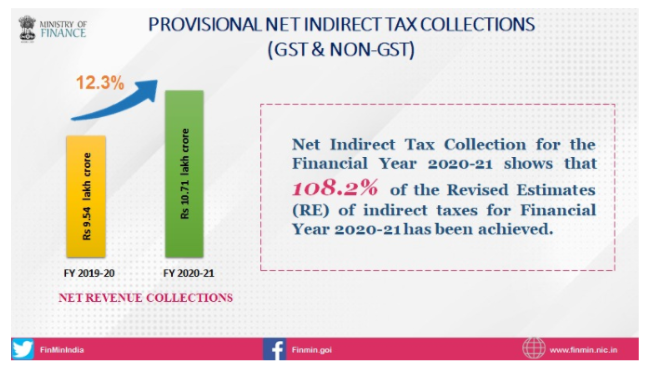

Net indirect tax collections grew 12% in 2020-21, a year marked by the most severe health crisis in more than 100 years and the resultant economic crisis. An increase in central excise and service tax collections pushed the mop-up to Rs 10.7 trillion, according to the provisional data released by the finance ministry.

Despite the economic crisis, all major tax heads have yielded higher receipts compared with the revised estimate of Rs 9.89 trillion estimated in the Union Budget 2021. The government’s net direct tax collections stood at Rs 9.45 lakh crore in 2020-21, 4.4% higher than the revised estimates. The tax collections figures point to a lower than estimated fiscal deficit for the year that could bring cheer to the pandemic-stricken economy that shrank 3.8% during the period.

READ I Two to tango: A case for strengthening Indo-US trade, investment ties

Indirect tax collections buoyed by levies on fuel

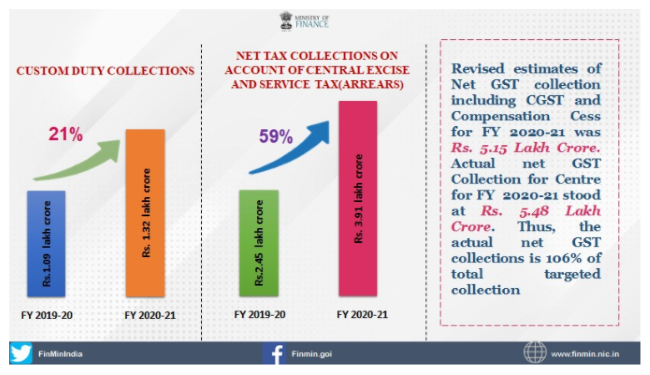

The buoyancy in indirect tax collections in the financial year can be attributed to higher excise collections from petrol and diesel. The government had come under severe criticism for charging high prices for petroleum fuels despite low crude prices throughout the global economic crisis triggered by the Covid-19 pandemic. However, GST collections also picked up in the past few months, pointing to a faster than expected recovery from the economic crisis.

The government collected Rs 1.32 trillion in FY21 from customs, Rs 3.91 trillion from central excise and service tax, despite lower GST collections. Net GST collections (CGST+IGST+ compensation cess) was Rs 5.48 trillion, compared with Rs 5.99 trillion in the last financial year, but higher than the revised estimate of Rs 5.15 trillion.

READ I Covid-19 vaccine diplomacy: India’s chance to deepen its strategic engagements

GST collections hit by pandemic

The GST mop-up was affected by the lockdown measures taken in the first six months of the financial year to curb the spread of the Covid-19 pandemic. The second half of the financial year saw collections picking up. March 2021 saw an all-time high GST collection of Rs 1.24 trillion, helped by several steps taken by the government to improve compliance.

The government also had its share of bad news on Tuesday. The Index of Industrial Production (IIP) contracted 3.6% in February, while retail inflation numbers showed a 5.52% rise in March.

The quick estimates of IIP (base 2011-12) stood at 129.4. This index had contracted 1.6% in the previous month. The manufacturing output shrank 3.7%, while the mining output contracted by 5.5%. Power generation grew by 0.1% in the month, bringing some cheer amid decline in other sectors.

Retail inflation measured by the Consumer Price Index rose in March on the back of higher inflation in food and beverages (5.24%) as well as fuel and energy (4.50%). The Consumer Food Price Index (CFPI) rose to 4.94% in March compared with 3.87% rise in February.