Indians airlines in trouble: It has been an eventful week for the low-cost airline Go First. On Wednesday, the National Company Law Tribunal’s Delhi bench granted the struggling airline bankruptcy protection, offering it a chance of survival. The NCLT named Abhilash Lal of Alvarez & Marsal as the resolution professional to take over the management of Go First and asked the suspended board to cooperate. The last one week saw various lessors approaching the civil aviation regulator, the Directorate General of Civil Aviation, for de-registration of Go First’s 45 aircraft.

READ | Beyond numbers: Understanding India’s school education crisis

Go First or previously called GoAir is the latest airline to fold in India’s unenviable aviation market. The company suspended its operations and filed for bankruptcy before the National Company Law Tribunal last Tuesday. The Wadia Group-subsidiary is the first major airline in India to collapse since the fall of Jet Airways in 2019. The recent development and the airline’s collapse will have a ripple effect on the country’s civil aviation industry which is plagued by multiple issues including pilot shortage, high ATF prices and a highly competitive market.

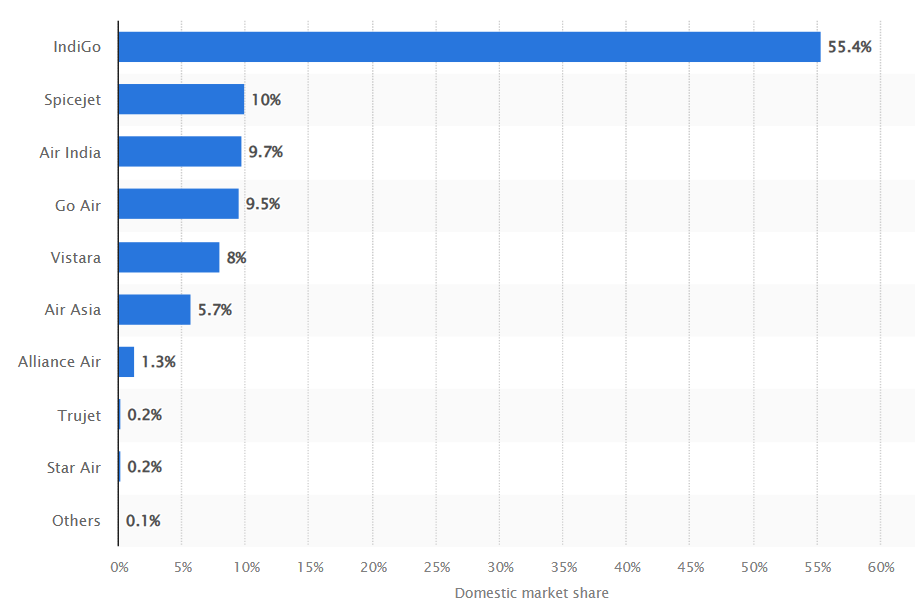

With nearly 200 flights operated daily, GoAir had a market share of nearly 7% as of March 2023 and carried almost 29,000 passengers daily, according to data from DGCA. Go First’s collapse comes at a time when airfares are already skyrocketing due to increased fuel costs and the post-pandemic rebound in demand.

Market share of domestic airlines in India

The airline collapsed due to a restricted cash flow after grounding of 25 of its Airbus A320neo aircraft. The airline has claimed that the grounding was due to an ever-increasing number of failing engines supplied by American aerospace manufacturer Pratt & Whitney. It also alleged that the manufacturer failed to supply Go First at least 10 serviceable spare leased engines by April 27. It was to supply 10 additional engines per month until December 2023.

GoAir is not the only airline facing a similar problem with the Pratt & Whitney engines. While IndiGo, which is the largest airline by market share in India, also faced similar issues, it could brace the impact because of a significantly larger aircraft fleet.

Go First’s troubles run deeper than Pratt & Whitney. The airline had been borrowing heavily to pay lease rentals, airport dues and salaries when business was down due to the pandemic. The airline’s proposal for $440 million initial share sale was blocked last year. Go First is now staring at imminent creditor defaults, with liabilities worth $1.4 billion.

Trouble at India’s airlines

Go First is the third high-profile carrier which is majorly owned by a billionaire and has failed in the last decade. It all started with Vijay Mallya’s Kingfisher Airlines which collapsed in 2012 after it failed to clear dues of banks. Naresh Goyal’s Jet Airways was next which folded in 2019. Smaller regional carriers such as Air Costa also collapsed in 2017.

What is causing a fall of so many Indian carriers is the fact that airfares are dirt-cheap in the country owing to cut-throat competition. High taxes on fuel is another reason why so many carriers go belly up. Then, the coronavirus pandemic was last nail in the coffin. Bogged down by high operating costs, airport charges, and taxes, airlines are running low on profit and hence many struggle to stay afloat.

The aviation industry has long complained about taxes of jet fuel with many states charging even 30% taxes on ATF. Air Turbine Fuel hence amounts to the single-biggest cost for airlines which at times is even higher than 50% of total cost. Bigger airlines are prone to undercutting competition by offering cheaper fares on the selected routes of rivals, like most other businesses do as well and end up paying from their own pockets.

Not helping matters for the Indian airlines is the fact that rupee has fallen much against the dollar in the past several months which translates into higher leasing costs of aircraft from foreign. Airlines also have a fixed operational cost which means that even during a period of slow demand, they have to end up paying for these operations including staff salaries and upfront plane cost and maintenance.

Other than this, the aviation industry is also facing a shortage of pilots, which has led to higher salaries and training costs. This, in turn, has put pressure on airlines’ profitability. While airlines were able to ramp up their fleet after a lull during the pandemic, it wasn’t able to do the same as far as pilots were concerned. The gravity of the situation can be gauged from the fact that the Union Minister of Civil Aviation, Jyotiraditya Scindia, recently announced that the government would ease up on Foreign Aircrew Temporary Authorisation (FATA) appointments.

The government has also been in the airline business with it operating Air India and Indian Airlines. Industry insiders believe that the government’s tendency to favour its own airlines via policies more than those of the private sector has also been a major deterrent to their growth and profit. While Air India has returned to the Tata Group, the previously rendered damage continues to skew airline business. According to credit rating agency ICRA, despite the high airfares, the airline industry is estimated to post a net loss to the tune of Rs 110-130 billion in the April 2022-March 2023 period.

Meanwhile, other players in the industry are looking to build their empire on GoAir’s miseries with SpiceJet already planning to bring 25 of its grounded aircraft back into service to cash in on the void left by Go First. Air India took the opportunity to rope in more than 200 pilots of the bleeding low-cost airline.