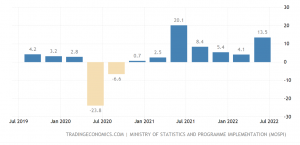

Indian economy roundup: The government published the GDP numbers for the April-June quarter earlier this week which revealed a lower than expected 13.5% growth during the period. Private forecasters had pegged the growth around 14.5% and the Reserve Bank of India at 16.2%. Global headwinds from the Russia-Ukraine war had a major impact on the Indian economy.

The Indian economy is currently giving mixed signals — the annual inflation rate is high, but GST mop-up is rising; consumption has increased, but consumer confidence remains low; and RBI’s more than optimistic estimates have led to a series of projection cuts. Thinking of the silver linings, this was the only quarter in the last three financial years that was not affected by the coronavirus pandemic. The lukewarm GDP numbers are the result of an interplay between various geopolitical factors.

READ I GDP growth: Indian economy faces global headwinds

GST mop-up rises

Gross Goods and Services Tax collection rose to Rs 1,43,612 crore in August which is a 28% jump over the same month last year, showed data released by the finance ministry on Thursday. While the GST numbers are heartening for the exchequer, analysts largely attribute the spike to high inflation. Revival in consumption, high inflation rates, impact of GST rate hike by the 47th GST council meeting, and a broader economic recovery boosted indirect tax collections. Revenues from import of goods were 57% higher, while that from domestic transactions were 19% higher.

In its last meeting, the GST Council had recommended a 5% levy on pre-packaged and labelled items such as curd, lassi, puffed rice, and wheat flour which are among the staples in an Indian kitchen. The rise in GST collection indicates lighter pockets of households.

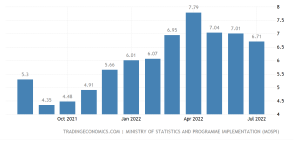

There is a spike in commodity prices, especially crude oil, which translates into higher input costs for producers and ultimately reflected in consumer prices. Inflation is above RBI’s tolerance level of 6%. The government has mandated the apex bank to maintain retail inflation at 4% with a margin of 2% on either side for a five-year period ending March 2026.

To curb inflation, the monetary policy committee had delivered a surprise rate hike in May which was followed by two more hikes in June and August totalling 140 basis points. However, the impact of these hikes remains to be seen on the economic activity.

Manufacturing gives hopes

India’s manufacturing activity remained robust in the previous month and production and fresh orders were found strongest since November last year, according to the S&P Global India Manufacturing Purchasing Managers’ Index (PMI). The manufacturing activity in the country continued to expand for the 14th straight month. Output growth also touched a nine-month high on account of demand boost, fewer Covid-19 restrictions, product diversification and a pick-up in exports.

The economic activity has been near normal as the vaccination drive led to lesser lockdowns. Even people have started to accept this as the new normal and the earlier disruptions caused by the pandemic are no longer troubling people as indicated by Google Mobility indicators. What this essentially means is contact-intensive sectors such as trade, hotels and transportation have staged a comeback and grew at 25.7%, albeit over a low base.

Domestic private consumption and capital investment registered a strong recovery in the April-June quarter. Household and private sector consumption came in at Rs 39.7 trillion compared with Rs 28.4 trillion in the comparable period last year.

Monsoon woes

While value added by the agricultural sector grew by a healthy 4.5% in the first quarter of the fiscal year 2022-2023, experts are sceptical of sustained growth due to unevenness in monsoon. Most parts in the country are likely to get normal to above normal rainfall in September except for East and Northeast India. This may spell bad news for UP, Bihar, Jharkhand and West Bengal.

READ I Crimes against women: What causes the rise in gender-based violence

Monsoon rains are crucial to the agricultural sector which is yet to be independent of unpredictable rain spells. The output is likely to be affected and that may even translate into lower rural demand. Why does this matter? Because even before the pandemic blues, the FMCG sector was witnessing a historic slowdown due to a fall in rural demand.

Geopolitical concerns and forecast cuts

The near future does not augur well too because of various geopolitical situations. Central banks across the world are focussed on handling inflation by tightening monetary policy which will have a direct bearing on global demand. Economic prospects are likely to be hurt with impacted exports, expanding current account deficit and a rupee decline.

Meanwhile, a day after the NSO released the Q1 GDP data, a number of financial institutions and banks downgraded their economic growth projections for India for the ongoing fiscal. These institutions include Goldman Sachs, SBI, Citigroup and Moody’s. The revised projections are: Citigroup from 8% to now 6%, SBI from 7.5% to 6.8%, Goldman Sachs from 7.2% to 7%, and Moody’s from 8.8% to 7.7%. Moody’s cut its forecast stating that dampening economic momentum in the coming quarters due to rising interest rates, uneven monsoon and slowing global growth hurt prospects.

Anil Nair is Founder and Editor, Policy Circle.