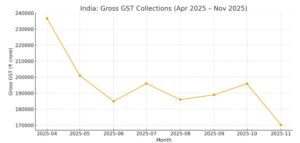

GST revenues in November: India’s goods and services tax revenues slowed sharply in November, creating new doubts about the strength of the GST 2.0 framework. Net receipts grew just 1.3% year-on-year to ₹1.52 trillion. When the compensation cess is included, collections contract by 4.25%, according to ministry of finance data. This moderation is uncomfortable at a time when the government needs predictable revenue to stay on its fiscal path.

The first full month of GST 2.0 was expected to show some transition effects. Countries such as Australia experienced similar disruptions after VAT reform. Firms adjust inventories, rework invoicing systems and reconcile input credits. These shifts often distort reported GST for a few months. November’s number cannot be treated as structural evidence of weakening demand.

READ | India-Russia oil ties in a shifting global order

Domestic GST collections contract

The broader picture is less reassuring. Gross revenues declined 9.5% month-on-month, and net revenues fell over 6%. Domestic GST contracted 2.3% even as imports rose 10% and buoyed headline collections. A tax system leaning on import flows rather than domestic value addition cannot be seen as a sign of healthy momentum.

A useful metric here is GST buoyancy. It measures growth in GST relative to growth in nominal GDP. Early estimates suggest buoyancy has slipped below 1 in recent months. This means GST is growing more slowly than the economy. Lower buoyancy typically reflects weaker compliance, soft pricing trends or a shift in the consumption basket towards lower-taxed items.

GST revenue buoyancy falls as inflation softens

Inflation trends have also played a role. GST is levied on value, not volume. Prices of several goods categories have softened in recent months. The Wholesale Price Index shows disinflation in manufactured products. Lower prices reduce GST per unit even when sales volumes rise. This limits the revenue benefit from higher consumption during the festive season.

Centre–state fiscal flows add another layer of complexity. States rely heavily on SGST and IGST settlements. Monthly GST data can be distorted by the timing of these settlements, which depend on invoice matching and reconciliation cycles. A delayed settlement can depress net collections for one month and inflate them the next. This makes trend interpretation harder and adds uncertainty to state fiscal planning.

Mixed economic indicators complicate outlook

High-frequency indicators continue to offer mixed signals. Passenger vehicle wholesales rose 21% year-on-year in October. Rail freight increased 4.2%. The taxable value of GST supplies grew 15% over September–October. But UPI transactions dipped in both volume and value. Demand under MGNREGS fell for five consecutive months. Industrial output hit a 14-month low. The manufacturing PMI slipped to a nine-month low, according to S&P Global. The data shows festive strength but weaker underlying momentum in rural and industrial demand.

Lower GST rates on several categories have lifted sales. But the revenue gain per unit is smaller. The benefits of higher compliance and formalisation take time to appear. The government must absorb the near-term revenue impact while waiting for the medium-term benefits of reform.

Whether GST stabilises will depend on the post-festive demand cycle, the balance between imports and domestic production and the pace of compliance normalisation. If transitional frictions are indeed the main cause, collections should improve from December onwards. If not, FY26 may see a meaningful shortfall.

The fiscal consequence is significant. GST is central to the government’s ability to sustain high capital expenditure. A prolonged soft patch could tighten fiscal space for both the Centre and states. The priority is to strengthen compliance systems, improve data matching within the GSTN architecture and ensure timely IGST settlement. Durable buoyancy will depend on a broader tax base, steadier domestic demand and credible enforcement rather than higher rates.