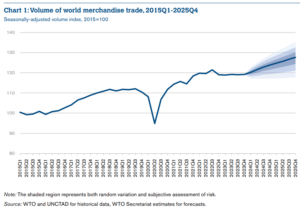

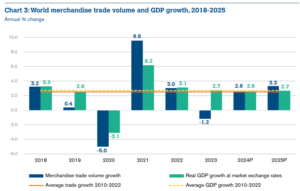

The growth in merchandise trade volume may remain subdued this year, as ongoing geopolitical tensions and policy uncertainty could restrain the trade rebound. In its biannual ‘Global Trade Outlook and Statistics‘, the World Trade Organisation has revised its projection for merchandise trade volume growth down to 2.6% for the current year from a previous estimate of 3.3% made in October.

Despite a 1.2% contraction in 2023, the demand for traded goods is expected to rebound in 2024 with inflationary pressures easing and real household incomes improving. The Global Trade Research Initiative, a New Delhi-based think tank, predicts a likely decline in global merchandise trade growth by 1.2% from last year.

READ | The rural trap: India must train its workforce on skills for the future

Global trade slowdown

The WTO report identifies several factors threatening the global commerce rebound. Geopolitical tensions and policy uncertainties are significant contributors, causing business growth limitations and price spikes in food and energy. The Red Sea crisis, while not catastrophic economically, has already impacted sectors like automotive and retail with delays and increased freight costs.

The ongoing geopolitical conflicts are exacerbating the divide between the US and China, with a noticeable shift in commerce patterns. There is a decline in commerce between these two nations, contrasting with their business with other countries. Moreover, global trade in intermediate goods, essential for global supply chains, experienced a downturn in 2023. This fragmentation is also evident in the services trade, with the US importing more ICT services from North American partners like Canada, and less from Asian countries, primarily India. According to a study by the OECD and WTO, this trend, along with potential data flow policy fragmentation, could significantly reduce global commerce and GDP.

Technology and innovation are becoming increasingly pivotal in shaping the future of global commerce. Advances in digital technology, e-commerce, and logistics are enabling more efficient business processes and creating new commerce opportunities. However, the digital divide between countries is also becoming more apparent, with technologically advanced countries gaining a competitive edge. This trend highlights the necessity for nations to invest in technological infrastructure and innovation to stay relevant in the global market.

Ralph Ossa, WTO Chief Economist, notes a growing scepticism towards business benefits among governments, leading to initiatives aimed at re-shoring production and redirecting commerce towards allied nations. This scepticism is challenging the free movement of goods and services. The resilience of business is further tested by disruptions in major shipping routes like the Panama Canal, affected by freshwater shortages, and the diverted traffic from the Red Sea.

The global economic slowdown has cast a shadow over international commerce, with many economies experiencing decreased demand and investment. This deceleration has been particularly pronounced in developed countries, where consumer spending and industrial production have stalled. The ripple effects are felt across emerging markets, which rely heavily on exports to these larger economies. This slowdown contributes to the uncertainty in global business, further complicating the already volatile trade dynamics.

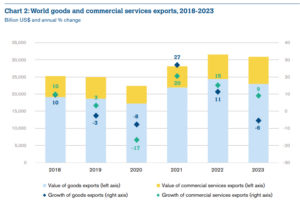

In dollar terms, world merchandise trade fell by 5% last year to $24.01 trillion. However, this decline was largely offset by a 9% increase in commercial services trade, reaching $7.54 trillion, boosted by the recovery in international travel and digitally-delivered services. The largest drop in exports was from the Russian Federation, which saw a 28% decrease. Other manufacturing-centric economies like China, Japan, and South Korea also experienced declines.

The WTO highlights the high variability of the current forecast, influenced by numerous global economy risk factors, including regional conflicts, geopolitical tensions, and rising protectionism. Consequently, trade volume growth in 2024 could range from a high of 5.8% to a low of -1.6%.

India stands 13th among leading merchandise exporters (excluding intra-EU trade) and 6th in imports, holding 2.2% of global exports. In commercial services, India is ranked 5th, with a 5.4% share.

Despite the challenging business environment, India’s goods exports increased by 11.9% in February, marking the strongest growth in 20 months and surpassing the $40 billion mark three times in two years, well above the previous year’s average of $35.4 billion.

With the global trade outlook remaining uncertain, India must consider long-term risks and develop strategies to mitigate the impact of disruptions in crucial trading routes like the Red Sea and the drought-affected Panama Canal. While recent commerce performance is encouraging, policymakers must remain vigilant to the ongoing risks and challenges, including freight cost increases. Attention should also be given to the WTO’s latest electronic components trade barometer, which has dropped to 95.6. Support for exporters, particularly in labour-intensive sectors like textiles and gems and jewellery, is crucial to prevent further decline.