Gold prices have surged by nearly 80% over the past year, confounding investors who expected easing inflation and stabilising growth to sap demand for safe assets. The immediate catalyst this week has been the US intervention in Venezuela and the forcible removal of President Nicolás Maduro. But the persistence of the rally tells a deeper story. Markets are pricing not a single geopolitical episode, but a broader erosion of confidence in policy discipline, institutional restraint, and the long-term credibility of the dollar.

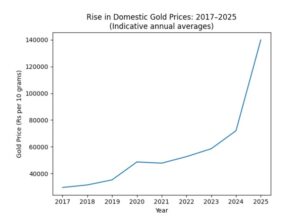

With gold crossing $4,400 an ounce and silver pushing towards $76, asset prices today are being driven less by optimism about growth and more by anxiety about governance. For investors in emerging markets such as India, bullion prices and currency movements are increasingly shaped by how global power, fiscal credibility, and monetary independence interact.

READ | Sovereign gold bonds are becoming a budget nightmare

Why gold is surging again

The Venezuela episode has sharpened geopolitical risk. US President Donald Trump’s statements on America’s intentions to control the oil-rich Latin American state have reinforced fears that flashpoints can escalate abruptly, without multilateral restraint. Gold benefits not because war is inevitable, but because it cannot be ruled out.

Yet this is not a one-off reaction. Gold has delivered its strongest annual performance since 1979, revealing that the rally is anchored in structural forces rather than headlines. Three drivers stand out, all of which appear durable.

Central banks are voting with reserves

The most powerful force is sustained central-bank buying. Monetary authorities in China, Turkey, Russia and several emerging economies have been steadily increasing gold holdings to reduce exposure to the dollar and mitigate sanctions and currency risks. According to World Gold Council data, official sector purchases have remained near record levels for a third consecutive year, cushioning prices even during periods of softer retail or ETF demand.

China’s role deserves particular attention. Gold accumulation is part of a broader strategy to insulate reserves from geopolitical leverage and to support a gradual rebalancing of the global monetary system. By expanding gold holdings alongside efforts to internationalise the yuan and deepen non-dollar settlement mechanisms, Beijing is signalling that reserve safety now ranks alongside liquidity and yield. This structural demand is less sensitive to price corrections and lends durability to the rally.

READ | What will drive gold prices in 2026 and beyond

Monetary easing and institutional unease in the US

The second driver is US monetary policy. The Federal Reserve has already delivered multiple rate cuts, and markets are pricing further easing as growth moderates and financial conditions tighten. Lower real yields mechanically raise the appeal of gold, which offers no interest income.

More troubling for investors is the perception of political pressure on central banks. Repeated signals that President Trump may seek to reshape the leadership of the Federal Reserve have revived concerns over the institution’s independence. In this environment, gold is no longer behaving primarily as an inflation hedge. It is increasingly a hedge against institutional slippage, where policy credibility itself becomes uncertain.

Fiscal dominance fears are back

The third force is fiscal. America’s debt trajectory has become harder to dismiss, even by the standards of a deficit-tolerant world. Former US Treasury Secretary Janet Yellen has warned that rising federal debt is increasing the risk of fiscal dominance — a situation where central banks feel compelled to keep interest rates artificially low to contain debt-servicing costs.

When investors suspect that debt sustainability will override price stability, confidence in fiat currencies erodes. This mix of fiscal strain and pressured monetary independence is historically supportive of real assets such as gold. It also explains why bullion prices are rising even without a sharp unanchoring of inflation expectations.

Reflecting these dynamics, major investment banks have turned decisively bullish. Goldman Sachs has projected gold prices approaching $4,900 an ounce under its base-case scenario, with further upside if geopolitical or fiscal stresses intensify. For Indian investors, this optimism feeds directly into domestic prices, amplified by currency movements.

READ | Gold prices signal India’s shift to digital wealth

The dollar’s uneasy resilience

The dollar’s position is more complex. It continues to benefit from its role as the world’s primary reserve currency, and the Bloomberg Dollar Spot Index has remained resilient, at times rising alongside gold.

But the foundations are under strain. Persistent fiscal deficits, a rising debt-to-GDP ratio, and the politicisation of economic institutions all threaten long-term credibility. If rate cuts continue while inflation proves sticky, the dollar’s yield advantage will erode. At the margin, growing efforts to settle trade in non-dollar currencies will chip away at dominance, not through collapse but gradual dilution.

Why silver is no longer just gold’s shadow

Silver’s rally has been even more dramatic, challenging its reputation as “poor man’s gold.” Unlike gold, silver straddles precious and industrial demand. Its safe-haven appeal is now reinforced by structural demand from the energy transition, particularly in solar panels and electronics.

Policy risk has added a supply premium. Proposed US tariffs on refined silver imports have heightened concerns about availability, pushing prices higher. This dual role explains why silver prices have moved faster — and why volatility is likely to remain elevated.

What this means for India

For India, rising bullion prices are not merely a portfolio story. Higher gold prices can widen the current account deficit by inflating the import bill, even as they strengthen household balance sheets. They also complicate the policy push toward financialisation by reinforcing the attraction of physical assets over market-linked savings.

For the Reserve Bank of India, the global shift reinforces the logic of gradual reserve diversification without signalling abrupt intent. The challenge lies in balancing gold’s role as a hedge with the need to channel domestic savings toward productive investment.

Bullion’s outlook remains favourable, but it is not risk-free. A sharp de-escalation of geopolitical tensions, a surprise rebound in global growth, or tighter monetary policy could trigger corrections.

The dollar’s trajectory is more nuanced. It may continue to outperform weaker currencies in the short run, but its long-term path depends on whether the US can restore confidence in fiscal discipline and institutional independence. Until that happens, gold’s appeal as a hedge against political, fiscal, and institutional uncertainty is unlikely to fade.