Fuel pricing and inflation: After a long pause that started in November 2021, retail fuel prices witnessed a series of hikes post the assembly elections in five states in March. The price hikes are justified on the grounds of the elevated global crude oil price amid the Russia-Ukraine conflict. Under a decontrolled fuel price regime, the domestic selling price of fuel closely followed global crude oil prices.

The fuel price regime was decontrolled to leverage the benefits of the lower price of oil in the international market for domestic consumers. For instance, the oil marketing companies (OMCs) in India have been on a price-hiking spree since March 2020 to recover the losses caused by the 82 days of lockdown even as global crude oil prices hovered around $40-43 a barrel. Juxtaposing this with the current situation, international oil prices are moving in the range of $115 to $122 per barrel, raising the selling price of fuels across all major Indian cities.

READ I Timely action on inflation needed to avert hard landing, says Maurice Obstfeld

As the global crude oil price fell, the government raised the excise duty on fuels to bridge the revenue shortfall during the pandemic. The prices are raised to align them with the international crude prices. But who is benefiting from a rise or fall in international crude price in the deregulated pricing mechanism? Does politics override economics in the pricing system? How far does it affect the common people of the country?

Crude price fluctuations in FY22

This analysis is based on the diesel prices in Mumbai which reflect the nationwide trends in fuel pricing. From previous episodes of fuel price fixing, it is evident that prices are sticky downwards whereas not rigid upwards. During the post-pandemic period, the gap between domestic and global prices became significantly high. In a bid to rake up more revenue, the government raised the excise duty (15% between 2020 and 2022), thus raising domestic fuel prices despite a fall in global prices.

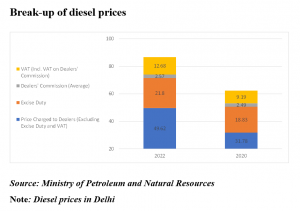

From the breakup given below, the price charged to dealers increased between 2020 and 2022. This increase caused the total contribution of the petroleum sector to the Union government exchequer to shoot up by 36% to Rs 4,55,069 crore in financial year 2021. As can be seen from the filling up of the government’s coffers during a low-price period by means of higher taxes, the free-market pricing of fuels in the country is inexplicably led by political ruses and not economic factors.

The previous episodes of fuel price hikes between 2014 and 2016 reveal that when global crude oil prices were around $60 per barrel, the government raised excise duty nine times, resulting in a 330% increase in diesel prices. During the Karnataka elections in 2018, fuel price hikes were paused only to resume once again after the polls. Ahead of the 2019 Lok Sabha elections, fuel prices remained unchanged for some time.

Recently, there was a pause for 137 days starting from November 2021 ahead of the politically crucial assembly elections in five states including Uttar Pradesh. The long freeze in fuel prices till the announcement of election results underscores the preponderance of political factors over economic ones. Post elections, people had to face five price hikes in six days.

READ I Tracing Sri Lanka economic crisis to mindless liberalisation, fancy projects

Fuel pricing and inflation

The economics of free-market pricing was undermined for short-term political gains with serious ramifications for common people. Given the current situation of elevated global crude oil prices, one could expect another series of hikes. While for consumers, the impact is largely seen in the form of fluctuations in fuel bills, the linkages are much more entwined in the economy.

Domestic inflation is a major channel through which common people feel this impact. The transport and communication components in the retail inflation basket also get impacted due to the high correlation between it and fuel prices, nudging the overall inflation higher.

Increased fuel prices have a cascading impact on the headline numbers through other channels like food. A study by the RBI shows that a $10 a barrel increase in global crude oil prices can lead to a 49 basis points (bps) increase in India’s headline inflation under normal circumstances.

Retail inflation has already breached the RBI’s comfort zone for the second straight month in February at 6.07%. The soaring prices are mostly driven by high food and fuel prices. Given the underlying price pressure, the government will be forced to effect excise duty cuts. However, the impact of high global oil prices emanating from geopolitical tension is hard to contain and will continue to pinch our pockets.

The distortion of the free-market pricing mechanism for short-term political gains should end. The serial hikes in fuel prices soon after polls and allied formalities push inflation expectations. Political interventions should be curbed to insulate the pricing mechanism from bad economics. Although the global crude prices are hardening, cuts in excise duties on fuels will bring down input costs to some extent.

Monetary policy faces the hardest challenge amid hardening prices and a weakening recovery. Cuts in excise duties may contain the price pressure to a certain extent at this juncture, giving the Reserve Bank of India some headroom to support growth in the coming monetary policy committee meeting scheduled for April 6-8.

Dr. Aswathy Rachel Varughese is Assistant Professor at Gulati Institute of Finance and Taxation, Thiruvananthapuram, Kerala.