On Tuesday, President Joe Biden announced a new wave of protectionist measures targeting Chinese imports, signaling a substantial escalation in the ongoing trade conflict between the United States and China. The measures include significant tariff increases on a variety of Chinese goods, notably electric vehicles, semiconductors, and critical minerals. This move has far-reaching implications for the US manufacturing industry and global trade.

The Biden administration’s justification for these tariffs revolves around concerns about economic security and unfair trade practices. The White House cited unacceptable risks posed by China’s practices, such as flooding global markets with cheap goods and allegedly stealing US intellectual property. The aim is to protect US industries from being undermined by low-cost Chinese imports and to bolster domestic manufacturing.

READ I India seeks to balance cryptocurrency regulation with market growth

Impact on US manufacturing

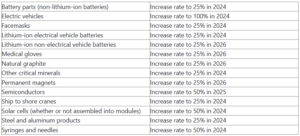

The new tariffs, particularly the quadrupling of duties on Chinese EVs to over 100 percent and the tripling of tariffs on Chinese EV batteries and battery parts to 25 percent, are intended to shield American auto manufacturers from Chinese competition. This move could provide temporary relief to US auto jobs, as it discourages the import of cheaper Chinese EVs and promotes domestic production.

New tariffs on imports from China

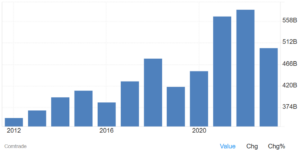

China’s exports to the United States

The immediate impact on consumers may be minimal given the current low volume of Chinese-made EVs sold in the US. Nonetheless, the increased cost of importing Chinese EV components, such as batteries and critical minerals, could drive up production costs for US automakers. This is particularly concerning as the US strives to ramp up EV adoption to meet ambitious climate targets.

Consequences for US automakers

The protectionist measures may offer short-term protection for US automakers but could prove counterproductive in the long run. Chinese manufacturers are currently leaders in the global EV supply chain, providing cost-effective batteries and other components. Restricting access to these supplies could hinder the US’s ability to compete in the rapidly growing EV market.

Beyond the auto industry, these protectionist measures have broader implications for the US economy. Increased tariffs on semiconductors, steel, and aluminum could lead to higher production costs across various sectors, from consumer electronics to construction. This rise in production costs might be passed on to consumers, leading to higher prices for everyday goods and potentially contributing to inflationary pressures. Additionally, industries that rely on these imports might face supply chain disruptions, hampering their ability to operate efficiently and competitively.

Moreover, these tariffs might stifle innovation and efficiency within the US auto industry. Historical precedents suggest that trade barriers often lead to complacency among domestic manufacturers. For instance, similar protectionist measures in the 1970s and 1980s allowed US automakers to delay necessary reforms, ultimately resulting in significant job losses and restructuring when competition became inevitable.

Implications for global trade

The new tariffs are likely to exacerbate tensions between the US and China, leading to potential retaliatory measures from Beijing. Such a trade war could disrupt global supply chains, particularly in industries heavily reliant on Chinese manufacturing, such as electronics and renewable energy.

For instance, US automakers could face higher costs for essential EV components, making it difficult to achieve price competitiveness in the global market. This could slow the adoption of EVs, undermining efforts to combat climate change. Additionally, retaliatory tariffs from China could impact US exports, particularly in sectors where American companies have significant market shares, such as agriculture and high-tech goods.

Politically, these tariffs are also a strategic move by President Biden to appeal to voters in key swing states such as Michigan, Wisconsin, and Pennsylvania, which have significant manufacturing sectors. By taking a tough stance on China, Biden aims to address voter concerns about job losses and economic security, issues that resonate strongly in these regions. This approach mirrors former President Trump’s tactics, indicating a rare area of bipartisan agreement on the need for robust trade measures against China. However, the long-term electoral benefits of such protectionism remain uncertain, as voters may also react to potential price increases and economic disruptions.

Strategic considerations

While President Biden’s tariffs aim to protect and revitalize US manufacturing, they also reflect a strategic effort to counter China’s dominance in critical high-tech industries. By imposing these tariffs, the administration hopes to foster domestic production capabilities and reduce reliance on Chinese imports.

However, this approach requires a delicate balance. Over-reliance on protectionist measures could alienate international allies and disrupt global trade partnerships. Biden’s strategy of collaborating with international allies to counter China’s economic practices could mitigate some of these risks, fostering a united front in promoting fair trade practices.

The newly announced protectionist measures by the Biden administration mark a significant escalation in the US-China trade conflict. While aimed at protecting US manufacturing and addressing economic security concerns, these tariffs could have mixed outcomes. In the short term, they may provide relief to US industries by curbing low-cost Chinese imports. However, in the long term, they risk stifling innovation, increasing production costs, and sparking retaliatory measures that could disrupt global trade and slow the adoption of critical technologies like EVs.

Furthermore, the realignment of global supply chains in response to these tariffs could have significant geopolitical ramifications. As companies seek to reduce their dependence on Chinese manufacturing, there could be a shift towards diversifying supply sources. This might lead to increased investments in other countries, such as Mexico, Vietnam, and India, potentially reshaping global trade networks. However, such transitions are complex and time-consuming, and the immediate impact might be increased costs and logistical challenges. Moreover, these changes could strain diplomatic relations with China, potentially leading to broader geopolitical tensions.

Ultimately, the success of these measures will depend on the US’s ability to balance protectionism with strategic investments in domestic manufacturing and international cooperation. Ensuring that these policies foster a competitive, innovative, and sustainable manufacturing sector without isolating the US from global trade networks will be crucial in navigating the complexities of 21st-century global commerce.

The environmental implications of these protectionist measures cannot be overlooked. By imposing higher tariffs on Chinese-made solar cells and other green technologies, the US risks slowing its progress towards achieving its climate goals. These tariffs may make renewable energy sources more expensive and less accessible, thereby hindering the transition to a greener economy. Balancing protectionism with environmental sustainability will be a critical challenge for the Biden administration. Ensuring that the pursuit of economic security does not come at the cost of environmental progress will be essential in addressing the multifaceted challenges of climate change.