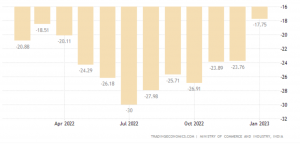

The merchandise trade deficit fell to a 12-month low of $17.7 billion in January with both imports and exports showing a decline. There was a sharp decline in the deficit figure from $23.76 billion recorded in December. The country’s merchandise exports in January was $32.91 billion, compared with $34.48 billion in December. Imports also fell to $50.66 billion from $58.24 billion. For the April-January period though, the trade deficit has widened to $232.95 billion from $153.78 billion a year ago.

Merchandise exports dropped 6.5% year-on-year to $32.91 billion in January following a slowdown in demand in India’s key trading partners, especially developed economies. This was due to monetary policy tightening and high inflation in developed markets. On a sequential basis, the decline was 4.5%. The engineering exports sector has also been witnessing a downward trend for almost seven months in the current financial year. This is primarily due to weak demand from key markets including China. Engineering goods exports declined by 9.8% year-on-year to $8.40 billion in January.

READ | Income-share agreements offer smarter alternative to education loans

India imports commodities which are crucial in day-to-day life from other countries. This includes petroleum products, electronic goods and chemicals. The import of these products has been higher than in the year-ago period. Within imports, petroleum and crude products saw the sharpest increase with a more than 53% jump, followed by coal and electronic goods.

India balance of trade ($ billion)

Global slowdown fuels trade deficit

The demand for India’s exports such as cotton, engineering goods, iron ore, and gems and jewellery slowed down due to the downturn in the global economy. India’s merchandise exports witnessed an annual contraction in 19 out of 30 sectors in January. While exports of gems and jewellery were down by 19.28%, drugs and pharmaceuticals fell by 2.62%, chemicals by 4.57%, engineering goods slipped by 9.8% and readymade garments by 3.48%. Non-petroleum and non-gems and jewellery exports, which are also known as core exports, fell 8.12% in January to $25.35 billion. Core imports contracted nearly 4% to $33.56 billion.

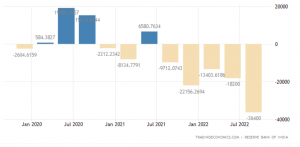

India current account deficit ($million)

Gold imports, which significantly contribute to the widening of the current account deficit (CAD), have also declined 70.7% to $697 million due to weak demand. Amid rising risks to external demand, the government is concerned about the CAD, and is expected to put a curb on non-essential imports such as gold. Analysts believe that the coming months are going to be tough for the economy unless both the global economic growth and geopolitical situation improves drastically. Having said that, India is still likely to be on course to cross the previous year’s export target quite easily, touching almost $440-445 billion with a growth of over 4-5% this fiscal year.

India is still the fastest growing major economy in the world, but a rising trade deficit may cause a key downside risk to the economy. To mitigate the risk, the government is currently in talks with the Reserve Bank of India, commercial banks and other stakeholders to make rupee trade more attractive. This will help with rupee trade with many countries including Sri Lanka, Bangladesh and South Africa which in turn will reduce pressure of dollar outgo.

Meanwhile, the global economic growth is projected to slide from an estimated 3.4% in 2022 to 2.9% in 2023. India’s economic growth is also estimated to slow from 6.8% in 2022 to 6.1% in 2023, according to the latest report by the IMF. A global recession is threatening to impact demand, posing a risk for exporters.

This means India is likely to witness a dual effect on trade. On the one hand, the exports are falling as there is a decline in global growth and sluggish export demand, while on the other increasing imports as domestic demand remains resilient due to relatively high growth, the ministry of commerce and industry said in a statement.

The surplus in trade in services rose to $16.5 billion with $32.2 billion worth exports and $15.8 billion imports. Exports in software, consulting, and management recorded steady growth but are expected to slow in the coming months. Software exports account for 47% of total receipts.

While the moderating deficit may bring a sense of relief among policy makers, this trend could be transitory in nature. The persisting weakness in trade also reflects the slowing economic growth momentum in the domestic economy. India needs to adopt a calibrated approach to trade to support export-led growth and employment generation.