The government has been pushing for a major capital expenditure thrust to accelerate growth against global headwinds. The Union Budget 2023-24 has made a major effort towards this end. While the Union government has set the ball rolling for higher capital expenditure, it needs to get on board the state governments and the private sector if it were to achieve the desired spike in the GDP growth rate. There is a great slippage in the states’ ability to boost capital expenditure, while the private sector has witnessed a fall in both capital formation and investment.

The budget for the upcoming financial year saw an increase in capital expenditure by 33% to Rs 10 lakh crore which is one of the biggest hikes in a decade. This comes on the heels of a record investment of Rs 7.28 lakh crore in the current fiscal. Going by the capex multiplier estimated for the country, the economic output of the country is set to increase by at least four times the amount of the capex, according to the Economic Survey 2022-23.

READ | Sticky inflation may force RBI into another repo rate hike

States are vital stakeholders in reviving private investment in the economy. To ensure that various state governments do not cut back on their capital expenditure, the Union government has linked a third of the un-tied part of the capex loan to them in FY24 to achieve their individual capex targets in the year. Spending by the states is earmarked at 13% or Rs 1.3 lakh crore of the Centre’s FY24 budgetary capex outlay in the form of long-term, interest-free loans. Of the Rs 1.3 lakh crore loan, Rs 1 lakh crore is un-tied, while the balance is linked to reforms and other criteria specified by the Union government.

When seen as a block, the states have improved their fiscal balance over the last couple of years, but individual performance show a diverse picture. With the government shoring up capex for ministries of railways and roads, some states will also need to do their part to help the infrastructure plans. Given that states usually back-load their capex as they give priority to committed revenue spending including salary, pension and interest costs, the Union government is expected to put conditions on the states to accelerate their own capex pace in FY24.

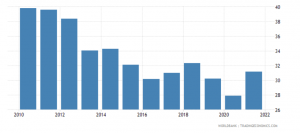

India – Gross Capital Formation (% Of GDP)

State of private capital expenditure

Capital expenditure by India’s private sector has been in the vicinity of Rs 6 lakh crore in 2022. The Indian corporates still seems wary of the global macroeconomic conditions. The global headwinds are causing a major risk to private capital investment and with the exception of certain pockets, there is very little indication of a pickup in the same. Private capital expenditure has not yet picked up as the prolonged war in Ukraine has brought uncertainty into the global economy. Further, there is no indication of any pause in interest rate hikes in the US or at home. Sluggish demand in some key sectors has also made most corporations circumspect.

Leaving a few sectors such as chemicals, railways and defence, especially those which are associated with or supplying to government undertakings, there is a lull. Makers of consumer discretionary products are suffering from subdued demand from both rural and urban customers, leaving them bearish.

Capex gain, loss of social welfare

While capex growth is mandatory to push growth of the country, it seems to be happening at the cost of social welfare schemes. This is the third consecutive year that capital investment outlay has increased, but social welfare programmes that provide safety nets to citizens and ensure basic rights, such as livelihood, health, nutrition and education, have suffered.

This is the first time since 2009-10 that social sector expenditure as a share of total expenditure has slipped below 20%. For 2023-24, at Rs 8.28 lakh crore ($100.77 billion), it is 18% of total government spending.

While the infrastructure push is laudable, India also needs to provide its citizens with social infrastructure considering the present vulnerabilities. Thus, attention is needed on various fronts such as reopening of schools that had closed down during pandemic. There is an increasing dependence on government facilities and provision for enrolment in schools, which would also require a higher budget.

Even for health, additional budgets are needed, especially given that India lacks quality health infrastructure and human resources. Further, attention is also needed on child nutrition which is dismal. As many as 36% of India’s children were stunted or short for their age, 19% had low weight for height and 32% had low weight for age, as per data from the National Family Health Survey between 2019 and 2021.