The monetary policy committee of the Reserve Bank of India is expected to announce a hike in the benchmark repo rate today. The MPC raised the policy interest rate aggressively in its last four meetings. The MPC may, however, moderate its rate action to ensure that the economic recovery is not affected. The committee is expected to raise the repo rate by 35 basis points or lower this time, compared with the three jumbo rate hikes of 50 bps each in the last three meetings.

The Indian economy expanded 6.3% in the second quarter of the financial year 2022-23, according to the government data released last week. The growth rate in the first quarter was 13.5%. The economy is growing at a steady pace, considering that the global economy is staring at a recession. In the last financial year, India’s GDP grew at 8.4% in Q2 and 20.1% in Q1. The growth rate for the first half of the current financial year is 9.7%, compared with 13.7% in the same period of the previous year.

Agriculture, with growth rate of 4.6% in Q2 and 4.5% in Q1, continues to play a pivotal role in the India growth story. Other sectors such as construction, real estate, public administration, trade, hotels, and transport have also performed well this year.

READ I Higher remittances to India bring cheer

Indian economy braves global headwinds

The private final consumption expenditure as a share of GDP increased to 59.2% in the first half from 55.4% in the same period of the previous year. Similarly, the fixed capital formation in government sector rose from 33.1% to 34.7% during the period. Exports of goods and services also rose from 22.4% to 23.1%, but growth in imports was significantly higher at 26.4% and 31.5% during the period, implying an increasing pressure on current account deficit.

The high frequency data is quite encouraging in terms of sales of commercial vehicles, purchase of private vehicles, consumption of steel, and cargo handled at sea ports, pointing at a revival in economic growth. There is a significant growth in bank deposits and credit offtake in the banking sector, with growth in credit out-stripping deposits significantly. Industrial performance in the first half of the year, in terms of IIP and the core sector growth, especially of coal, fertilizers, cement and electricity, also show a positive trend. Thus, the economy is performing well and the green shoots are visible across the spectrum.

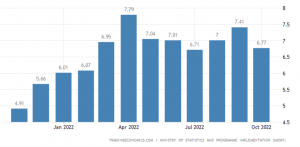

India retail inflation rate

The CPI inflation fell to a three-month low of 6.7% in October, while food inflation eased to 7.01% compared with 8.6% in September. However, the consumer inflation stayed above the RBI’s target band of 2-6% for the tenth month running. The WPI inflation continued to ease, and the declining trend in oil prices would ensure further fall in both consumer and wholesale inflation in coming months.

READ I Green hydrogen opportunity may fizzle out without policy support

The fiscal story also seems to be very encouraging with the GST collection touching Rs 1.45 lakh crore in November 2022. The indirect tax system is expanding to bring the whole economy under tax net and there is potential for GST collections to rise further in coming months. Additionally, direct tax collections for the year up to November 10 is significantly higher than the previous year.

The growth rate in corporate tax and personal income tax collection are 24.5% and 28.1%, respectively. The direct tax collection is 61.3% of the budget estimate for 2022-23. Direct tax collection, net of refunds, is 25.7% higher in the current year, compared with the previous year. The robust fiscal expansion points to the resilience of the domestic economy in the face of global challenges.

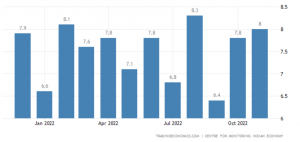

India unemployment rate

On employment, PLFS and CMIE data show that unemployment has decreased significantly. EPFO data reveals that formal sector employment has improved with 16.82 lakh members added in September 2022. In the July- September period, unemployment rate in urban areas declined to 7.2% from 9.8% during the same period last year.

Moderate interest rate hike likely

India is outperforming most other countries in terms of economic growth. A slowdown in growth rate can be observed across the world, but the decline is more severe in advanced economies compared with the emerging market economies. The lower growth projections for advanced economies by the IMF, compared with the earlier projections, is because of a sharp rise in interest rates that is triggering recessionary trends.

The aggressive rate hikes by advanced economies could be detrimental for the growth of global economy, and revival of growth in the post-Covid period for emerging markets. As far as inflation is concerned, the advanced economies are experiencing inflation in the range of 5 times the long-term trend. In contrast, inflation is just about the upper side of the target band in India.

With this scenario, India is emerging as an island of growth and stability in the global economy. Hence, the RBI is unlikely to raise the repo rate aggressively. Maybe, it is time for the RBI to press the pause button to nurture the growth impulses in the economy.

Dr Charan Sigh is a Delhi-based economist. He is the chief executive of EGROW Foundation, a Noida-based think tank, and former Non Executive Chairman of Punjab & Sind Bank. He has served as RBI Chair professor at the Indian Institute of Management, Bangalore.