Indian economy’s winter? 2022 hasn’t been a great year for the world economy. While this year was supposed to bring about a pleasant change after the destruction caused by the coronavirus pandemic across the globe, the same couldn’t materialise because of Russian invasion of Ukraine. Sadly, India is no outlier and has also borne the cost of the war as it continues to witness the headwinds of inflation, falling rupee against dollar and increasing imports.

The triple whammy, along with the already present effects of coronavirus such as supply shortages and surging raw material prices have dashed the hopes of an early economic recovery. Earlier this week, former Niti Aayog Vice-Chairman Arvind Panagariya expressed his optimism on the prospects of the Indian economy. He predicted that Asia’s third largest economy will grow at around 7-8% in the next couple of decades. His optimism comes from India’s growth record in the last 17 years. It recorded 8.7% growth in 2021-22 after contracting 6.6% in the previous fiscal. Is Panagaria’s optimism misplaced?

India economic growth

Also Read: Can rupee on steroids challenge dollar-euro duopoly

It is obvious that the Indian economy cannot shrug off a global recession. But then, there is optimism that the Russia-Ukraine conflict will de-escalate soon and the concerted efforts by monetary authorities across the world will help the world economy ward off a deep recession.

Global economic crisis is just a part of India’s economic worries. The country was already under the grip of an economic slowdown even before the Covid-19 pandemic brought all economic activity to a standstill. The lockdown measures further aggravated the crisis, pushing the economy into a precarious position. Here are some signs of economic trouble that India cannot wish away.

Is FMCG slowdown back?

The signs of an ailing economy were present even before the pandemic hit. There were talks of an FMCG slowdown which became the buzzword in 2019 in the financial newspapers, right before coronavirus struck the country, pushing all other problems under the carpet. Fast forward to 2022, fast-moving consumer goods companies are again talking of pain points in selling day-to-day items even though inflation is the culprit this time around. Sales declined by 3.7% in value terms in the first week of July compared with 6.4% growth in the comparable period in June.

Experts blamed it on rising prices of products as companies went with a price hike. So, while items such as food staples saw an uptick in consumption, people have started to care less about personal care which saw a 15.5% slump. Prices of commodities such as soaps, detergents, toothpastes and shampoos were on the rise.

Why do FMCG sales matter so much in understanding the health of an economy? Simply because FMCG products constitute the basic needs of any household and a fall in sales of these items directly means an economic slowdown as consumers think twice before spending on useful day-to-day items. This also indicates a fall in the quality of life.

Chinese imports boom

The widening trade deficit with China should be another cause of concern for the government and policymakers alike. The value of goods imported from China touched an all-time high of $85.14 billion during the April 2021- February 2022 period. This number goes even higher if one takes into consideration the imports from Hong Kong. In the first 11 months of FY2022, combined imports from China and Hong Kong stood at $102.38 billion. This is especially worrying considering that India has been making a great hue and cry about banning Chinese products and Prime Minister Narendra Modi’s pitch for Atmanirbhar Bharat and PLI scheme. China remains the main source of raw materials for the country.

ALSO READ: Uncertain future: Are cryptocurrencies headed towards a great winter?

Trade deficit and Indian economy

And it is not just imports from China. India also witnessed an increase in imports from Russia which rose 272% in the first two months of this financial year from a year before to $5.03 billion. This was owing to a step up in purchases of oil, fertilisers and coal to cater to growing domestic shortfalls in commodities.

There has been a steep jump in imports owing to elevated global commodity prices which drove the trade deficit to a new monthly record of $26.2 billion, according to the latest data by the commerce ministry last week. In June quarter, trade deficit touched record $70.8 billion, way above $31.4 billion in the same quarter last fiscal. Given the fears of a looming recession in top global markets- EU and the US, external demand for Indian goods is likely to remain even in the coming months.

Inflation and rupee pains

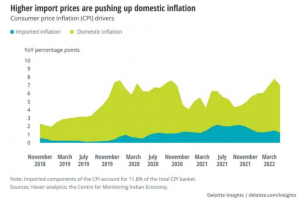

Inflation has been a persistent problem ever since the pandemic hit Indian shores and the current situation is also not ideal because of the geopolitical situations.

Adding to the woes is the fact that the rupee has been hitting new lows since the last few weeks and has fallen below 80 against the dollar. The rupee is falling because of the rising price of global oil and India imports 85.5% of all its oil needs. The fall of the rupee translates into higher inflation meaning costlier everything. Since the Ukraine invasion, the rupee has fallen 4%. India has been witnessing an outflow of foreign investments. Foreign portfolio investors (FPIs) have pulled out $5.26 billion just in June, taking the total amount of outflows to $33 billion since October 2021. This means the demand for rupee is weakening.

RBI’s facile optimism

The RBI, however, is optimistic on the Indian economy. In a global landscape marred by fears of recession and war, the country’s economy has shown resilience, the central bank says. RBI pins its hopes on India’s forex reserves, foodgrain stocks and the financial system. RBI believes these three factors will brighten the outlook and strengthen the conditions for a sustainable high growth trajectory in the medium-term.

The RBI is not alone in believing in the Indian economy. According to analysts at Deloitte, services, export opportunities, domestic demand potential and the country’s ability to emerge as an attractive investment destination will help the country post strong economic growth this year.

Prachi Gupta is an Assistant Editor with Policy Circle. She is a post graduate in English Literature from Lady Shri Ram College For Women, Delhi University. Prachi started her career as a correspondent with financialexpress.com. She specialises in policy impact studies.