The third quarter gross domestic product print for the fiscal year 2023 stood at 4.4%, dragged down by a decline in consumption, investment and imports. The downside risks to growth can be ascribed to aggressive monetary tightening by central banks across the world, subdued global demand and geopolitical uncertainties.

Global factors culminating in domestic concerns and inherent structural problems in the domestic economy may add to the woes. With multiple challenges from the demand and supply sides of the economy, stimulating private investments is crucial for medium to long-term economic growth of India.

During the post-liberalisation era, private investment surged to around 37% of the GDP until it suffered a downward shift in the aftermath of the 2008 financial crisis. Currently, private investment is hovering around a meagre 22% of the GDP. The share of private investment in total investment stood at 35% in FY21 as per the latest disaggregated data available.

READ I Solar energy: Reforms needed as policy guidelines clash with installation targets

The trend of falling private investment

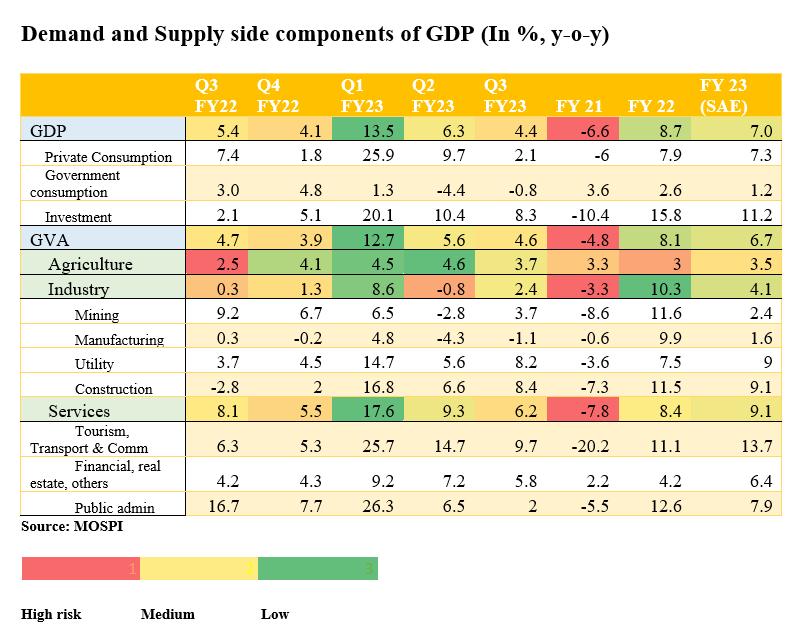

Investment in the economy is measured on the basis of Gross Fixed Capital Formation (GFCF), wherein private investment is one of the component. As per the latest print, GFCF growth moderated at 8.3% y.o.y compared with the robust growth in the previous quarters despite the favourable base effect. In the Second Advance Estimates, it is likely to pick up to 11.2%.

Notably, the investment-GDP ratio fell to 32% vis-à-vis 34% in the previous quarter. Any moderation in GFCF underscores the lag in private investment, given an estimated uptick in government investments. A 37% hike in the capex announced in the FY 2024 Union budget will also give further impetus to government investment. Nevertheless, the question is whether we have a roadmap for private investment which can catalyse economic growth in the country.

Economic Survey 2023 was emphatic on private investment being the key driver of economic growth with potential job creation, impetus to exports, technical progress and uplifting the aggregate demand in the economy. India needs a channelised policy for stimulating private investment in the present scenario, given the quantum of crowding out expected from the increased government capex, government borrowing and elevated level of interest rates. The increased government borrowing reduces the supply of loanable funds, pushing the interest rates further.

The dwindling supply of loanable funds and high interest rates result in tepid investments by the private sector. The government’s gross and net borrowing estimated at Rs.15.4 lakh crore and Rs.11.8 lakh crore respectively for FY 2024. The government borrowing has increased in the recent years to finance the deficit arising from the multiple macroeconomic challenges.

The increased borrowings led to heavy reliance on private saving than private investment, especially the net household financial savings. Bank deposits, insurance policies, mutual funds, equities and provident funds are the mostly sought financial saving instruments by the households. All these financial intermediaries predominantly invest in approved government securities, supporting the market borrowing endeavours of the government. It underscores the role of household financial savings in government borrowing.

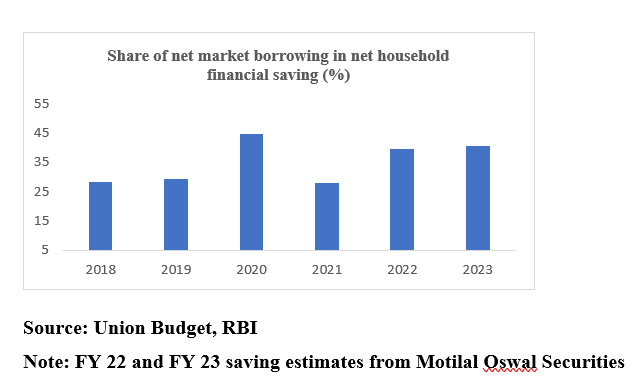

The ratio of net government borrowing to net household financial savings increased manifold, hovering at 40% currently vis-à-vis 28% in FY 2019. Further, the share of net market borrowing of the government and incremental outstanding small savings claimed an average of 48% of net household financial saving during the pre-financial crisis era. In the post-crisis period, it increased to 76%, implying a great deal of reliance on household saving. It’s a clear case of crowding out the private investment with heavy reliance on private savings. The limited space for private investment spells trouble for the medium- and long-term growth prospects of the economy.

Delving deeper into recent GDP estimates, it is clear that deceleration is evident on the demand and supply sides. The private final consumption expenditure growing moderately at 2.1%, highlights the weaning off of the pent-up demand and elevated inflation level reducing the purchasing power of people. The government final consumption expenditure fell into a red zone at (-) 0.8% y.o.y. Subdued global demand and higher interest rates are affecting investment pick-up.

From the supply side moderation in growth is broad-based across sectors. Compared with Q3FY22, agriculture registered a growth of 3.7% y.o.y. However, the El-Nino effect and related climate risks pose challenges to the sustained growth in the sector.

Industrial growth contracted by 2.4%, dragged by negative growth in the manufacturing sector. Services sector grew at 6.2% y.o.y. The demand and supply side indicators are reeling under respective challenges. Here comes the relevance of growth bolstered by private investments. Private investment may fix the rising unemployment problem in the economy through increased job creation, boosting aggregate demand in the economy.

Creating an ecosystem for private investment is the need of the hour to revive the growth trajectory of the country. Policies should focus on improved credit market for private investment which will have a positive spillover for the growth. Lack of policy roadmap for stimulating private investment may not lead us to virtuous cycle of investment driven demand through exports and job creation.

Dr. Aswathy Rachel Varughese is Assistant Professor at Gulati Institute of Finance and Taxation, Thiruvananthapuram, Kerala.