and aid recovery. However, since the onset of the Covid-19 pandemic, more and more emerging market central banks experimented with quantitative easing despite the large associated risks. With the announcement of G-SAP, India is the latest addition to the club of EM central banks to have adopted QE.

READ I Covid-19 vaccine diplomacy: India’s chance to deepen its strategic engagements

Monetary policy raises RBI balance sheet by 25%

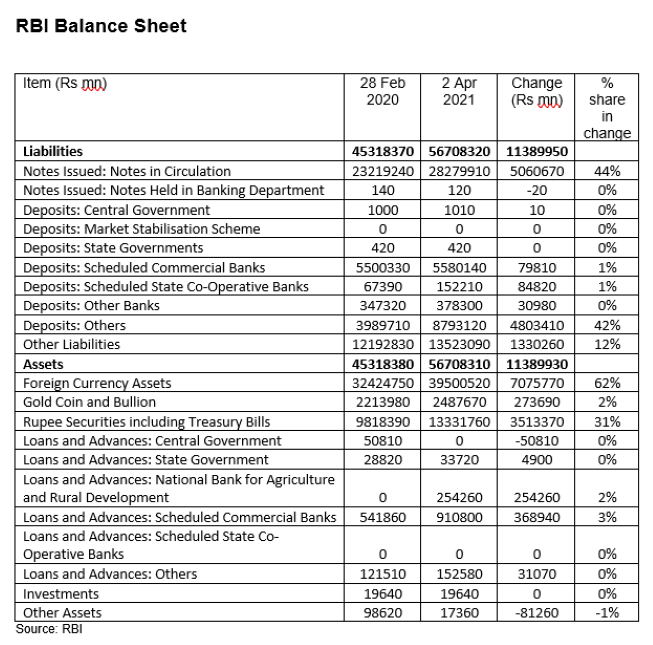

On 2 April 2021, the RBI’s balance sheet stood at Rs 56.7 tn, up 25% from Rs 45.3 tn on 28 February 2020. That is, during the pandemic, the RBI increased its balance sheet by a quarter. If we look at the average monthly increase in the central bank’s balance sheet since 2001, we notice that the balance sheet has increased at its fastest pace during the Covid-19 pandemic, even surpassing the growth recorded during the global financial crisis.

The chart shows that the average monthly increase in RBI’s balance sheet in FY21 was 30.4%, higher than the 29.8% and 28.7% increase recorded in FY09 and FY08 respectively, although two thirds of the increase was due to forex interventions.

If we look at the components of the balance sheet, we notice that from the asset side, 62% of the increase (a little over Rs 7 tn) has come from foreign currency assets. This mostly reflects the foreign currency interventions undertaken by the RBI. Purchases of government securities (which is included in ‘Rupee Securities including Treasury Bills) accounted for 31% of the increase in balance sheet during the said period.

G-SAP to increase RBI balance sheet by 5%

In FY21, the RBI conducted net OMO purchases of Rs 3.13 tn. Assuming it purchases Rs 3trn under G-SAP during FY22, the programme alone is likely to increase RBI’s balance sheet by 5%. Including purchases of government securities under other liquidity operations, the total increase in RBI’s balance sheet due to this component is likely to be even higher.

Shift from calendar-based guidance to state-based guidance

Deviating from the practice in the past policies, the MPC shifted from calendar-based guidance to state-based guidance. The April 2021 policy stated that the MPC will continue with accommodative stance “as long as necessary to sustain growth on a durable basis” against the Feb 2021 statement of maintaining accommodative stance “at least during the current financial year and into the next financial year.” The emergence of the second wave of Covid-19 in some states and the resultant mini lockdowns have made the growth outlook for FY22 more uncertain. Hence, the MPC may have felt that shifting to state-based forward guidance will give it more flexibility to adapt to the evolving situation compared to an explicit calendar-based guidance.

READ I Covid-19 endgame: Vaccines take on coronavirus variants

Inflation forecast upped modestly; growth outlook unchanged

The committee upped inflation forecasts modestly for H1FY22. It now expects CPI to print 5.2% in Q1 and Q2FY22 each (up from 5.0%-5.2% in H1FY22 in Feb policy), 4.4% in Q3FY22 (up from 4.3% in Feb policy) and 5.1% in Q4FY22. Hence, implied inflation in FY22 is seen at 5%. The committee retained its GDP growth forecast for FY22 at 10.5% despite large stimulus in major economies and their likely impact on global growth, partly due to the resurgence of the Covid-19 pandemic in some states.

It now expects the real GDP growth at 26.2% in Q1, 8.3% in Q2, 5.4% in Q3 and 6.2% in Q4FY22. The central bank noted that the vaccination drive, fiscal stimulus, PLI scheme for several sectors, and rising capacity utilisation are likely to support growth while the recent surge in Covid-19 infections and lower consumer confidence are likely to act as headwinds.

Monetary policy extends several liquidity facilities till Sep 2021

In order to provide continued support to the still nascent recovery, the RBI extended several liquidity facilities that were set to expire on 31 March 2021. It extended ‘On Tap TLTRO’, primary sector lending classification for bank lending to NBFCs, and enhanced WMAs limit for state governments till 30 September 2021. It also announced fresh liquidity support of Rs 250 bn to NABARD, Rs 100 bn to NHB and Rs 150 bn to SIDBI.

RBI eyes higher short-term rates

The RBI announced longer-term variable rate reverse repo (VRRR) auctions while stressing that it should not be perceived as liquidity tightening. We expect longer tenors and higher amounts to be announced for VRRR auctions. Also, under the current circumstances of surplus liquidity, reverse repo is the operative policy rate.

Once the RBI moves to normal liquidity conditions, repo rate will become the operative rate. Hence, before moving from accommodative to neutral stance, the RBI will hike reverse repo in a phased manner and narrow the LAF corridor to pre-pandemic range of 25 bps.

(Anagha Deodhar is Chief Economist at ICICI Securities. Views expressed in this article are personal.)