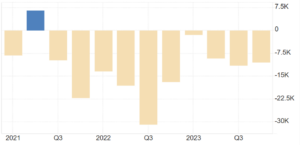

India’s current account deficit fell marginally due to a record high services trade surplus and secondary income, shows the latest Reserve Bank of India data. CAD, a critical indicator of an economy’s health, shrank to $10.5 billion or 1.2% of GDP in the third quarter of FY2024, an improvement from both the previous year and quarter.

In simpler terms, CAD represents the difference between the value of a country’s exports and imports of goods and services, along with net income from overseas investments. A manageable CAD, typically around 2-3% of GDP, is generally considered a healthy sign. A large and widening CAD indicates potential problems like external pressure on the currency and difficulty financing the deficit.

READ | India must fortify its steel industry against global headwinds

India has faced a widening merchandise trade deficit in the ongoing financial year, with the deficit rising slightly to $71.6 billion in Q3 FY2024 from $71.3 billion in Q3 FY2023. However, the services exports sector, particularly in software, business, and travel services, saw a 5.2% year-on-year growth, providing relief. Net services receipts also increased sequentially and year-on-year, with private transfer receipts, primarily from overseas Indian remittances, reaching $31.4 billion, up 2.1% from the previous year, mitigating the CAD.

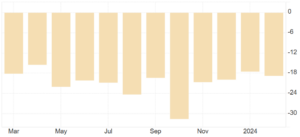

India trade deficit ($ billion)

The trade deficit reached a record high in October last year, with merchandise exports growing by 6.29% and imports by 14%, leading to a significant trade gap. Such a large trade deficit is worrying and should be managed carefully to avoid disproportionate growth relative to the economy’s size.

India has faced a widening merchandise trade deficit in the current financial year, with the deficit slightly increasing to $71.6 billion in Q3 FY2024 from $71.3 billion in Q3 FY2023. Several factors contribute to this rising import bill. Firstly, global commodity prices of essential imports like crude oil and coal have surged significantly in recent times. Secondly, domestic demand for consumer goods, especially electronics, is on the rise. Finally, India relies heavily on imports for critical components needed in various manufacturing sectors.

India current account deficit ($ billion)

The ballooning trade deficit, particularly due to rising imports, has put considerable pressure on the CAD. Notably, gold imports have doubled over the past year, significantly impacting the current account. The trend of increasing imports, from October 2021 to 2023, emphasises the urgent need for economic strategies to mitigate this imbalance and stabilise the CAD.

The export sector has been a persistent issue, while imports have steadily increased, exacerbating the CAD. The domestic currency weakens when imports surpass exports, affecting India’s trade balance, particularly as it relies heavily on imports for essential commodities like crude oil, coal, and electronic components.

On a positive note, foreign direct investment (FDI) showed a net inflow of $4.2 billion, compared with$2 billion in Q3 FY2023. This increase in FDI inflows is crucial. FDI acts as an external source of financing for the current account deficit. When foreign investors invest in Indian companies, they bring in foreign currency, which helps bridge the gap between export earnings and import payments. This, in turn, contributes to a surplus in the balance of payments, which is a broader measure of a country’s external transactions.

On the export front, India has faced challenges for several quarters, struggling to keep pace with the global demand dynamics. While imports have surged, notably in sectors like crude oil, coal, and electronics, exports have not seen a proportionate increase, leading to a persistent trade imbalance. This scenario highlights the importance of not only controlling imports but also enhancing the export capabilities to improve the overall trade deficit.

The government’s attempt to reduce imports through new licensing norms for electronics initially failed, leading to its reversal after international criticism. While efforts to reduce the import bill continue, increasing exports is essential for sustainable CAD management, job creation, and economic growth.

Experts suggest India needs to capitalise on global trade opportunities and diversify its export sectors, such as pharmaceuticals, engineering goods, and textiles, to balance its export portfolio. Additionally, there is a significant gap in domestic high-tech manufacturing, particularly in electronics, where the trade deficit has doubled in the last decade.

The Economic Observatory has pointed out a significant gap in domestic manufacturing capabilities, particularly in high-tech sectors such as computers and microchips. With the electronics industry’s trade deficit doubling over the last decade, reaching over $50 billion in 2022-23, it is imperative for the government to bolster domestic manufacturing and reduce dependency on imports in these critical sectors.

India’s focus on free trade agreements should aim to enhance exports while protecting local industries to ensure the domestic economy’s growth.